CRU

January 15, 2021

CRU: Digging into the Data Behind the Rusal High-Carbon Aluminum Spinoff

Written by Eoin Dinsmore

By CRU Research Manager, Aluminum, Eoin Dinsmore

Utilizing the powerful CarbonFlow feature in CRU’s Emissions Analysis Tool, we explain why Rusal is proposing a demerger of its higher-carbon aluminum assets.

UC Rusal, the largest aluminum producer outside China, announced on May 18 that it plans to split into two companies. “AL+” will house the company’s lowest carbon assets and will have ambitious net zero targets. The New Company (name not yet decided) will comprise the company’s higher carbon emitting assets; it is proposed to be listed in Moscow and will focus on the Russian domestic market.

So which assets are considered higher carbon and what are the reasons for the higher carbon emissions from these plants?

First Off, What Bits Go Where?

AL+ retains most of the smelting and alumina assets, with 2.67Mt of aluminum production and 5.14Mt of alumina output in 2020.

The plants being spun off produced 1.7Mt of aluminum and 2.84Mt of alumina in 2020.

The new company’s assets are all in Russia, except for an equity stake (21.7Mt output) in the Bogatyr Komir coal mine in Kazakhstan.

AL+ is geographically spread, with bauxite mining in Guinea and Guyana and alumina refineries in Ukraine, Ireland, Italy, Australia, Guinea and Jamaica. Rusal’s only smelter outside of Russia, Sundsvall (KUBAL), will also go to AL+.

Value-Added Products

AL+ and the New Company have a similar share of billet and primary foundry alloy production.

However, on slab and wire rod there will be commercial implications from the split. AL+ remains a large rolling slab producer, allowing AL+ to export rolling slab to mills in Europe that buy from Rusal. Russian rolling mills also buy slab from Rusal, which means AL+ will remain a supplier to domestic companies in the short to medium term.

Wire rod consumers will buy wire rod from the New Company, as AL+’s smelters produced no wire rod in 2020, according to CRU’s estimates.

