Market Data

January 21, 2021

Steel Mill Negotiations: Mills in the Driver's Seat

Written by Tim Triplett

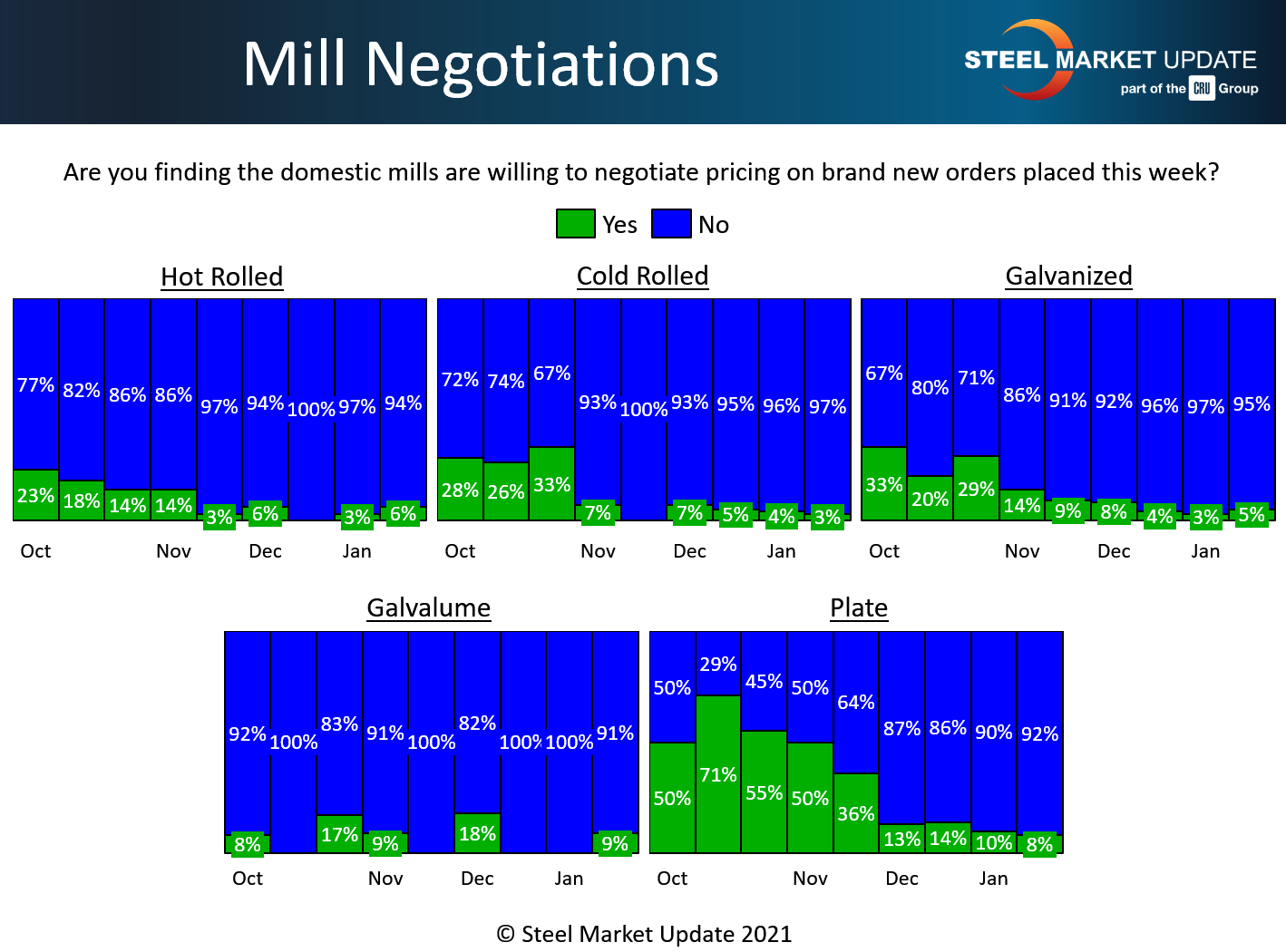

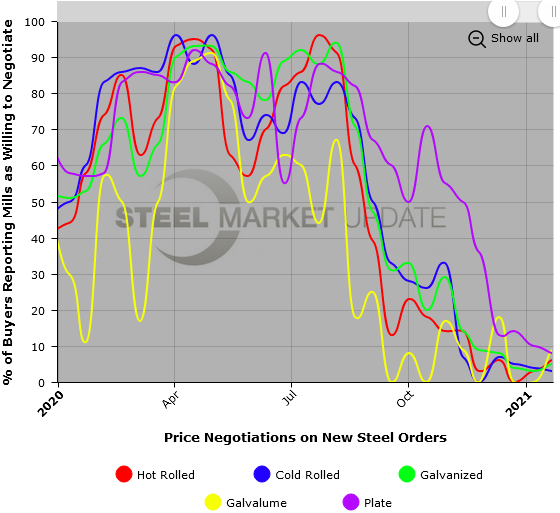

There has been little to no price negotiations between spot buyers and the mills since September, and Steel Market Update data shows no sign that is changing. More than nine out of 10 buyers responding to SMU’s questionnaire this week (note the predominant blue bars) reported that the mills are almost always unwilling to negotiate the price on any flat rolled or plate product.

And why would they. With steel supplies remaining so tight, it’s easy for the mills to find buyers who desperately need steel and are willing to pay a premium. Based on Steel Market Update’s check of the market this week, average hot rolled steel prices have hit a new record at $1,130 per ton, well in excess of the previous high recorded by SMU of $1,070 in 2008. Transactions at $1,200 or more are widely reported by various sources.

As long as buyers must compete to secure tons and are willing to continuing bidding up the spot price, the mills will remain comfortably in the driver’s seat when it comes time to negotiate.

Note: These negotiations are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. To see an interactive history of our Negotiations data, visit our website here.

By Tim Triplett, tim@steelmarketupdate.com