Analysis

January 11, 2021

Final Thoughts

Written by John Packard

The runup in steel prices continues unabated with benchmark hot rolled prices now averaging $1,080 per ton. The $1,080 number on hot rolled is the highest in our history (we reported $1,070 back in July 2008). Steel buyers should note that even as we bust through our past record high, we believe prices will still move higher from here as there is nothing immediate that will affect pricing momentum, which is clearly on the side of the steel mills.

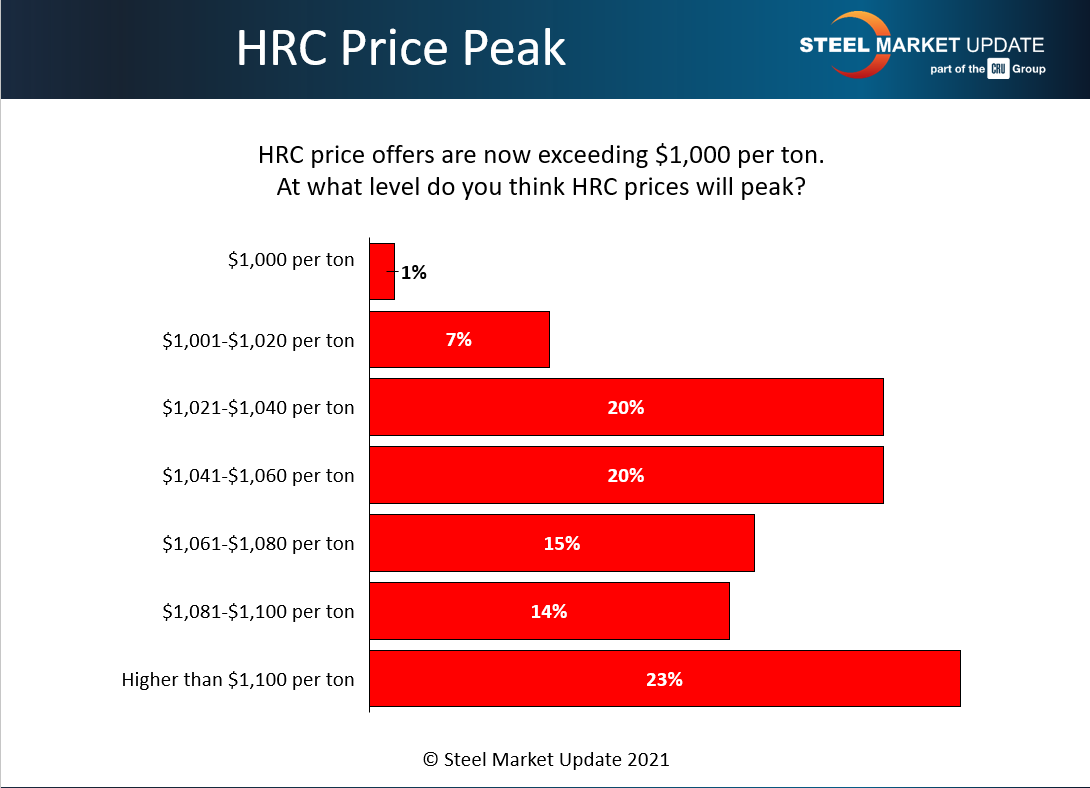

One thing that I find interesting as we canvass steel buyers is their belief that prices cannot go much higher than where they are today. In our most recent survey, we found 48 percent of the respondents reporting prices would peak at numbers below the $1,080 per ton we reported this evening. We are already collecting data that has HRC offers out there close to $1,200 per ton ($60.00/cwt). Yet, only 23 percent of the steel buyers believe spot prices will exceed $1,100 per ton….

In discussions I have had with steel service centers, there is an issue of credit lines affecting companies’ ability to buy enough steel to keep their businesses going. When you have an established credit line of X when the price of steel was $550-$600 per ton, and then prices effectively double, the credit line is cut in half.

I am hearing both service centers and steel mills are concerned about the potential for demand destruction due to the squeeze in credit lines.

Tomorrow (Wednesday, Jan. 13) Michael Cowden and I will discuss how we are seeing the steel markets as we conduct one of our free SMU Community Chat Webinars. We are in historic times, and I thought this might be a good time to 1) introduce Michael Cowden to our community, and 2) to review what our surveys are telling us, and what we are hearing in the marketplace as we discuss steel prices, demand, supply, commodity prices and a whole host of other subjects that impact your businesses. You can register for this free webinar by clicking here or going to www.SteelMarketUpdate.com/blog/smu-community-chat-webinars

With Michael Cowden joining SMU, the number of inquiries we have been receiving requesting subscription pricing has gone up dramatically. If you are interested in joining the SMU newsletter community as a new subscriber, please contact Paige Mayhair at Paige@SteelMarketUpdate.com or by phone at 724-720-1012.

As always, your business is truly appreciated by all of us here at Steel Market Update.

John Packard, President & CEO, John@SteelMarketUpdate.com