CRU

January 15, 2021

CRU: China Removes VAT Rebate on Steel Exports

Written by CRU Americas

By CRU Analyst Kevin Bai from CRU’s Steelmaking Raw Materials Monitor

China has announced that it will remove the value-added tax (VAT) rebate it has historically applied to steel exports, alongside changes in import and export tariffs. This will increase the cost of exporting and discourage export volumes, which will help loosen a tight domestic market. Initially, due to the height of flat products prices elsewhere in the world, the greatest impact on trade volumes will be for carbon steel long products.

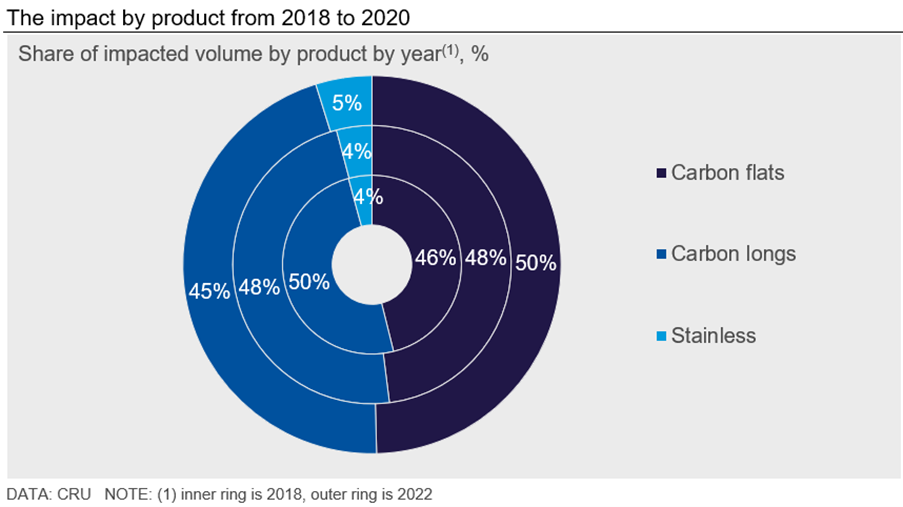

Historically, China has provided a VAT rebate for steel exports from the country of around 13% (though this varies by product and by vintage). China will now remove the entire VAT rebate for some finished steel products from May 1, 2021, which will increase the cost of exporting steel products. Overall, many carbon and stainless steel flat and long products are affected, including hot-rolled, cold-rolled and galvanized end products (wire and roll-formed sheet). The coverage is significant and represents a volume of around 70% of China’s total finished steel products in recent years. Meanwhile, import tariffs will be removed for pig iron (from 1% to 0), HBI (from 2% to 0), steel scrap (2% to 0) and semifinished steel (2% to 0), and the export tax has been lifted by 5 percentage points for high purity pig iron (10% to 15%), ferrochrome (15% to 20%) and ferrosilicon (20% to 25%). This Insight will focus on the tax rebate removal and price impact.

What is the VAT Rebate and What Is Happening?

In China, the VAT is levied on both domestic and, unusually compared with most countries, export sales. However, rebates of varying amounts have been applied to the VAT on exports of different products in different periods. The rebate is effectively money that can be claimed back from the government to offset the VAT charge.

China’s Ministry of Finance announced an entire removal of the VAT rebate for 146 steel products from May 1, 2021. Many carbon and stainless steel flat and long products are affected, including hot-rolled, cold-rolled, and galvanized products. The coverage is significant and represents a volume of around 70% of total China’s finished steel products in recent years.

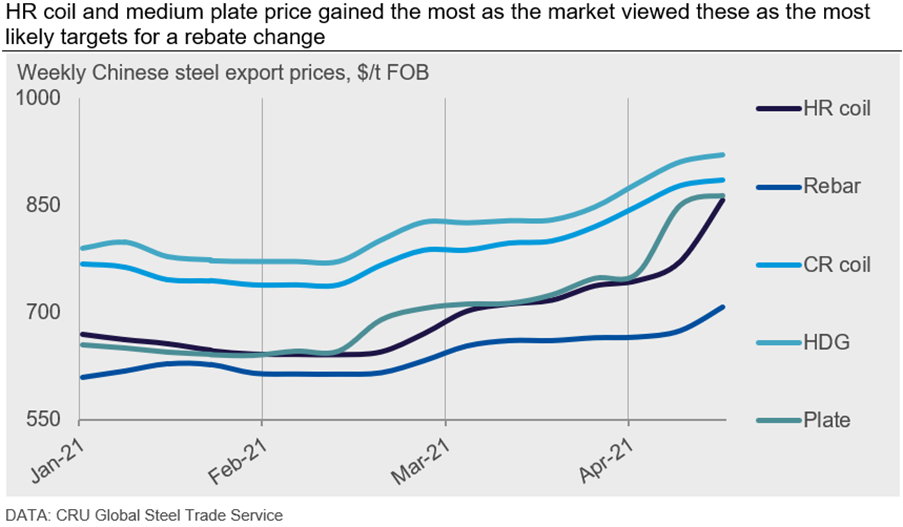

Impact on Export Prices Already Embedded in the Carbon Steel Market

Rumors related to this VAT rebate change have been in the market for almost two months. Uncertainty over what products, when and by how much Beijing would reduce the VAT rebate for steel exports kept most overseas buyers and Chinese exporters on the sidelines in April. In response, some Chinese exporters have started to renegotiate contracts or add clauses to mitigate potential risks from a change in the rebate. From the third week of April, most market participants began to anticipate the tax rebate cancellation and priced in a 13% VAT rebate removal by lifting export offers. Before the VAT rebate removal, HR coil prices CRU assessed have increased by $114 /t and plate by $109 /t.

