Market Data

February 18, 2021

Steel Mill Lead Times: No Course Correction Yet

Written by Tim Triplett

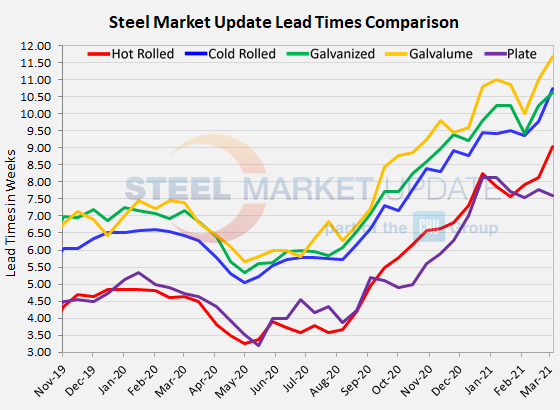

Lead times for spot orders of cold rolled and coated products have now extended to more than 10 weeks, while lead times for hot rolled now exceed nine weeks, based on Steel Market Update’s check of the market this week. Despite widespread expectations that mill lead times are overdue to reverse course as supplies catch up with demand, delivery times continue to stretch out as the market remains tight.

Buyers report that shipments from the mills are routinely late, adding to the difficulty they face in servicing their customers’ needs. “Not only are lead times extended, pretty much all the mills are running tardy, too,” complained one service center executive, calling it “a nice little 1-2 punch by the mills to keep this rally alive and well.”

Another buyer was also critical of suppliers: “Stated lead times are longer than normal and then most mills are running late 2-4 weeks on top of that. So, we’re paying outlandish prices for poor service and have seen more quality issues of late. They are relaxing their quality management parameters to get product out the door. Not a good strategy for them long term.”

Current hot rolled lead times now average 9.03 weeks, up from 8.13 two weeks ago and 7.91 at this time last month. At more than nine weeks, HR lead times are nearly three times longer than their pandemic-driven low point last April at 3.25 weeks.

Cold rolled lead times, now averaging 10.74 weeks, are up from 9.77 two weeks ago and are more than a month longer than in late April.

Galvanized lead times now average 10.61 weeks, up from 10.24 weeks in SMU’s last check of the market. The current average Galvalume lead time has stretched to 11.69 weeks from 11.00 weeks in the last survey.

Plate lead times have been more stable since the beginning of the year, ranging from 7.73 to the current 7.60 weeks. COVID containment measures drove average plate lead times down to 3.20 weeks back in May 2020.

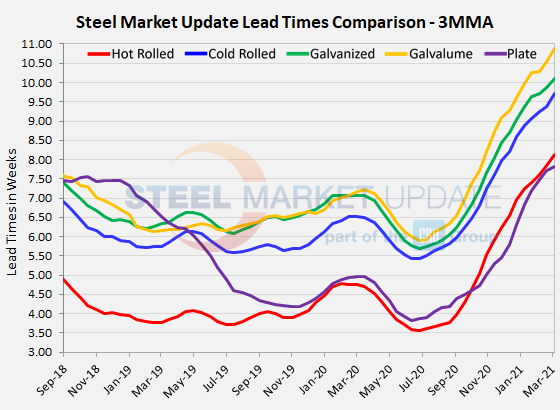

Viewed as three-month moving averages to smooth out the volatility, hot rolled lead times have continued to extend to 8.13 weeks, cold rolled to 9.71 weeks, galvanized to 10.10 weeks, Galvalume to 10.89 weeks and plate to 7.82 weeks.

By Tim Triplett, Tim@SteelMarketUpdate.com

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace. To see an interactive history of our Steel Mill Lead Times data, visit our website here.