Market Data

November 15, 2020

SMU Steel Buyers Sentiment: Optimism Not So Surprising

Written by Tim Triplett

Industry sentiment, which was already at surprisingly optimistic levels, moved even higher in the past two weeks as steel prices continued to rise and the nation picked a new president.

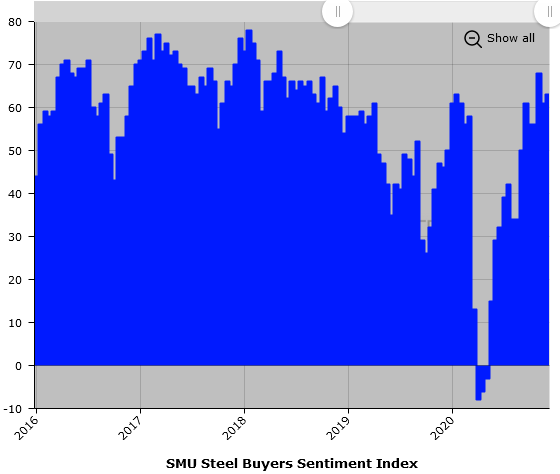

Every two weeks, SMU asks steel buyers how they view their company’s chances for success in the current environment as well as three to six months in the future. The Current Sentiment Index inched up by an additional two points to +63. At this time last year, prior to the COVID pandemic, the Current Sentiment reading was +47. Current Sentiment has rebounded by 71 points since hitting a low of -8 in the first week of April when the virus first derailed the economy.

Future Sentiment

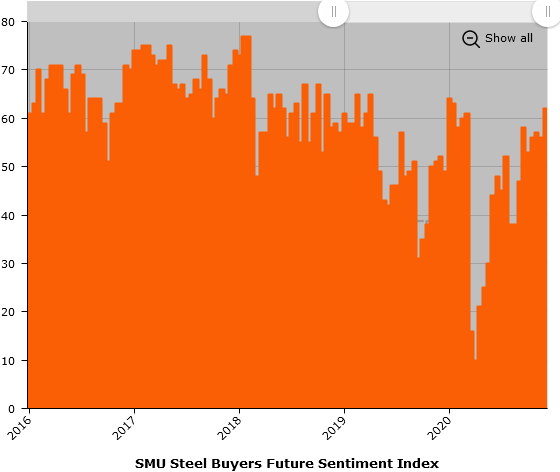

SMU’s Future Sentiment Index moved up by six points to register a robust +62 this week, up 52 points from a low of +10 back in April. The last time Future Sentiment was this high was in January 2020.

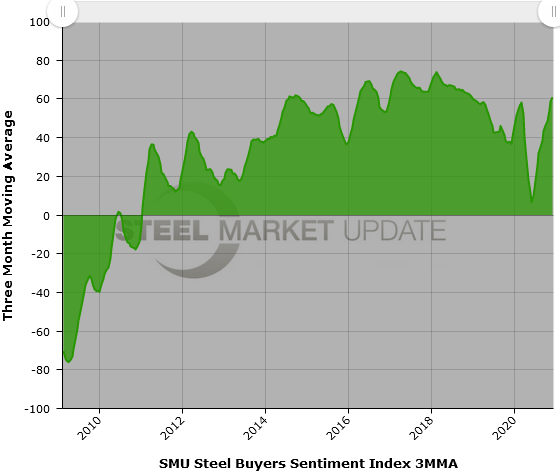

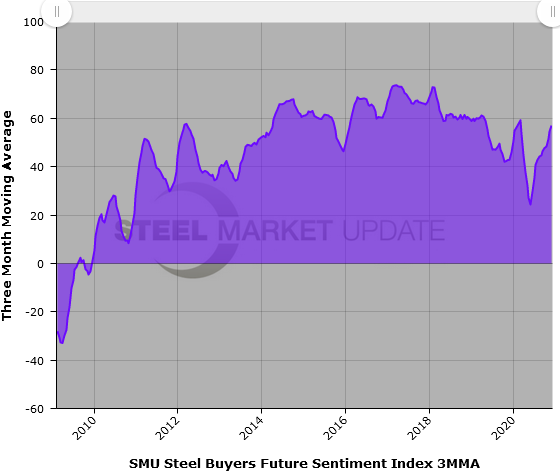

Three-Month Moving Averages

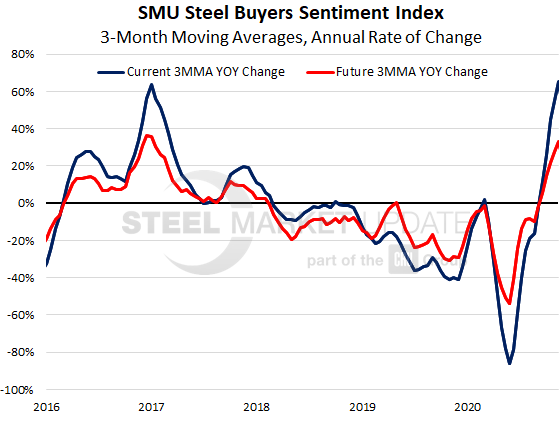

Calculated as a three-month moving average to smooth out the monthly variability, Current Sentiment now measures +60.83 and Future Sentiment +57.00, levels comparable to those prior to the pandemic.

No doubt COVID remains a big worry for most steel executives, but those concerns are outweighed by a number of positive developments. The economy has come much of the way back from the depths of the coronavirus recession. Steel demand is strong in many sectors. Aided by tight supplies, steel prices continue to rise, ensuring industry profitability at least for the near-term. Though the vote count continues, the outcome of the election is becoming clear, so we can all move on. Importantly, the experts tell us there’s a vaccine on the way, and the promise of more normalcy next year. So, on reflection, perhaps the numbers in SMU’s Sentiment Index are not that surprising.

What Respondents Had to Say

“As long as demand is steady and increasing, we can try to secure orders. If there’s no demand, we all lose. It’s all related to COVID-19 surges and potential shutdowns.”

“I don’t know about the COVID-19 effects on demand, but feel the headwinds are stronger.”

“Mill supply issues are causing problems and the spot market appears to be drying up.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies; approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.