Market Data

November 24, 2020

Steel Mill Negotiations: Mills Still Have the Leverage

Written by Tim Triplett

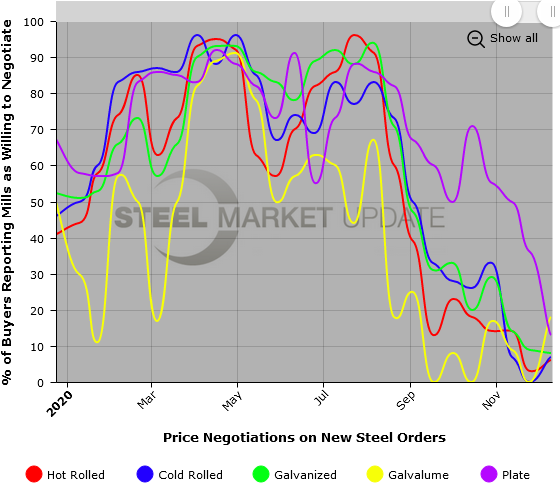

There is very little negotiation going on between the mills and their spot market customers as supplies remain extremely tight and buyers are happy just to find available material, even if they have to pay a substantial premium. It has been a seller’s market since September, with the mills enjoying most of the leverage, and there are no signs of that dynamic changing anytime soon.

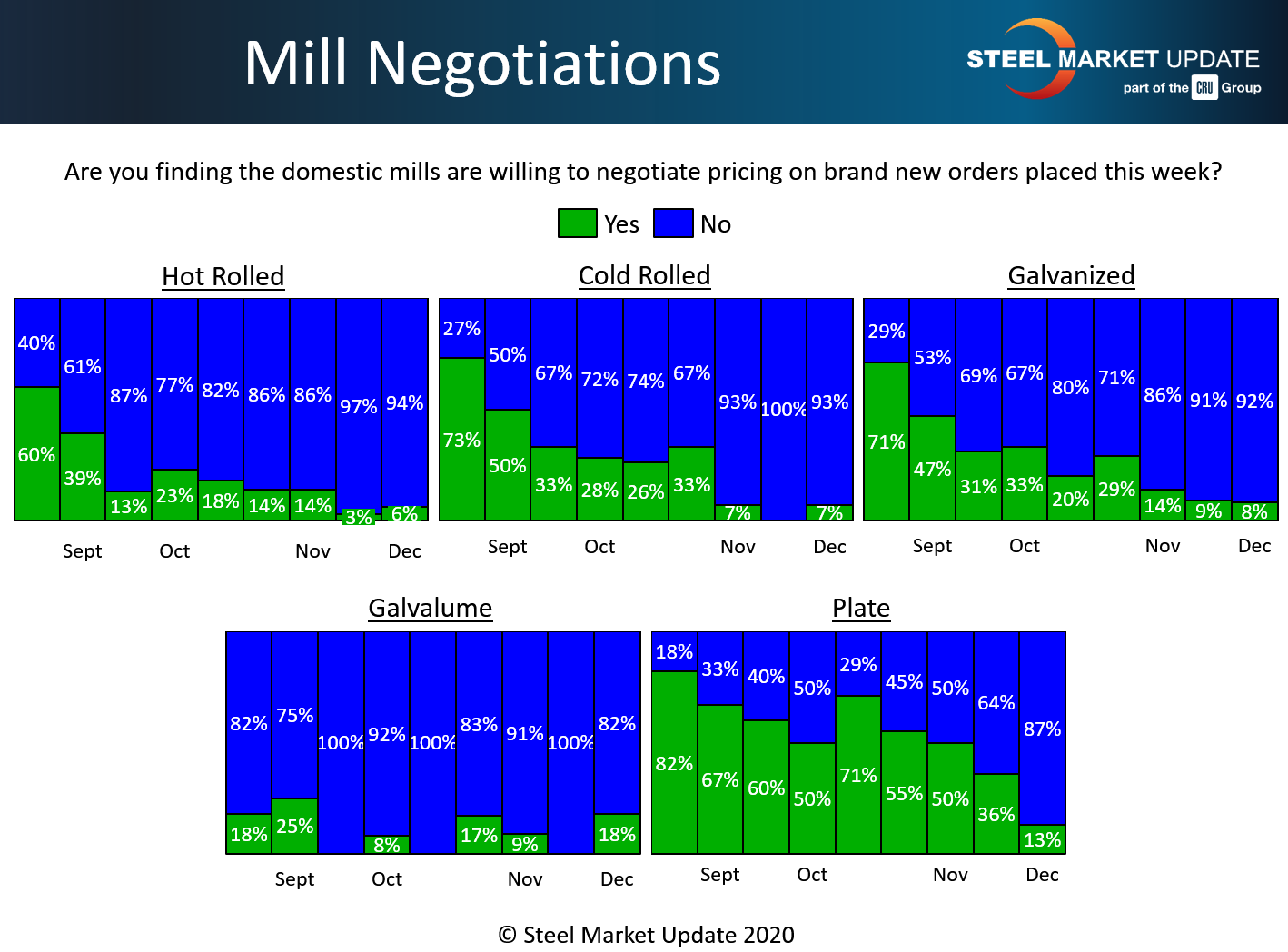

Data from Steel Market Update’s market trends questionnaire this week shows only minor changes since the last survey in late November. The vast majority (94 percent) of the steel buyers responding this week said the mills are unwilling to deal on hot rolled. Only 6 percent said the mills are willing to bargain to secure an HR order. In the cold rolled segment, 93 percent of those responding said the mills see no reason to talk price.

Negotiations for coated steel orders are just as tight, with 92 percent reporting the mills refusing to discount galvanized orders, and 82 percent reporting no price breaks on Galvalume.

The negotiating environment in the steel plate market has tightened a bit, with just 13 percent reporting that the mills are flexible on price, down from 36 percent in late November. Demand for plate seems to have improved in recent weeks, with plate prices on the increase.

Based on SMU’s check of the market this week, hot rolled steel prices are nearing $900 per ton, double the price in August. Until the mills increase capacity or steel orders decline, the supply-demand imbalance will give the mills the upper hand in price negotiations.