Market Data

January 28, 2021

Ecommerce Platforms Popular in Tight Market

Written by Tim Triplett

The steel industry’s ecommerce platforms have drawn a lot of interest lately from buyers searching for material and sellers searching for the highest price. John Armstrong, president and CEO of Reibus, said his online platform is thriving despite—or perhaps because of—the tight market conditions. “The volatility drives buyers to look for new solutions. Our tool is built for volatility, providing buyers and sellers more market access.”

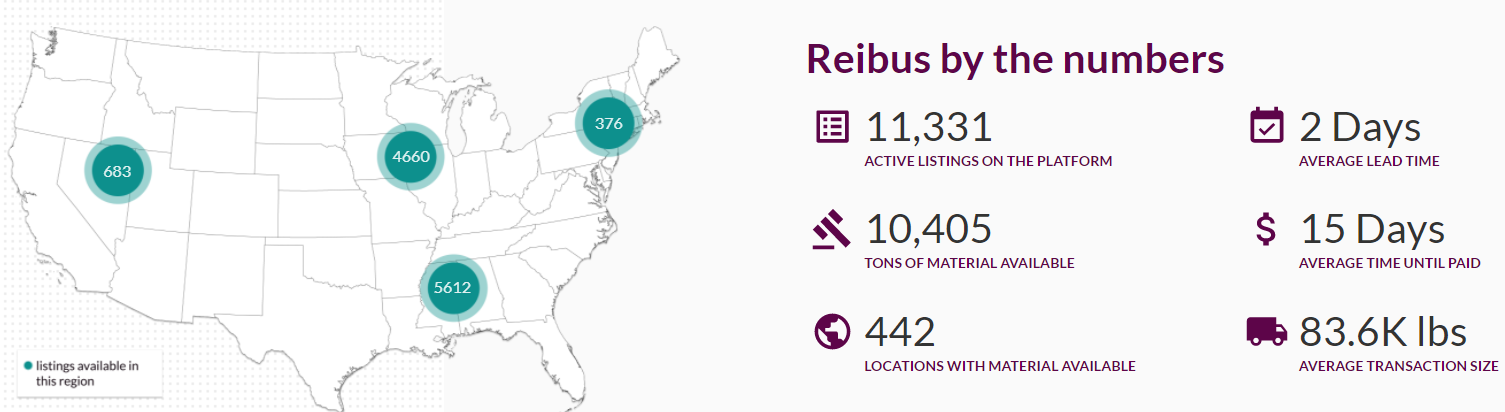

Atlanta-based Reibus is an online B2B marketplace for prime, excess prime and obsolete materials used in industrial, transportation and construction markets. Unlike other passive sites that merely list products, Reibus combines in-depth product knowledge and supply chain expertise to provide a full e-commerce experience to mills, service centers and fabricators. The platform matches supply and demand of metals while achieving greater reach, price performance and efficiency, the company claims.

“We are a supply chain solution company. People struggling to locate material use us to find it,” Armstrong said. Product that has landed on the site recently was usually scooped up quickly, sometimes in a matter of minutes, he added.

As a go-between, Reibus is not affected by the big swings in steel prices. “Because we don’t buy it unless we’ve sold it, I don’t take on the price risk. So, we are good as prices are on the way up or on the way down,” Armstrong said.

As a go-between, Reibus is not affected by the big swings in steel prices. “Because we don’t buy it unless we’ve sold it, I don’t take on the price risk. So, we are good as prices are on the way up or on the way down,” Armstrong said.

Not that Armstrong is unconcerned about the inevitable downturn in steel prices to come. “I do worry that on the way down it’s going to get messy for service centers,” he said. “If you don’t have a strong balance sheet in the second half of 2021, you are in trouble. As that deflation hits [if steel prices plummet], they won’t be able to borrow, they won’t be able to pay their bills and they are stuck with high priced inventory they will have to sell at a loss. That is a death spiral. How many smaller service centers and OEMs are not going to be here a year from today because of the deflation that inevitably will come?”

Armstrong said he has sensed a subtle shift in the market lately. “We are seeing a change, with more supply becoming available in just the last 10 days. Is that a sign that folks think the top is near?”

Editor’s note: Reibus is Lead Sponsor for the Tampa Steel Conference, a virtual event to be co-hosted by Steel Market Update next Tuesday, Feb. 2. For more information and to register for the conference, click here.

By Tim Triplett, Tim@SteelMarketUpdate.com