Analysis

December 8, 2020

Planning for Nonresidential Construction Dips in November

Written by Sandy Williams

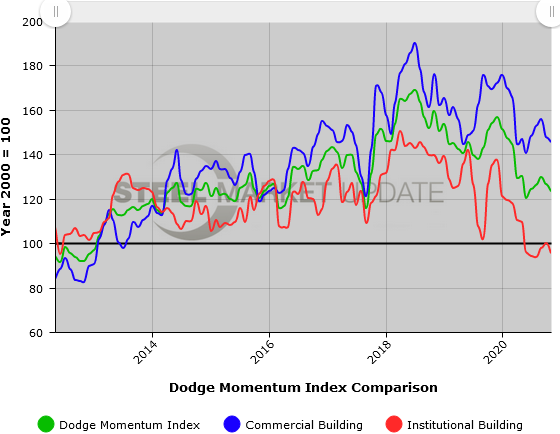

Dodge Data & Analytics reports a decline in project planning for new construction in the nonresidential sector. The latest Dodge Momentum Index fell 2.6 percent in November to 123.3 The institutional component of the index fell 4.4 percent, while the commercial component slid 1.6 percent.

“Since the expiration of support programs in the CARES Act, the economy has struggled to maintain traction and in its wake planning for nonresidential building projects has slowed,” said Dodge in its report. “As the next wave of COVID-19 infections quickly approaches, economic growth and job gains will ease further. Additionally, uncertainty over the potential for further federal stimulus has significantly complicated the recovery and will continue to negatively impact nonresidential building throughout the planning and construction processes.”

Nine projects valued at $100 million or more entered the planning phase in November.

Below is a graph showing the history of the Dodge Momentum Index. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.