Market Data

December 2, 2020

SMU Steel Buyers Sentiment: Solidly Optimistic

Written by Tim Triplett

Steel buyers continue to feel solidly optimistic about their prospects in the weeks and months ahead, though the limited availability of steel is causing widespread concern. As one service center exec commented this week: “The tightness in supply is what will hinder us from being successful. We can’t make a sale if we can’t get steel. It’s ugly out there in the trenches.”

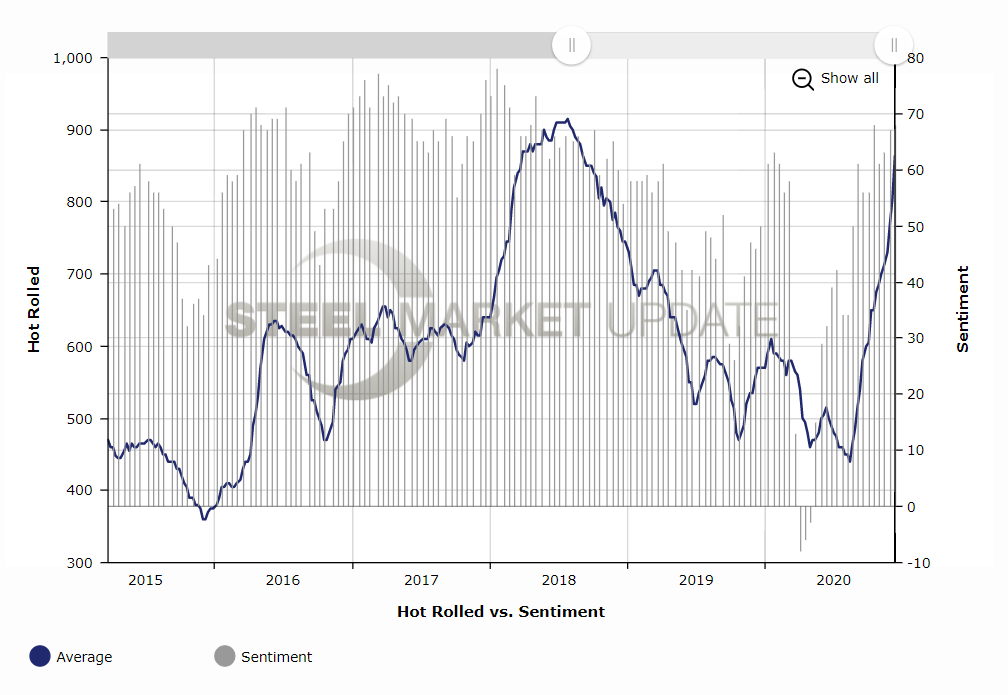

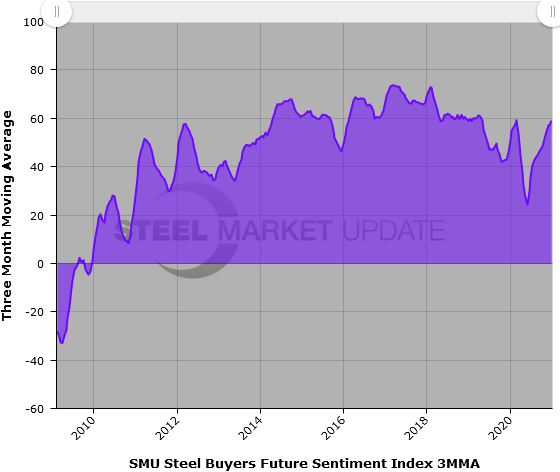

Historically, industry sentiment has correlated fairly closely with the ups and downs in steel prices. That relationship has never been more apparent than this year when the steep upward slope in prices and optimism have closely mirrored each other (see chart).

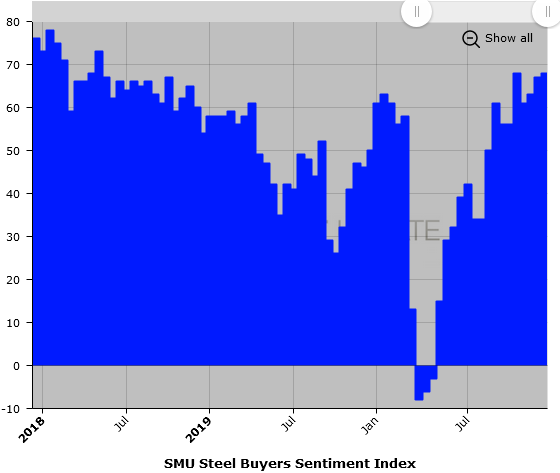

Every two weeks, SMU asks steel buyers how they view their company’s chances for success in the current environment as well as three to six months in the future. The Current Sentiment Index moved up by another point in the latest poll to a reading of +68—a whopping 76-point rebound from the low of -8 back in April when the market was staggered by the arrival of COVID-19.

