Market Data

January 8, 2021

Employment by Industry: December Results Disappointing

Written by David Schollaert

Employment gains have slowed each month since June, and after a marginal increase in November, December employment numbers retracted for the first time since March, according to Steel Market Update’s latest analysis of the U.S. Bureau of Labor Statistics (BLS) data.

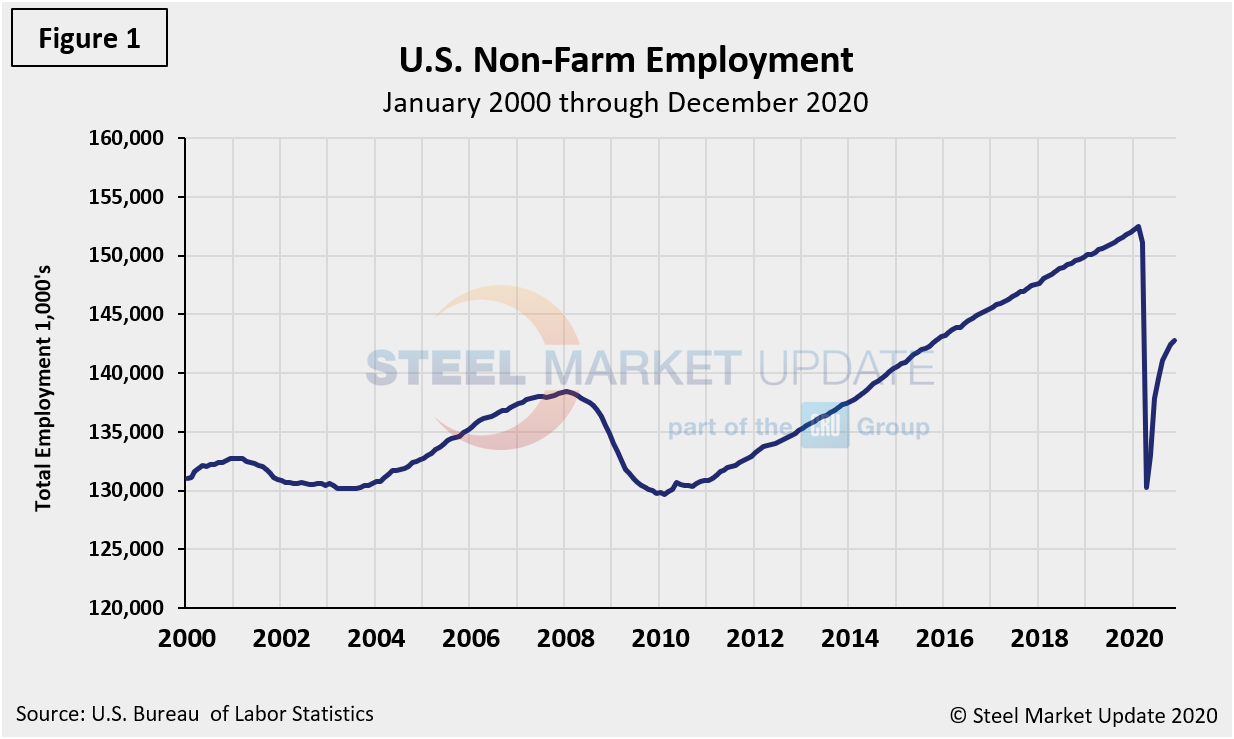

The net change in employed persons in December was a negative 140,000, following a disappointing gain of only 245,000 in November. Since June when 4.8 million jobs were recovered, the pace of employment increases has steadily slowed. The baseline against which future comparisons will be made is February 2020, the all-time high for nonfarm employment at 152,463,000. Figure 1 shows the total number of people employed in the nonfarm economy.

