Market Data

January 7, 2021

Steel Mill Negotiations: “They Can Charge Whatever They Want”

Written by Tim Triplett

With steel in such tight supply as 2021 gets off to a fast start, it’s clearly a seller’s market, with little to no price negotiation between buyers and the mills.

Based on Steel Market Update’s check of the market this week, average hot rolled steel prices have surpassed $1,000 per ton. SMU has received anecdotal reports of service centers and OEMs paying nearly $1,200 per ton to secure critically needed hot rolled. Similar premiums have been reported for most other flat rolled products as well.

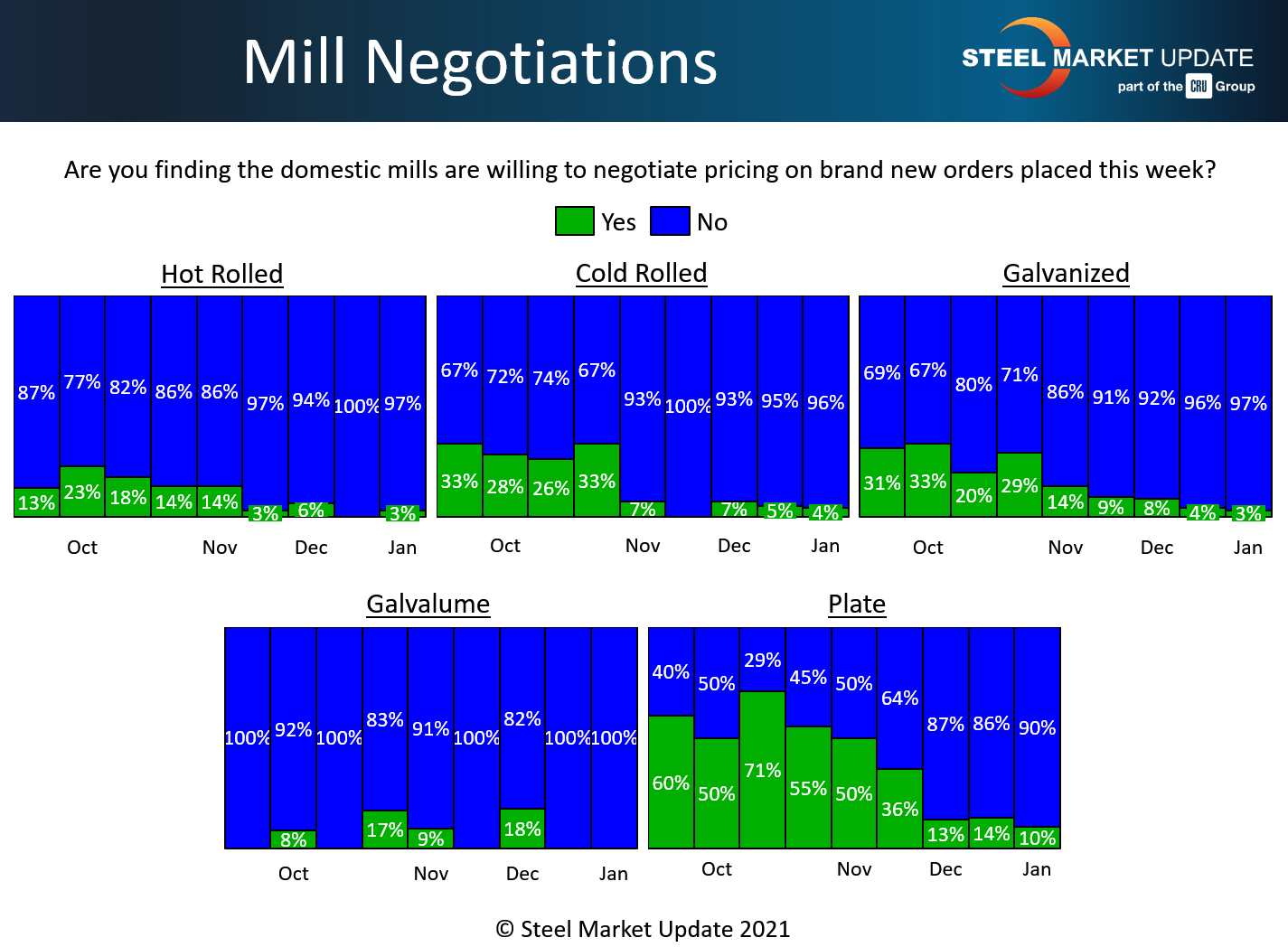

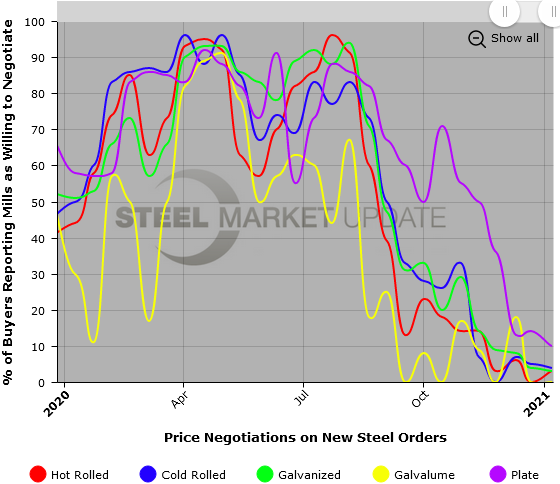

Virtually all the steel buyers responding to SMU’s market trends questionnaire this week said the mills are unwilling to deal on almost any product, as indicated by the predominantly blue bars below. As one buyer said, “Right now they can charge whatever they want.”

With demand staying strong into the new year, steel is expected to remain in short supply for some time, at least until more mills bring on additional capacity.

Note: These negotiations are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. To see an interactive history of our Negotiations data, visit our website here.

By Tim Triplett, tim@steelmarketupdate.com