Analysis

December 28, 2020

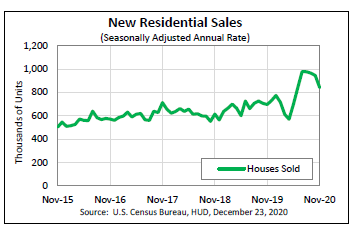

New Home Sales Slip in November as Supply Tightens

Written by Sandy Williams

New home sales in November slipped 11 percent from October to a seasonally adjusted annual rate of 841,000, reported the Census Bureau and Department of Housing and Urban Development. The pace of sales continues to outperform the 2019 rate however, up 20.8 percent from November last year.

The median sales price in November was $335,300 and the average sales price $390,100. Inventory stood at 286,000, a supply of 4.1 months at the current sales rate and 11.2 percent lower than a year ago.

“Though the market remains strong, the pace of sales pulled back in November as inventory remains low and affordability concerns persist as builders grapple with a shortage of lots, labor and building materials,” said National Association of Home Builders Chairman Chuck Fowke.

“The home building industry saw a historic gap between the pace of new home sales and construction of for-sale single-family housing this fall,” said NAHB Chief Economist Robert Dietz. “As a result, the pace of new home sales was expected to slow to allow construction to catch up. This appears to have occurred in November as inventory of completed, ready to occupy new homes was down 43 percent compared to November 2019 at just 43,000 homes nationwide.”

New home sales rose on a year-over-year basis in all regions: 28.2 percent in the Northeast, 24 percent in the Midwest, 16.9 percent in the South, and 20.5 percent in the West.