Canada

November 12, 2020

Furnace Upgrade Positions Stelco for Better Results in Q4

Written by Sandy Williams

Canadian steel producer Stelco has completed the blast furnace reline and modernization at Lake Erie Works and is “ready to roll.” Chairman and CEO Alan Kestenbaum said the project was on time and under budget and will be North America’s first truly “smart” blast furnace. The modernization boosts the mill’s production capacity by 300,000 net tons per year and lowers costs by CAD $30 per ton.

The timing of the project couldn’t be more perfect, said Kestenbaum, occurring during a low pricing cycle and allowing Stelco to resume production in a significantly higher pricing environment.

“Our achievements this quarter have set the stage for us to effectively deploy our tactical flexibility model and fully capitalize on the emerging recovery in the steel market where prices are now about 50 percent higher than we saw during the third quarter,” said Kestenbaum.

Stelco has sold out its production every quarter of 2020, despite the pandemic and an October cyberattack. Books for Q4 closed last week and new orders will be for first quarter 2021 delivery. End markets continue to be strong and Stelco is making progress on penetrating the auto market. Recent mill consolidation has some customers exploring new supply sources, providing opportunities for Stelco to gain business, the company said.

A 65-megawatt co-generation project at Lake Erie Works is expected to start up in mid-2022. Stelco expects to commission its pig iron casting facility by year end and will be able to provide EAFs and foundries with iron units. With international coke prices up substantially, Stelco is back in the business of selling merchant coke. Volume projections were not available, but coke sales will be “noticeable,” said CFO Paul Scherzer.

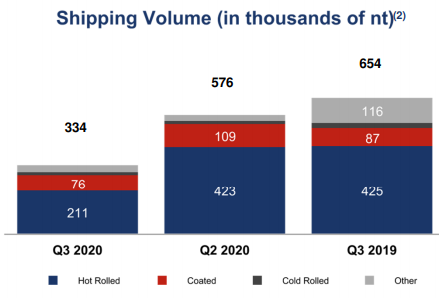

As expected, revenue decreased in the third quarter due to a 49 percent year-over-year drop in shipping volumes related to the blast furnace upgrade project. Revenue was CAD $237 million resulting in a net loss of CAD $88 million for the quarter.

As of Sept. 30, the company had CAD $137 million of liquidity—$106 million in cash and $31 million in an undrawn ABL revolver. With most of the capex expenditures behind it, Stelco plans to focus in Q4 and 2021 on higher shipments, lower costs, gaining market share and providing positive returns for shareholders, the company said.

(Note: 1 CAD = $0.76 USD)