Market Data

December 2, 2020

SMU Steel Buyers Sentiment: Clarity Adds to Positivity

Written by Tim Triplett

Industry sentiment inched even higher in the past two weeks now that the presidential election is in the rearview mirror and a COVID vaccine is in sight in the months ahead. The COVID pandemic remains a weight on Future Sentiment, however.

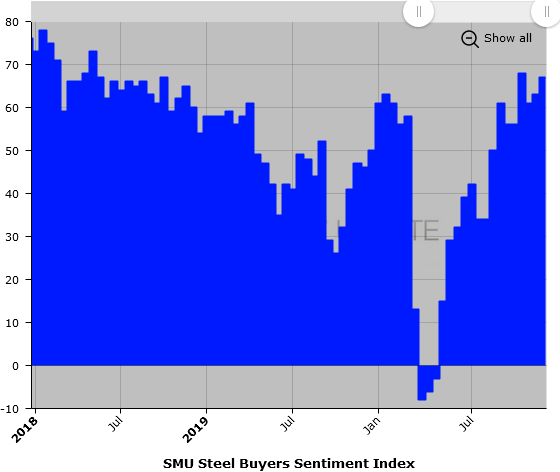

Every two weeks, SMU asks steel buyers how they view their company’s chances for success in the current environment as well as three to six months in the future. The Current Sentiment Index moved up by an additional four points in the latest poll to a reading of +67. At this time last year, prior to the pandemic, the Current Sentiment reading was just +46. Current Sentiment has rebounded by a whopping 75 points since hitting a low of -8 due to the COVID shock in the first week of April.

Future Sentiment

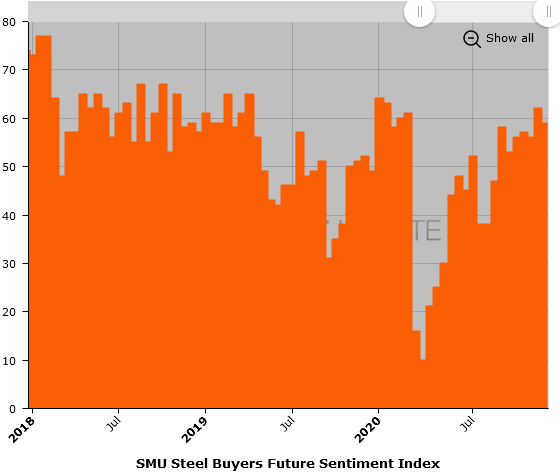

SMU’s Future Sentiment Index moved down by three points to register +59 this week, still a healthy level and up 49 points from a low of +10 back in April. Future Sentiment is well ahead of the average reading of +51 in the 12 months prior to the pandemic’s beginning in March.

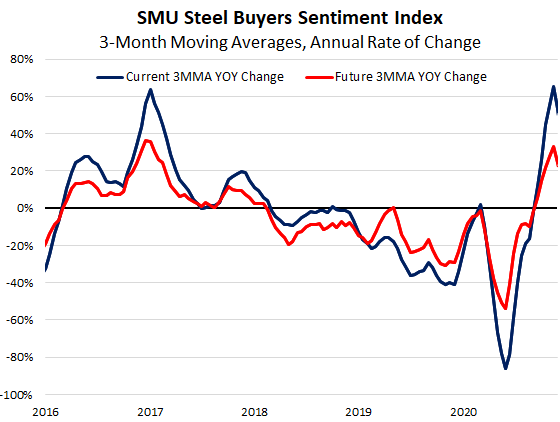

Three-Month Moving Averages

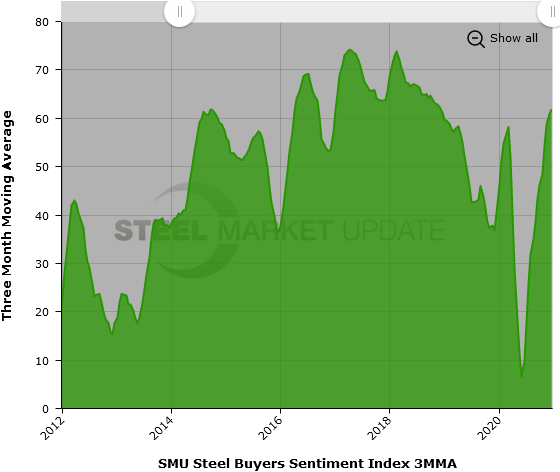

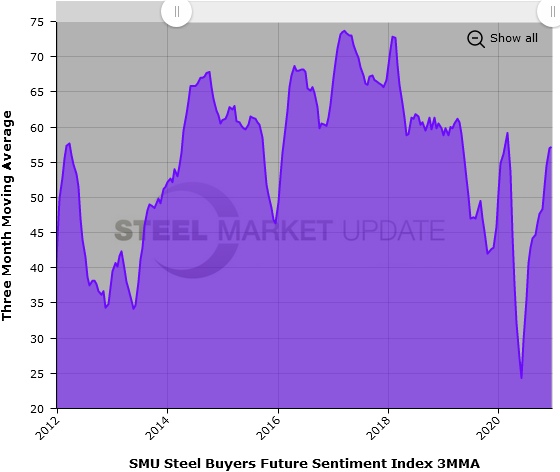

Calculated as a three-month moving average to smooth out the monthly variability, Current Sentiment now measures +61.83 and Future Sentiment +57.17, levels above those prior to the pandemic.

The surprisingly positive sentiment readings no doubt reflect the surprisingly high steel prices due to the strong demand and tight supplies. Future sentiment may be tempered by concerns over what happens to inventory values when prices revert to more normal levels sometime next year.

What Respondents Had to Say

“Too many supply problems.”

“For the moment things are fair, but if COVID-19 shuts down the U.S. and world, then we will slow down as well.”

“Success will depend on how well distributors navigate the price drop when, not if, it happens.”

“Unsure about COVID.”

“The future of COVID-19 is unclear for the next three months, but as the vaccine is applied we might be okay in the future.”

“At some point, inventory will be like POISON.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies; approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.