Market Data

January 18, 2021

Service Center Shipments and Inventories Report for December

Written by Estelle Tran

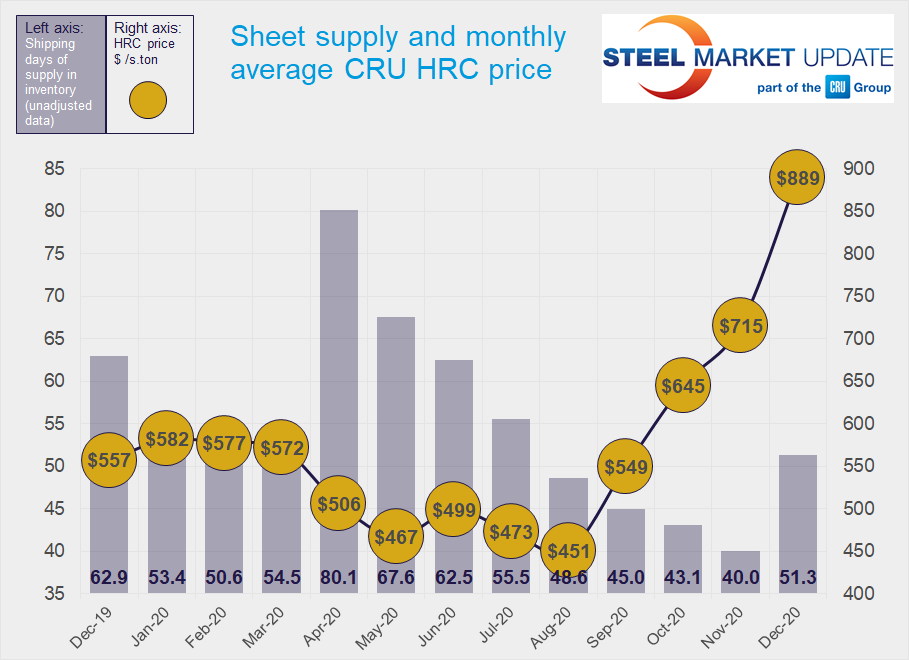

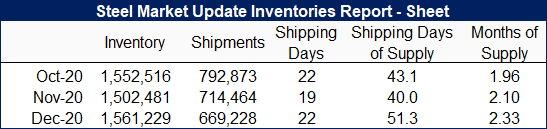

Flat Rolled = 51.3 Shipping Days of Supply

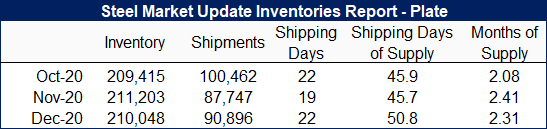

Plate = 50.8 Shipping Days of Supply

Flat Rolled

Service center flat rolled steel inventories found their low point in November and bounced back up in December. Service centers carried 51.3 shipping days of supply at the end of December, up from 40 in November. The data was elevated because of the holiday season and the difference in shipping days; December had 22 shipping days, while November had 19. In terms of months of supply, service centers carried 2.33 months of flat rolled steel inventory in December, up from 2.10 in November.

The lower daily shipping rates and restocking spurred a boost in material on order, which was the highest level recorded in the last two years. While service centers continue to have issues booking all the steel they need, we are starting to hear some hesitation from manufacturers about costs rising too high. The elevated on-order volumes raise some concerns that demand could have been pulled forward by OEMs preparing for the imminent spike in their quarterly contract prices and that orders may have been double booked at different service centers.

The elevated on-order volumes also speak to the long mill lead times. The Jan. 7 SMU survey showed that lead times for HRC were 7.87 weeks. While extended, this is a decrease from 8.24 weeks recorded in the Dec. 22 survey. Galvanized steel lead times, however, extended further to 10.25 weeks from 9.81 weeks previously.

Some service centers have noted they are only buying sold material because of concerns of having too much inventory at the peak of the market. This is evident in the data with 62.7 percent of inventory committed to contract customers in December, up from 58.4 percent in November and the highest level recorded in two years. Despite the concerns about inventory management, strong demand to start the year has persuaded more service centers to expect a more gradual decline in pricing later than previously expected.

Plate

Plate inventories also got the seasonal bump, rising to 50.8 shipping days of supply from 45.7 in November. The data showed that inventories represented 2.31 months of supply in December, down from 2.41 in November.

The data for December is skewed by seasonality and the increase in shipping days month on month. However, it seems that additional plate orders have shaken loose with plate mills increasing prices. The plate increases have been supported by rising HRC prices as well as scrap costs. Plate demand appears to be limited, particularly because of continued weakness in the energy sector and flat nonresidential construction spending.

The amount of plate on order at the end of December represented was also the highest level recorded in the last two years.

In the latest SMU survey published Jan. 7, only 10 percent of contacts said plate mills were willing to negotiate on pricing. This did not take into account the latest $100-140 /st price increases announced by mills early this year. Plate lead times stood at 8.13 weeks in the latest survey.

Inventory levels are poised to increase with the higher on-order figures in the coming months, while the outlook for plate demand is steady. The percentage of inventory committed to contracts was 33.8 percent in December, flat month on month.