Market Data

January 8, 2021

SMU Steel Buyers Sentiment: Fears of Fall Ahead

Written by Tim Triplett

Current Sentiment among steel buyers, as measured by Steel Market Update’s Jan. 4 questionnaire, saw a small increase, while Future Sentiment saw a small decrease, suggesting that service center and OEM executives feel more confident about their immediate prospects than they do about the uncertainty ahead. As one commented: “We ended 2020 struggling to get enough steel to satisfy customer orders and now we are starting 2021 with margin pressures due to the incredibly high steel prices. It’s a double-edged sword!” Added another: “The issue now is finding steel, and not to over buy, because the cliff to fall off of only gets higher as the numbers ascend.”

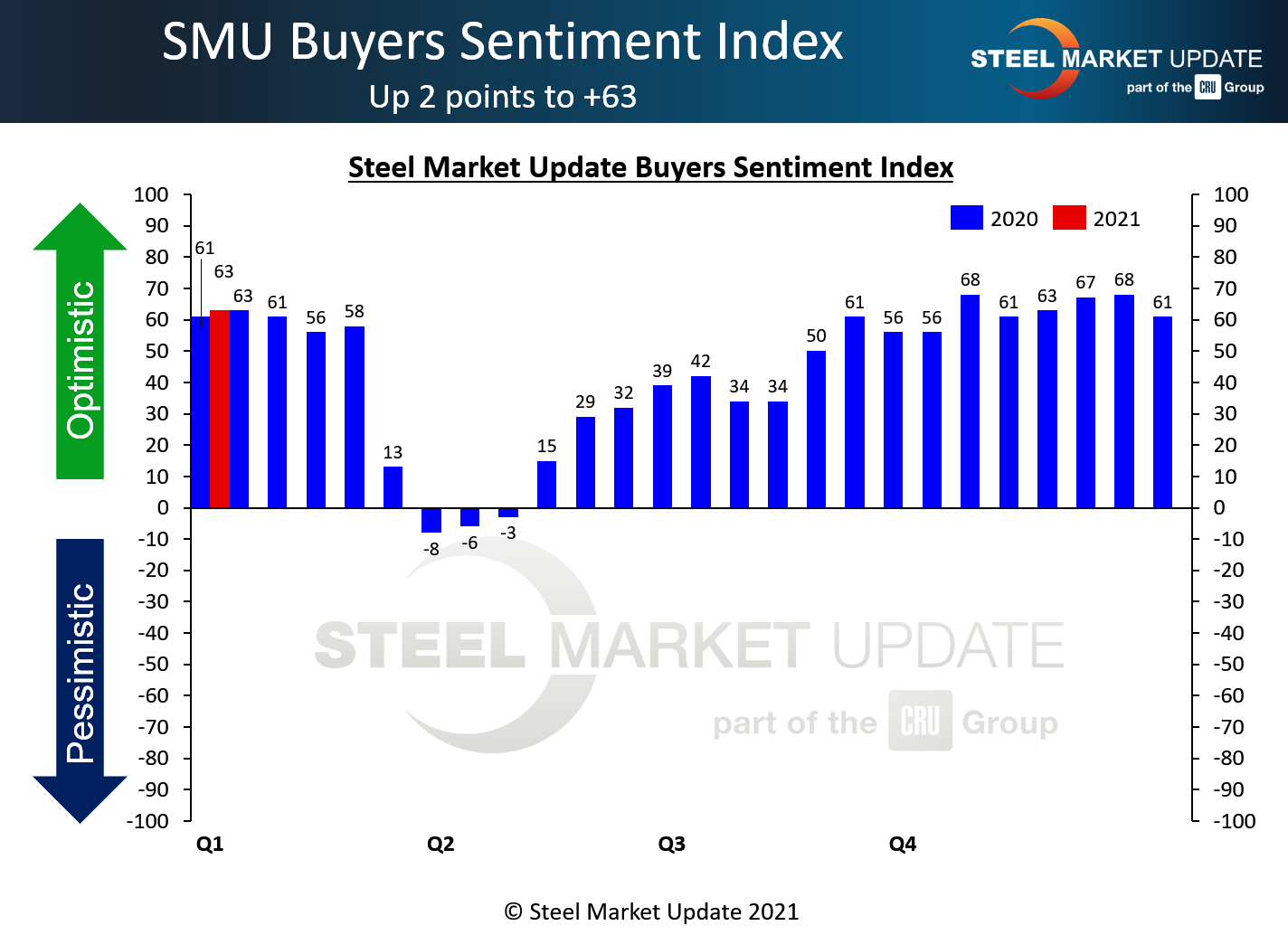

Every two weeks, SMU asks steel buyers how they view their company’s chances for success in the current environment as well as three to six months in the future. The Current Sentiment Index increased by two points to a very optimistic reading of +63—up by 71 points from the pandemic-induced low of -8 back in April.