Aluminum CarbonFlow Shows the Gap Between the Two Companies

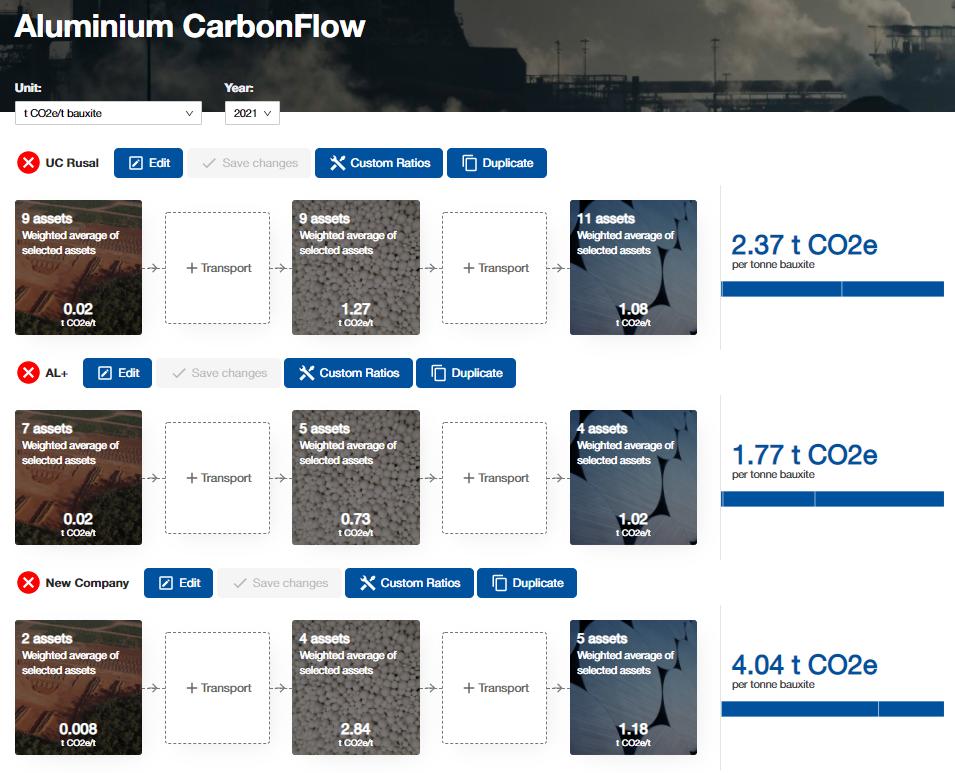

In Figure 1, we present CRU’s CarbonFlow Analysis of the current UC Rusal and the proposed AL+ and New Company.

Considering scope 1 and scope 2 emissions through to the primary production process, the CO2e/t aluminum produced for AL+ will be 4.33t CO2e /t aluminum, and the New Company will emit 9.91 t CO2e /t aluminum.

The vast majority of the difference between the two companies comes from the alumina refineries.

The two highest carbon alumina refineries in the world, Achinsk and Bogoslovsk, are set to be part of the New Company. Achinsk refines Russian mined nepheline ore, which is a technology only utilized by UC Rusal. The Bogoslovsk refinery utilizes the more energy intensive Bayer-Sinter process, as opposed to the Bayer process used in other refineries.

The aluminum smelters included in the New Company are all Soderberg and the plants in AL+ are predominantly pre-bake, with the exception of the Krasnoyarsk smelter, which is predominantly Soderberg.

Figure 1: Aluminum CarbonFlow for Rusal, Al+ and the new company (Click to enlarge)

DATA: CRU Emissions Analysis Tool

Are U.S. Sanctions a Factor?

It is notable that the New Company’s aluminum assets are all in Russia. The Rusal press release notes that “the new company would concentrate on the development of the domestic market.” China has also been mentioned as a target market for the New Company. Rusal parent company has also indicated the New Company would be listed in Moscow.

Any future U.S. sanctions would not disrupt the New Company in the way they impacted UC Rusal in 2018. This is because its main supply chains are in Russia and it may be able to trade in roubles with Russian customers and suppliers.

Hard to Reduce the Emissions, Easier to Drop the Assets

The main reason Rusal is splitting is that it has two high-emitting assets in its Achinsk and Bogoslovsk alumina refineries.

The Achinsk refinery and the Kia-Shaltyr nepheline mine employ 3,669 staff and 450 staff, respectively. As Rusal notes on its website, “The mine [Kia-Shaltyr] was commissioned in 1963 and is the town-forming enterprise in Belogorsk.” Constructing a new alumina refinery and shifting from nepheline to bauxite would greatly reduce emissions at the New Company, but that would present political challenges.

Benefit of a “Greener” Company

AL+ will comfortably meet the EU Taxonomy definition of sustainable aluminum, which is under 3tCO2e/t aluminum, considering scope 1 and 2 emissions. This presents the possibility of issuing green bonds, or further developing Rusal’s sustainability linked credit facilities and borrowing.

AL+ may find it easier to be included in green indices, where passively managed funds will allocate capital to listed companies that meet certain sustainability benchmarks.

Lord Barker noted in the announcement from EN+ that the split sets AL+ on track to launch its own zero carbon aluminum brand, similar to Elysis, but utilizing Rusal’s own inert anode technology.

AL+ could be the first metals company to split on a carbon footprint basis. Companies have been ditching coal assets for some time, but this is the first instance in metals.

Other aluminum companies will most likely try to sell their highest emitting smelters. In the coming years we could see the likes of South 32 review its coal-fired Hillside smelter in South Africa, or Alcoa sell off its coal-fired Warrick smelter in the U.S. along with the accompanying coal mine and power plant.

As investors, consumers and governments increase the focus on carbon emissions, the metals industry will remember the AL+ spinoff as the first of many carbon splits.

For more information on the CRU Aluminum Emissions Service, contact eoin.dinsmore@crugroup.com

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com