Market Data

January 21, 2021

Steel Mill Lead Times: First Sign of a Change?

Written by Tim Triplett

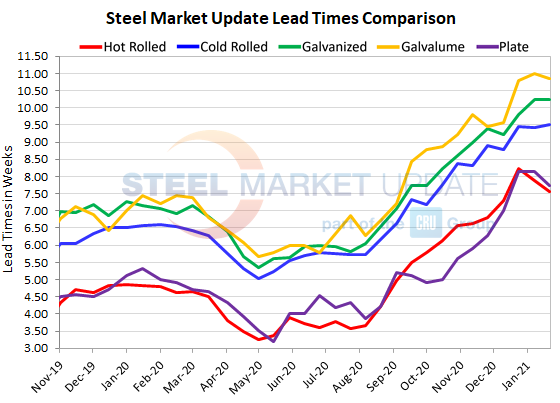

The average lead time on spot orders of hot rolled steel from the mill declined slightly for the second time in Steel Market Update’s biweekly survey and is now more than a half-week shorter than at this time last month. Lead times for other flat rolled products remained relatively unchanged, however, in SMU’s latest check of the market. Lead times are an indicator of steel demand—longer lead times mean the mills are busy and less likely to negotiate on price.

Current hot rolled lead times now average 7.57 weeks, down a bit from 7.87 two weeks ago and 8.24 in the last week of December. At around seven and a half weeks, HR lead times are still extremely extended compared with typical delivery times and remain more than twice as long as in April, shortly after the pandemic hit and steel demand stalled, when they registered a low of 3.25 weeks.

Cold rolled lead times, at 9.50 weeks, have seen little change in the past month. Like hot rolled, cold rolled lead times are more than a month longer than in late April.

Galvanized lead times now average 10.24 weeks, up from 9.81 weeks a month ago, and have been stable so far this year. Galv lead times are still about five weeks longer than the low point this spring. Similarly, the current average Galvalume lead time is out to 10.86 weeks.

Plate lead times dipped slightly to 7.73 weeks from 8.13 weeks over the past month, but also remain highly extended. Plate lead times bottomed at 3.20 weeks back in May.

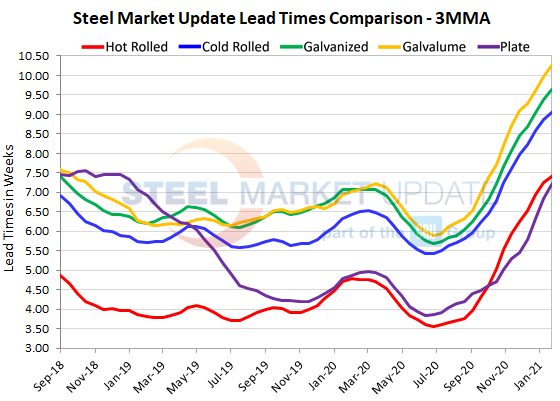

Viewed as three-month moving averages to smooth out the volatility, hot rolled lead times have continued to extend to 7.41 weeks, cold rolled 9.06 weeks, galvanized 9.65 weeks, Galvalume 10.25 weeks and plate 7.20 weeks.

The market is keeping a close eye out for any change in lead times that might signal supply is catching up with demand and steel prices may be nearing a peak. Given that the shortening in hot rolled delivery times was small, and the fact it was not mirrored by other flat rolled products, means it’s too soon to draw any conclusions about the change’s significance.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace. To see an interactive history of our Steel Mill Lead Times data, visit our website here.

By Tim Triplett, tim@steelmarketupdate.com