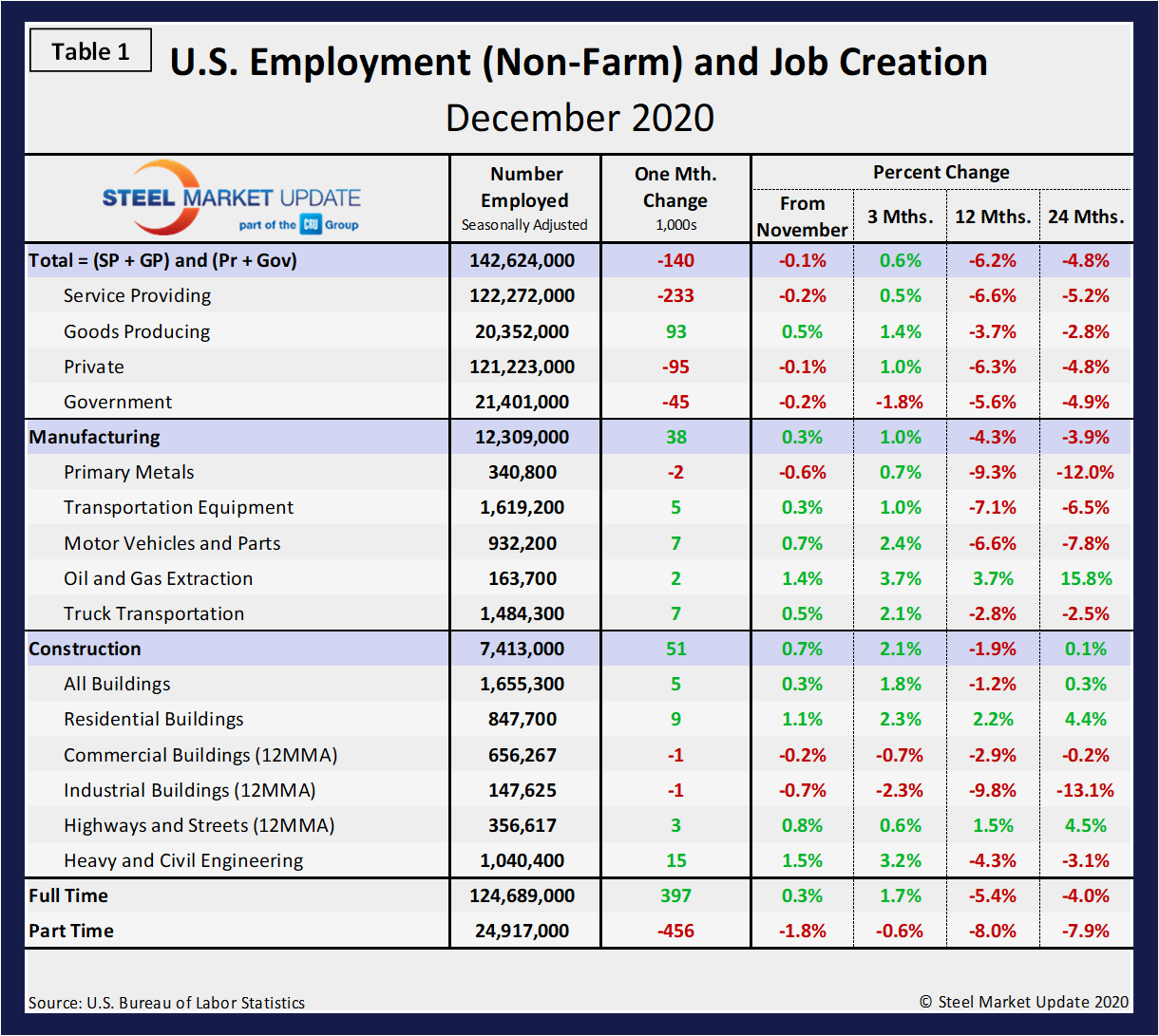

Table 1 is designed on rolling time periods: 1 month, 3 months, 1 year and 2 years. It breaks total employment into service and goods-producing industries and then into private and government employees. Most of the goods-producing employees work in manufacturing and construction and the components of these two sectors of most relevance to steel people are identified. Comparing service industries and goods-producing in December shows service jobs to have dipped by 0.2 percent while goods-producing rose by 0.5 percent from November’s result. Goods-producing has outperformed services in each of the four time periods shown in Table 1 on a percentage basis. Note, the subcomponents of both manufacturing and construction shown in Table 1 don’t add up to the total because we have only included those with the most relevance to the steel industry.