Since export prices have already priced in the potential impact ahead of the policy announcement, further price increases would not normally be expected because of the policy being confirmed. There might even be some room for prices of products not affected by the rebate change, such as cold-rolled coil and hot-dipped galvanized sheet, to adjust back toward previous price levels. However, since the current market is very tight given the supply restrictions in Tangshan, it is also likely that steel mills will offer higher prices given price gains in the domestic market.

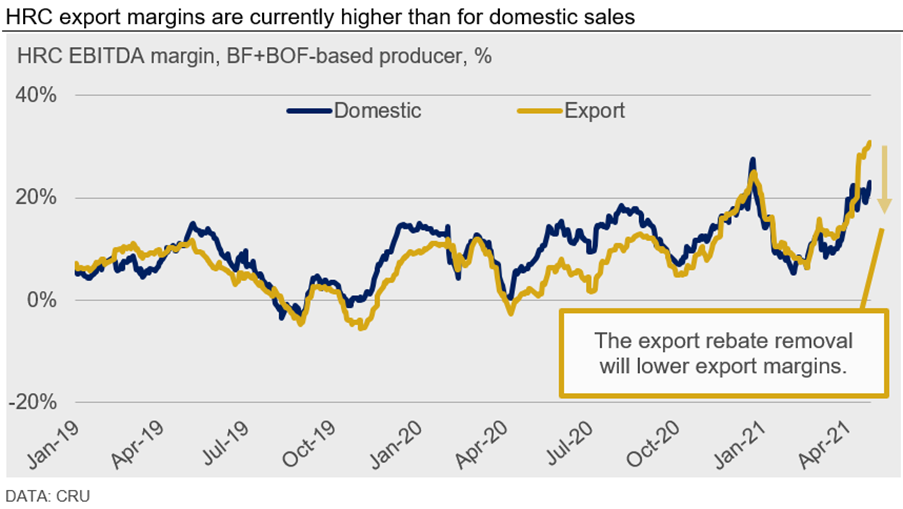

Using HR exports as an example, export margins for flat products have reached a historical high of around 30%, or $280/t, without considering the 13% VAT rebate cancellation. The impact of the rebate removal will be to lower export margins by around $120/t to $160/t (see chart below). While this is still high at around 17%, it is very similar to margins on domestic sales. This suggests the incentive to export will be lower, but depends on price and margin movements both in domestic and overseas markets.

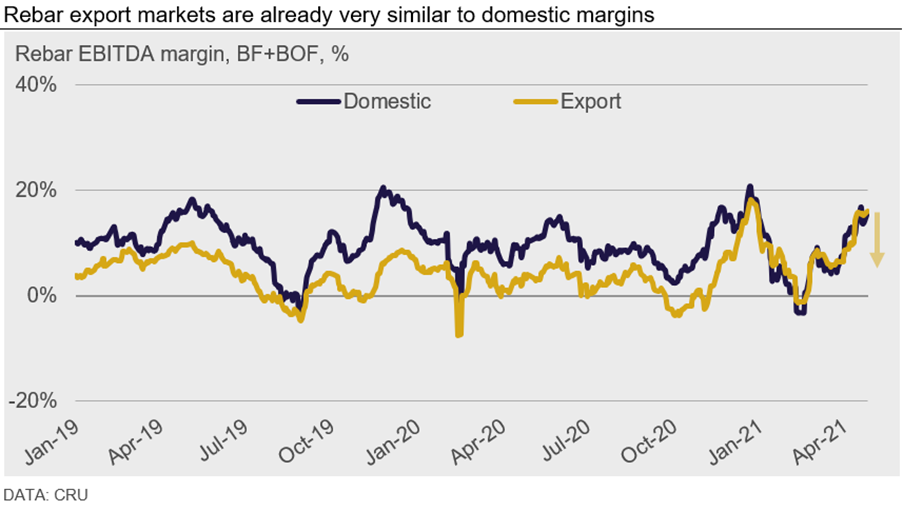

In contrast to HR coil, rebar export margins are already very similar to domestic margins before the VAT rebate cancellation, which means that export margins will fall under domestic margins after its removal. This indicates that the incentive to export will be much less for rebar compared to HR coil.

Reduced Export Volumes Will Reduce Domestic Prices – But Not Immediately

Domestic prices are expected to fall because a potential volume totalling 37 Mt could be redirected to the domestic market, which would ease current market tightness. As the Labor Day holiday is approaching (May 1-5), trade activity will be slower, and the initial price impact may be more muted. Consequently, we will have more information to share after the holiday. Overall, the impact will be greater for long products than for flat products, at least until international steel market prices fall.

Why remove the rebate now?

Changes in the rebate have historically been used to manage exports of steel: to encourage exports of high value-added products and to control those of low value-added and/or resource intensive commodities. The rebates policy has also been a tool to adjust trade flows to avoid trade tensions.

The latest rebate removal, together with import and export tax changes, is believed to be a policy package to help achieve the government’s aim of cutting domestic production and reducing carbon emissions. The Ministry of Industry and Information Technology said publicly at the beginning of this year that China’s crude steel production in 2021 will fall compared to the 2020 level. There has been heated discussion since then on how China will achieve this given firm domestic steel demand. At least a partial solution may be found in the rebate removal as it will limit any recovery of Chinese steel export volumes in 2021 compared to 2020. This will occur because, domestic mills will not be able to sustain production volumes through exports as domestic steel demand eases later in the year and as prices in international markets fall in the second half of the year.

In addition, according to an article published by China’s Iron and Steel Association’s (CISA) website, the rebate removal will redirect volume back to the domestic market and ease the current tightness. Meanwhile, the policy also signals to domestic steelmakers to focus more on the domestic market, which is what the Dual Circulation Strategy reiterates.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com