Analysis

February 5, 2021

Final Thoughts

Written by John Packard

Every other week Steel Market Update conducts a detailed analysis of the flat rolled and plate steel markets. We invite close to 600 individuals associated with manufacturing, distribution, steel mills, trading companies and suppliers to those industries. We intentionally weight the invitations toward end users and steel distribution companies since they are the largest buyers of flat rolled and plate steels. We believe this gives us the best view of the market.

Last week, 43 percent of the respondents were service centers, 37 percent were manufacturing companies, 9 percent were steel mills, and another 9 percent were trading companies; the balance was made up of toll processors/suppliers to the industry.

We ask many questions related to steel pricing, demand, lead times, sentiment, negotiations and much more. The results of the survey are published on our website and available to our Premium-level subscribers in a PowerPoint presentation. Pieces of the data collected are shared in our Executive-level newsletter as well (sentiment, lead times, negotiations). We published lead time and negotiation data in Thursday’s issue, and we produced an article regarding the SMU Steel Buyers Sentiment Index in tonight’s issue.

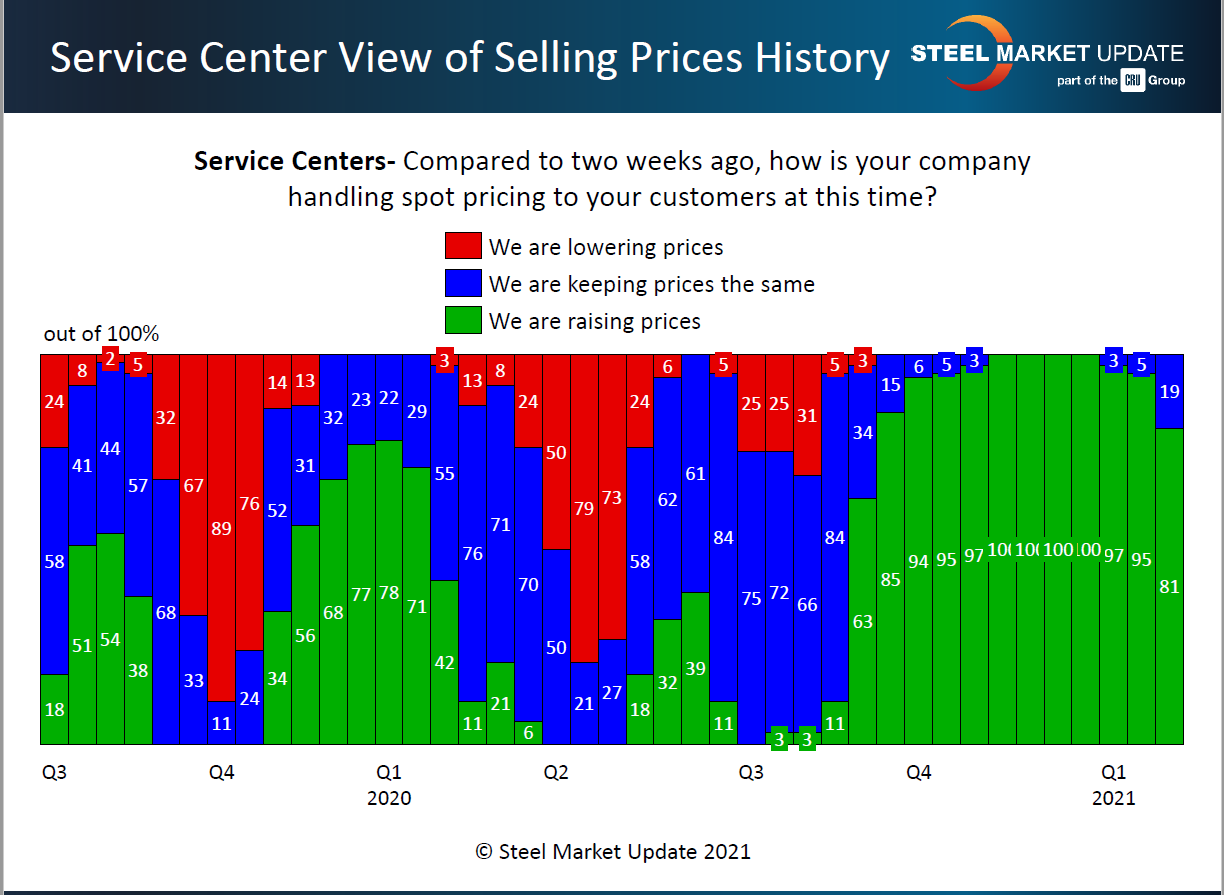

One factor I like to watch involves the questions on spot prices from service centers to their end customers. This has been a key indicator on the strength or weakness of a market, and it may help pinpoint when inventories are over-cooked and spot steel prices are being discounted.

We look at data supplied from both end users and service centers in order to make sure we are catching early changes (the end users are best used to confirm or challenge the data coming from the service centers). Last week, 92 percent of the manufacturing companies reported their distributors were raising spot pricing. Eight percent of the end users reported receiving cheaper prices from their service centers than they did two weeks earlier. This is something we will need to watch carefully in our next analysis, which will be the week of Feb. 15.

About 81 percent of the service centers responding said they are still asking for higher spot prices from their customers. However, 19 percent said they are leaving prices the same, which is a major change compared to just two weeks prior. The combination of what we are gathering from manufacturing and service centers gives me pause, as it could well be pointing to a crack in pricing. If that continues, it will put pressure on the domestic steel mills to lower prices.