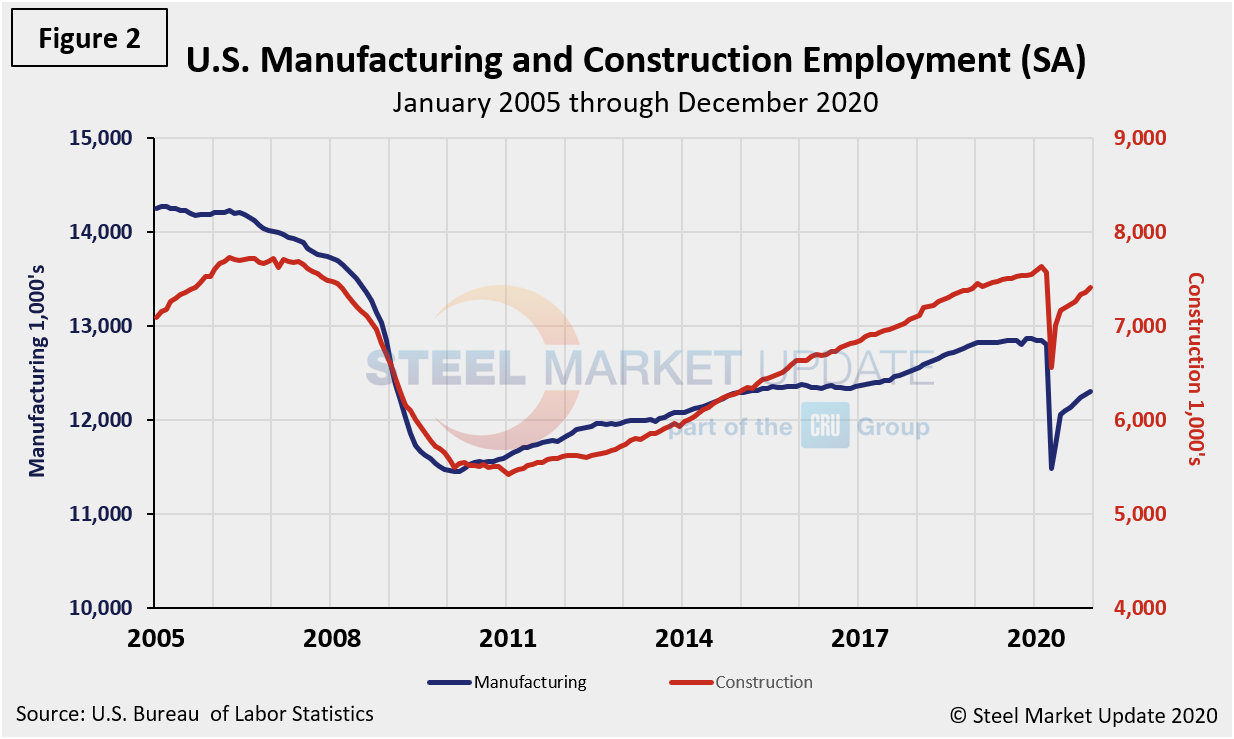

Comparing December to November, manufacturing employment was up by 0.3 percent and construction by 0.7 percent. In the year-over-year comparison, however, manufacturing has lost 4.3 percent and construction 1.9 percent. Although the percentages remain negative, they have been improving since the freefall in April.

“Construction added 51,000 jobs in December, but employment in the industry is 226,000 below its February level,” the BLS reported Jan. 8. “In December, employment rose in residential specialty trade contractors by 14,000 and residential building by 9,000, two industries that have gained back the jobs lost in March and April.

“In December, manufacturing employment increased by 38,000,” the BLS concluded. “Job gains in motor vehicles and parts, plastics and rubber products, and non-metallic mineral products were seen. Despite gains over the past eight months, employment in manufacturing is 543,000 below its February level.”

Figure 2 shows the history of employment in manufacturing and construction since January 2005.