Future Sentiment

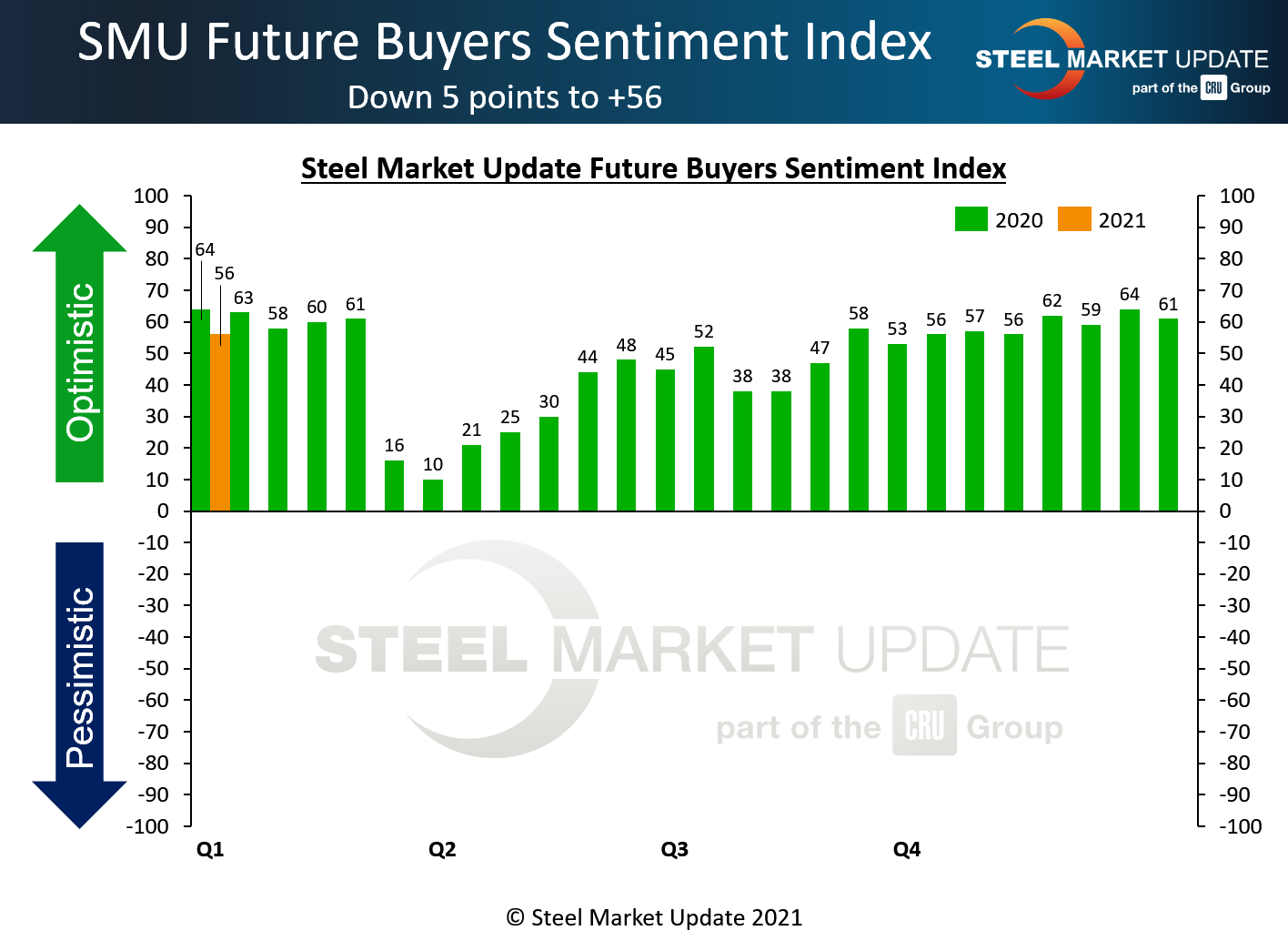

SMU’s Future Sentiment Index moved down by five points, however, to register +56 on concerns over the limited availability of steel and fears of a big price correction later this year. Yet sentiment about the coming few months remains above the average of +48 in 2020 and +51 in 2019 before the pandemic was a factor.

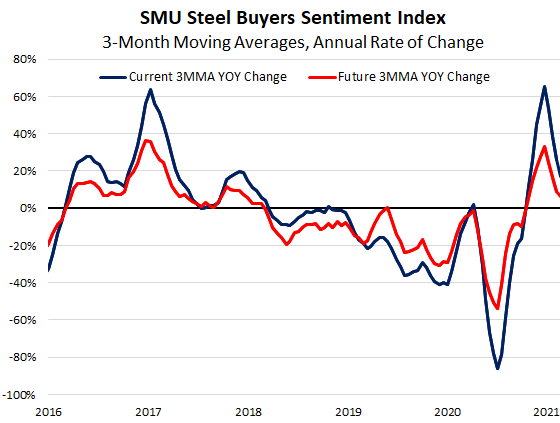

Three-Month Moving Averages

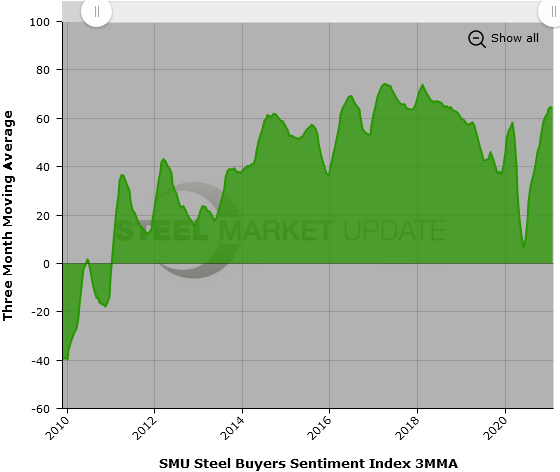

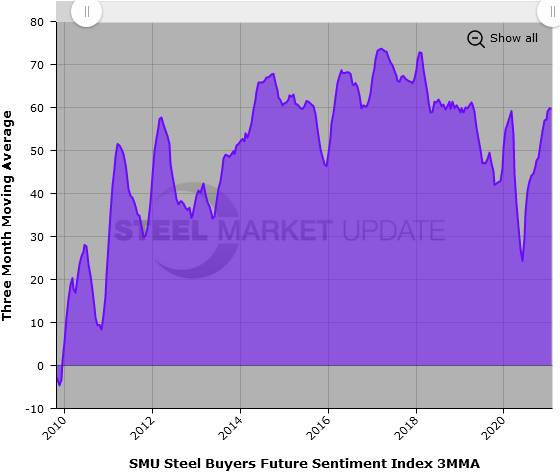

Calculated as three-month moving averages (3MMAs) to smooth out the monthly variability, Current Sentiment now measures +63.83 and Future Sentiment +59.67—both healthy readings compared with historical averages.

What Respondents are Saying

“We are optimistic that business will improve when more and more people are vaccinated.”

“We’re unable to get supply.”

“We need steel delivery to be timely.”

“Supply is restricted, so it’s harder to conclude prices. We’re worried about a price collapse and market claims or customers going out of business.”

“We don’t have much to sell, but profits look good short term.”

“We’re concerned about the risk of a price correction. What goes up must come down. We don’t want to be caught at the top.”

“I would say our prospects are excellent if steel were available.”

By Tim Triplett, tim@steelmarketupdate.com

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies; approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.