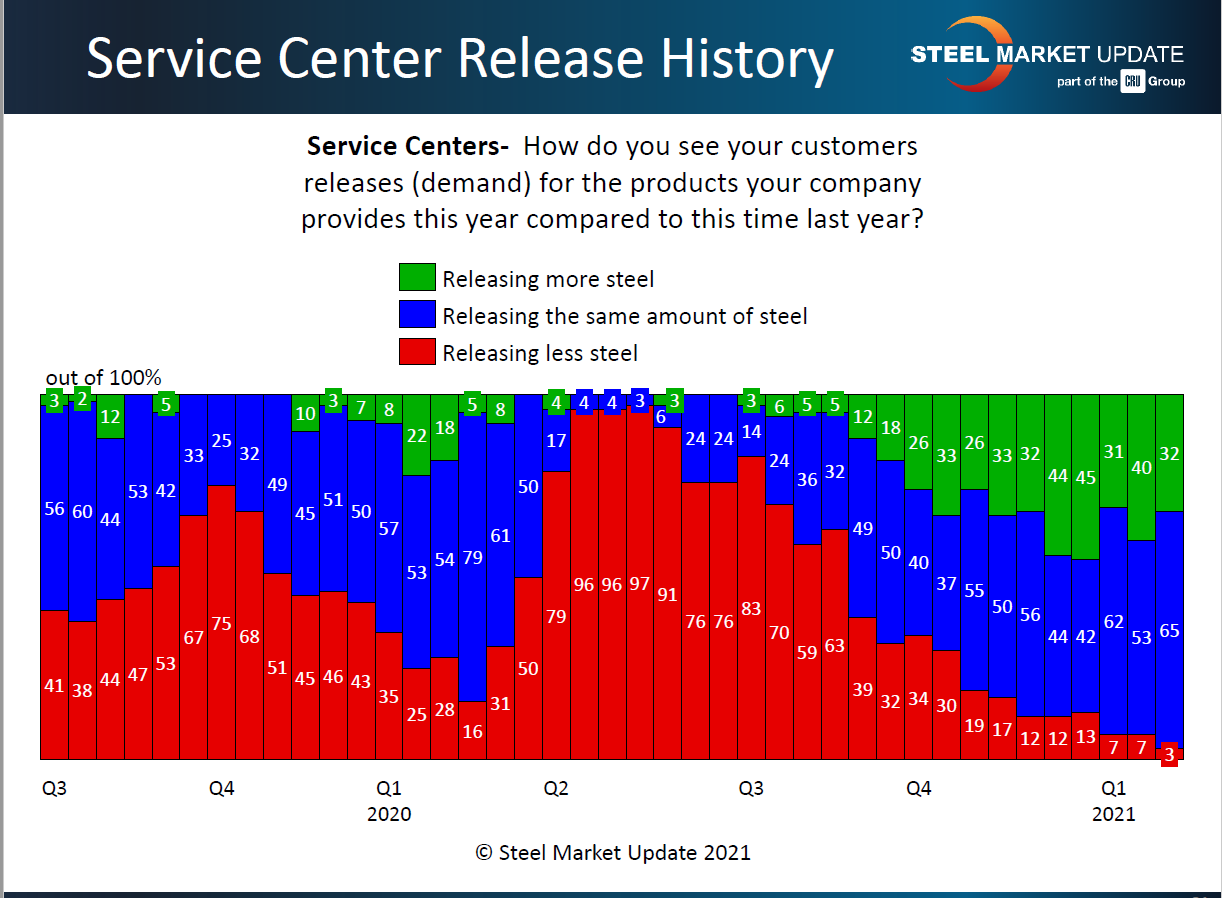

Manufacturers’ Releases of Steel from Distributors Inventories

One area our survey covers that we don’t report on very often is how manufacturing companies are releasing inventories that are being held by the service centers (the bulk being contract tons). We have seen some dramatic changes, which you can see in the graphic below.

I don’t think I have ever seen this graphic displaying the abrupt change caused by the pandemic in the second and early third quarters and now the strength of demand as companies release more steel. If we look to past “normal” markets, this should continue into the fourth quarter. Our Premium-level members can go back and look at this graphic from past months and years by clicking here (must be logged in).

By the way, one of the benefits of taking our Steel 101: Introduction to Steel Making & Market Fundamentals course is we do provide the attendees our Premium newsletter and access to the complete website as part of their registration. We are conducting a Steel 101 course this week and the next one will be May 11-12. Registration will open for that workshop this week.

Steel Hedging Workshops (plural), Steel 101 & SMU Steel Summit Conference Updates

Our first Steel Hedging 201: Advanced Strategies & Execution will be held on Feb. 23-24 (half day each day). You can learn more about the agenda, instructors, costs and how to register by clicking here.

Our next Steel Hedging 101: Introduction to Managing Price Risk Workshop will be held on March 30-31 (half day each). You can learn more about the agenda, our instructors, costs and how to register by clicking here.

