Distributors/Service Centers

February 11, 2021

Russel Metals Sees 2020 Profits Fall Due to Market Volatility

Written by Sandy Williams

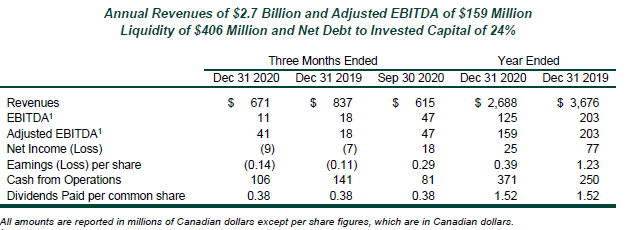

Russel Metals, a Canada-based metals processor and distributor, saw profitability fall in 2020 due to “extraordinary market volatility” caused by the global pandemic. The company posted net earnings of $25 million for 2020, down from $77 million in 2019. Earnings for the year included a $26 million non-cash impairment charge related to the U.S. energy operations. Revenue for the year totaled $2.7 billion. Operations in the U.S. contributed approximately 32% of total revenue for the company during 2020.

On a quarterly basis, price increases late in the fourth quarter resulted in the average selling price improving 5% from the third quarter. Increased pricing and stronger seasonal demand increased fourth-quarter revenue to $671 million from $615 million in the third quarter, but charges during the quarter negatively impacted earnings resulting in a net loss of $9 million.

“Our metals service centers and distribution operations experienced improving demand and multiple price increases in the fourth quarter, which provides a springboard going into 2021,” said President and CEO John Reid. “Oil prices and rig counts continued to modestly improve in the 2020 fourth quarter. Steel price increases have recently been reflected in rising energy product prices as the supply chain continues to rebalance. During the fourth quarter, we continued our strategy to redeploy capital from our OCTG and line pipe energy operations, and 2021 offers further opportunities to advance this initiative.”

Revenue from energy products fell 39% to $798 million in 2020. The segment reported an operating loss of $3 million in 2020 compared to a profit of $69 million in 2019. Lower oil prices impacted rig counts and delayed energy projects causing a significant reduction in revenue for line pipe and OCTG operations. Canadian rig counts averaged 89 for the year, down from 134 in 2019, while U.S. rig counts averaged 433 compared to 943.

Russel Metals service center shipments were 7% lower than in 2019. Shipments from the company’s U.S. service centers increased 1%, while volume decreased in all the Canadian regions. Average selling price per ton for 2020 was 11% lower than in 2019.

Steel distributor revenue fell 34% during the year due to lower general economic conditions and reduced demand. Operating profit was $9 million for 2020, compared to $16 million in the previous year, the company said.

NOTE: All dollar amounts are Canadian; 1 CAD $ = US $0.79