CRU

January 15, 2021

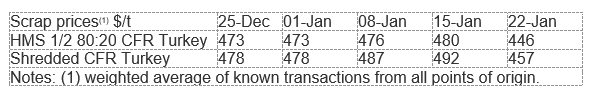

CRU: Turkish Scrap Prices Fall for First Time Since September

Written by CRU Americas

By CRU Research Analyst Yusu Mao, from CRU’s Global Steel Trade Service

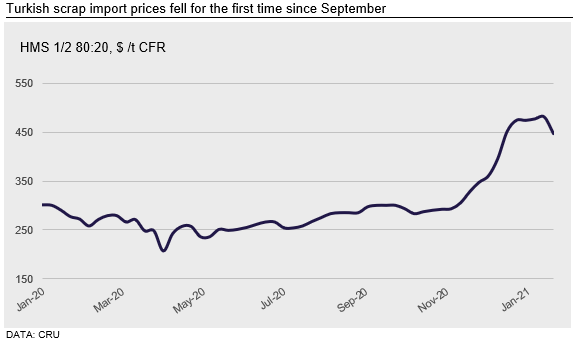

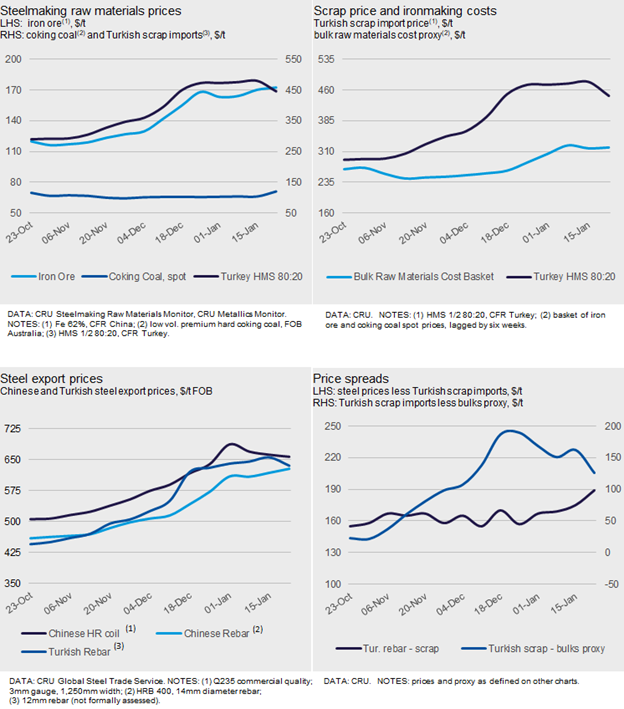

Last week, Turkish scrap import prices fell for the first time since September 2020. CRU recorded two deals and assessed HMS 1/2 80:20 at $446 /t CFR (- $34 /t w/w, -$27 /t m/m). The enlarged spread between HMS 1/2 80:20 and shredded scrap prices remained at $11 /t—a level that has remained the same since the week ended Jan. 8.

According to market contacts, one potential reason for this price drop is that steelmakers believe the scrap sellers have more supply availability. This can be partly attributed to a seasonally atypical increase in scrap collection and delivery in markets like the U.S. where winter has been generally mild. Also, mills have been keener to build scrap inventories given the rapid price increases w/w since September.

Along with the sudden drop in scrap prices, Turkish finished steel export prices also fell last week, with rebar and HR coil export prices decreasing for the first time since mid-October. Rebar prices have decreased to $635 /t FOB from $655/t FOB; and HR coil prices dropped to $790 /t from $800 /t last week.

However, finished steel markets in major Turkish export destinations have remained buoyant. In the U.S., HR coil prices rose to their highest levels $1,072 /s.ton FOB (+ $28 /s.ton). Likewise, German HR coil price rose to €698 /t, up by €33 /t w/w, while prices in Italy rose to €689 /t (+€42 /t w/w).

The Market is Beginning to Turn

We expect that Turkish scrap import prices will continue to fall into February, albeit at a relatively gradual pace. We then expect a larger decrease to take place in March, followed by a reversion back to a more historically average level throughout 2021 Q2.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com