Market Data

February 18, 2021

Steel Mill Lead Times: Inch Out a Bit Further

Written by Tim Triplett

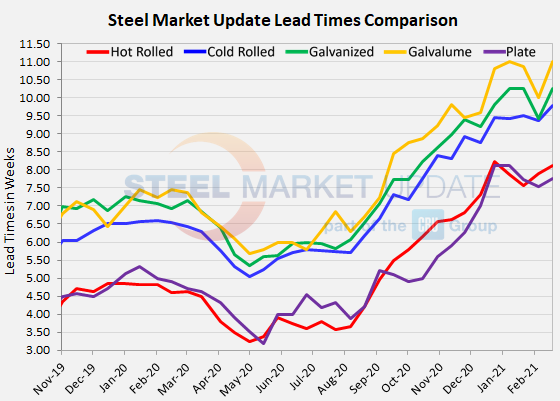

Many buyers have been expecting lead times for deliveries of spot steel orders to begin shortening in response to added mill capacity and more import arrivals, but there’s no hint of such a change yet in Steel Market Update lead times data. In fact, SMU’s check of the market this week shows lead times for flat rolled and plate orders inching out a bit further as mills scramble to meet demand in a tight market.

Current hot rolled lead times now average 8.13 weeks, up a bit from 7.91 two weeks ago and 7.57 at this time last month. At more than eight weeks, HR lead times are two and a half times longer than their low point last April at 3.25 weeks shortly after the pandemic hit.

Cold rolled lead times, now averaging 9.77 weeks, are up from 9.36 two weeks ago and more than a month longer than in late April.

Galvanized lead times now average 10.24 weeks, up significantly from 9.24 weeks in SMU’s last check of the market. Similarly, the current average Galvalume lead time stretched to 11.00 weeks from 10.00 weeks in the last survey.

Plate lead times have seen little change so far this year and now average 7.77 weeks, up a bit from 7.55 two weeks ago. The pandemic shock drove average plate lead times down to 3.20 weeks back in May 2020.

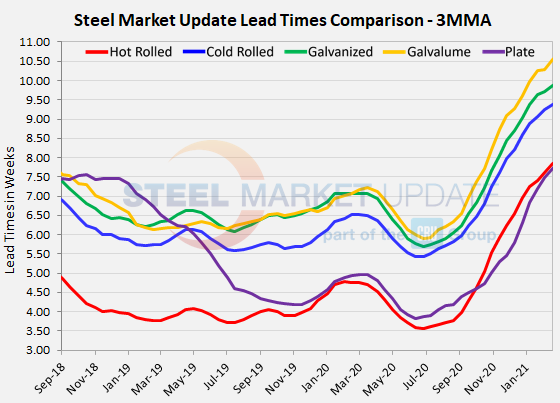

Viewed as three-month moving averages to smooth out the volatility, hot rolled lead times have continued to extend to 7.84 weeks, cold rolled to 9.38 weeks, galvanized to 9.86 weeks, Galvalume to 10.54 weeks and plate to 7.72 weeks.

Steel supplies remain limited, reported service center and OEM executives. “Hot roll spot is virtually non-existent,” said one buyer. “Some mills don’t have anything to offer,” said another. “Lead times are about the same—deliveries are 2-4 weeks late depending on the producer and product,” added a third.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace. To see an interactive history of our Steel Mill Lead Times data, visit our website here.

By Tim Triplett, Tim@SteelMarketUpdate.com