Our first Galvanized Steel Hedging Workshop is scheduled for April 21 (half-day workshop). We will have more details and information about when and how you can register in a couple of weeks.

The SMU Steel Summit Conference registration for our live and in-person event on Aug. 23-25 at the Georgia International Convention Center in Atlanta has already begun. We have already booked a number of key speakers (I added another mill CEO on Friday of last week) and I expect an incredible line-up suitable for what may well be the first live conference for the steel industry since March of last year. You can find more details, costs and how to register by clicking here.

If you are interested in becoming a sponsor or to exhibit at the 2021 SMU Steel Summit Conference, please reach out to Jill Waldman at Jill@SteelMarketUpdate.com

If you would like to know more about how to upgrade your Executive-level subscription to Premium, please contact Paige Mayhair at Paige@SteelMarketUpdate.com. Paige can also help you if you would like to add more people to your membership or if you would like to become a new subscriber. She also handles renewals. Paige can be reached by phone at 724-720-1012.

It is Super Bowl Sunday. I know Jeep has a commercial with Bruce Springstein as their spokesperson. It is a timely view of America and well worth watching. You can view it on YouTube by clicking here.

As always, your business is truly appreciated by all of us here at Steel Market Update.

John Packard, President & CEO, John@SteelMarketUpdate.com