Analysis

November 13, 2020

Final Thoughts

Written by John Packard

Flat rolled steel buyers are feeling a little skittish. Based on the results of last week’s flat rolled and plate steel market trends analysis conducted by Steel Market Update, the threat of higher prices, late mill deliveries and fear of a possible steel shortage situation are making steel buyers nervous (see article above with survey results).

![]() I thought the responses as to when the market would peak were interesting. A few weeks ago we had a large group of steel buyers expressing the opinion that prices were peaking at $650 per ton. We have since passed through $700 per ton ($710 per ton) and there is no immediate sign of relief. Now we are seeing 58 percent of the respondents to last week’s survey believing the market will not peak until February 2021 or beyond (36 percent February, 12 percent March, 5 percent each April or beyond).

I thought the responses as to when the market would peak were interesting. A few weeks ago we had a large group of steel buyers expressing the opinion that prices were peaking at $650 per ton. We have since passed through $700 per ton ($710 per ton) and there is no immediate sign of relief. Now we are seeing 58 percent of the respondents to last week’s survey believing the market will not peak until February 2021 or beyond (36 percent February, 12 percent March, 5 percent each April or beyond).

Something to think about. Over the weekend I had dinner with one of our scrap and pig iron market sources. I was told to anticipate domestic scrap prices rising rapidly by January. Right now, there are a number of countries looking for scrap in the United States to be exported (and having a difficult time finding any).

What else do we need to think about when it comes to scrap? How about China. Our source believes China will become a buyer of ferrous scrap in the not too distant future. In the process, you can expect world scrap prices to rise.

This does not take into consideration new EAF capacity coming online here in the United States.

Does this mean that at some point sub-$600 per ton hot rolled may be a thing of the past? Or will the theory of excess supply push prices lower? The wild card is Cleveland-Cliffs and how they treat the AK Steel and ArcelorMittal USA plants they have acquired. After listening to Lourenco Goncalves of Cliffs, I will be see if he holds true to his “value vs. volume” standards.

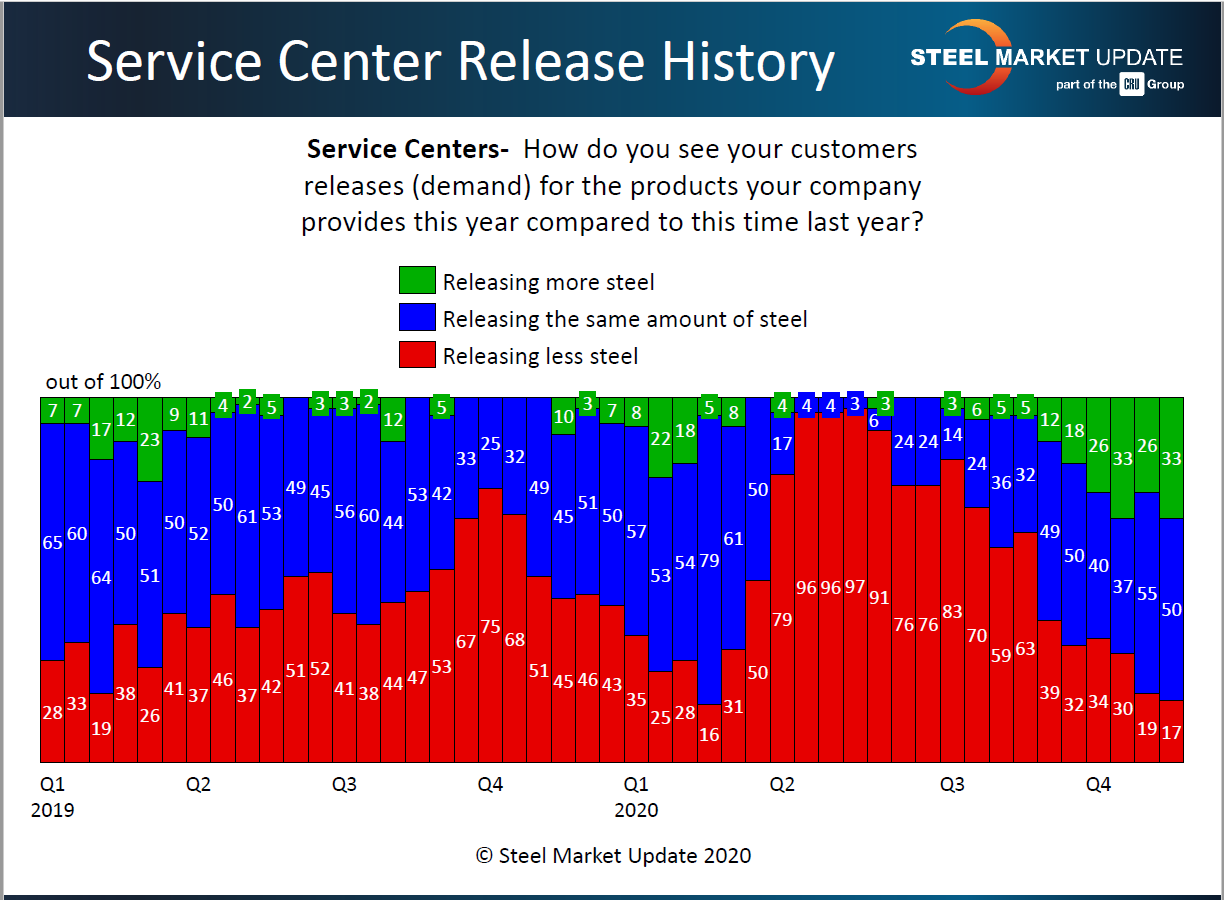

Demand is something buyers and sellers of steel want to understand better. Here is a telling graphic from last week’s survey:

Our next Steel 101: Introduction to Steel Making & Market Fundamentals Workshop will be held virtually on Dec. 8-9. You can learn more by clicking here.

The Tampa Steel Conference registration is now open. This will be the 32nd year of the conference, but it will be the first year for the conference to be presented by Steel Market Update and hosted by Port Tampa Bay. The conference will be held on Tuesday, Feb. 2, when we will have a full day of presentations. The timing should be good with the Biden administration having just been sworn in on Jan. 20. Registration is now open and can be accessed by clicking here. Remember, if you have attended a Tampa Steel Conference, you are eligible for a 50 percent discount off the full ticket price of $150 per person. SMU and CRU member companies receive discounts of $25 plus an additional $25 when you register more than one person from your company.

As always, your business is truly appreciated by all of us at Steel Market Update.

John Packard, President & CEO