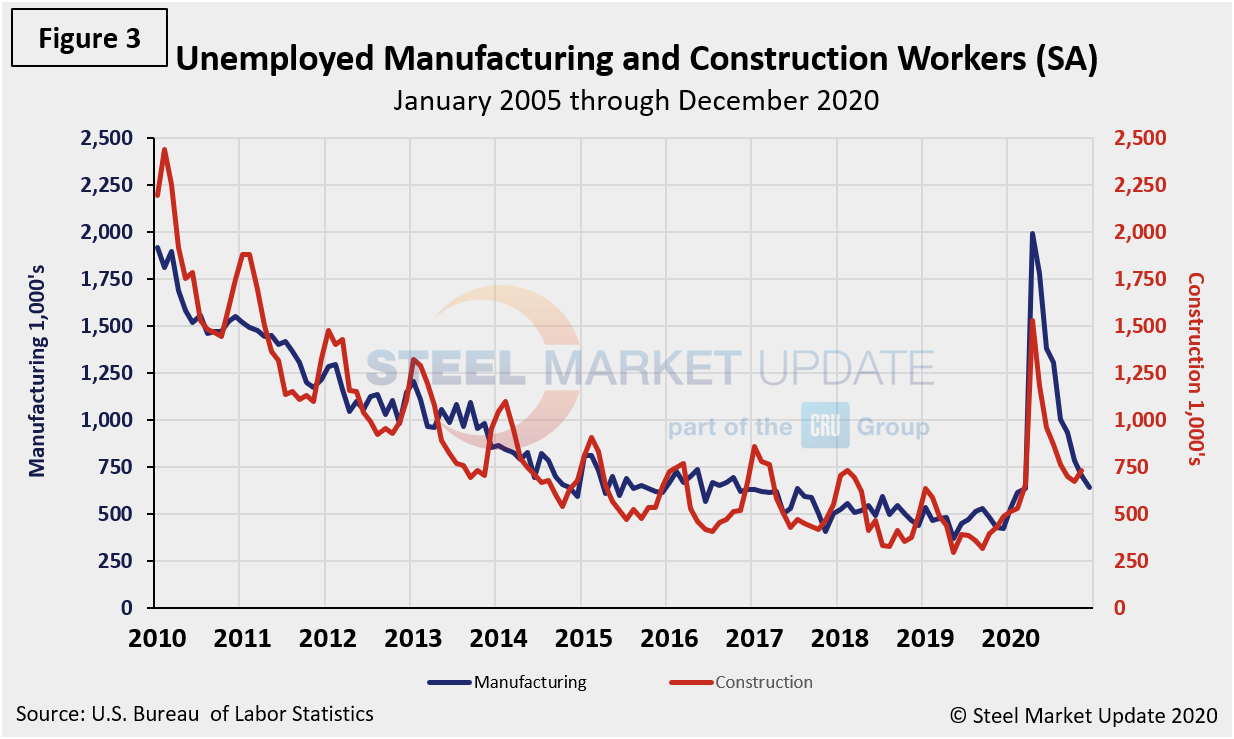

The reported number of unemployed manufacturing and construction workers is shown in Figure 3. These were 640,000 and 930,000, respectively, at the end of December.

SMU Comment: Primary metals underperformed total manufacturing for the second consecutive month and was the sole underperformer, losing another 2,100 jobs in December. Transportation equipment, including motor vehicles and parts, continued to gain in December after showing its best performance since June. Goods-producing industries, which are mainly in the manufacturing and construction sectors, continued to perform better than the service sector in December. As the market braces for another wave of Covid-19 cases throughout the winter months, this trend is projected to accelerate as a result. While many hoped for a vaccine-driven improvement, the poor showing in delivery of the potentially life-saving remedy means the employment situation is unlikely to truly improve until after spring. The pace of economic recovery could slow this winter, with a similar effect on steel consumption as a result.

Explanation: On the first or second Friday of each month, the Bureau of Labor Statistics releases the employment data for the previous month. Data is available at www.bls.gov. The BLS employment database is a reality check for other economic data streams such as manufacturing and construction. It is easy to drill down into the BLS database to obtain employment data for many subsectors of the economy. The important point about all these data streams is the direction in which they are headed.

By David Schollaert david@steelmarketupdate.com