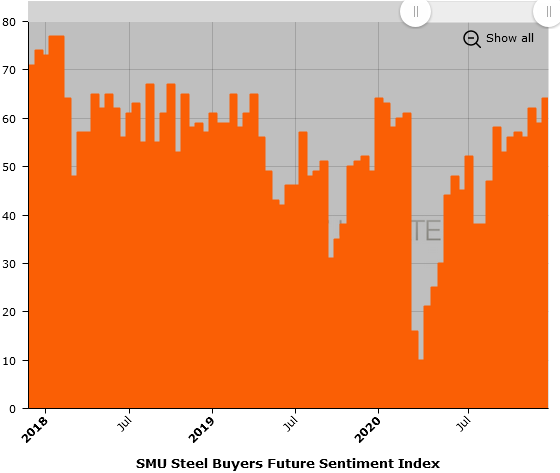

Future Sentiment

SMU’s Future Sentiment Index moved up by five points to register +64 this week, up 54 points from a low of +10 eight months ago.

At +68/+64, Current and Future Sentiment are not that far behind the all-time high readings of +78/+77 registered in January 2018. Interesting to note that the benchmark price of hot rolled coil was around $700 per ton when SMU’s sentiment indexes peaked in early 2018—about $200 per ton below today’s steel price.

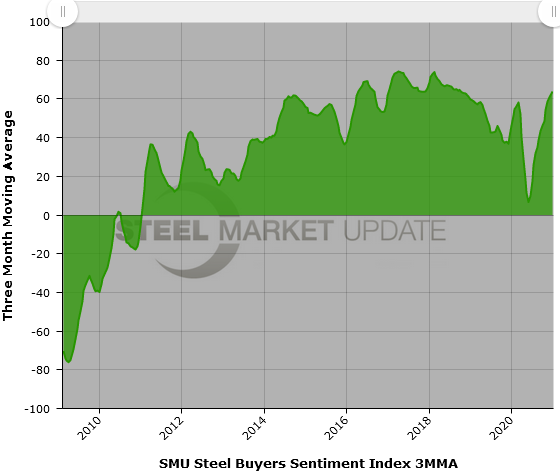

Three-Month Moving Averages

Calculated as three-month moving averages (3MMAs) to smooth out the monthly variability, Current Sentiment now measures about +64 and Future Sentiment +59—higher than levels prior to the pandemic. For comparison, the 3MMA for both indexes registered all-time highs around +74 in March 2017.

Some analysts believe steel prices still have considerable upside, predicting HRC might even hit $1,000 a ton soon. Given the relationship between prices and optimism, SMU’s Sentiment Indexes may have room to move up as well—though further increases could be tempered by coronavirus concerns and fears of steel shortages.

What Respondents Had to Say

“Demand is through the roof. We have most of our capacity sold well into Q2 now.”

“Our prospects are fair. We have decent inventory levels at great prices but nothing on order yet, so replacement costs are much, much higher.”

“We will be successful on top-line due to the significant increases in volume, but margins are being squeezed with the increase in price, and then of course the possible lack of availability.”

“The tightness in supply is what will hinder us from being successful. Can’t make a sale if we can’t get steel. It’s extremely ugly out there in the trenches.”

“It would be good if we had enough steel. We’re working hand to mouth, mill order from mill order.”

“Current supply issues are making things very challenging.”

“The future is still difficult to tell. Early second quarter still looks good, but as we move into third quarter?”

“Once we clear the availability issues, which I expect will continue through February 2021, we will be in pretty good shape.”

“Business is good for now, but come second-quarter 2021 all bets off.”

“We’ll feel better once the steel mills start delivering and lead times get to more normal levels.”

“I think the high prices and limited availability are going to stall construction and other manufactured goods.”

“There’s still too much manipulative behavior going on in the marketplace to feel good about anything.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies; approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.