Market Data

November 3, 2020

CRU: Vaccine Optimism Brings Recovery Forward, But Commodity Prices Unlikely to Rally

Written by James Campbell

By CRU Principal Analyst James Campbell, from CRU’s Global Steel Trade Service

The recent acceleration in news of a pre-approved vaccine has led us to bring forward the economic recovery to the first half of 2021. Confidence has returned and spending is resuming. An earlier-than-expected vaccine provides upside risks to our automotive and construction outlook. This could directly benefit metals demand, particularly those metals which are used as inputs into consumer goods. The implications for prices are less clear cut, given that commodity prices have detached from costs of production.

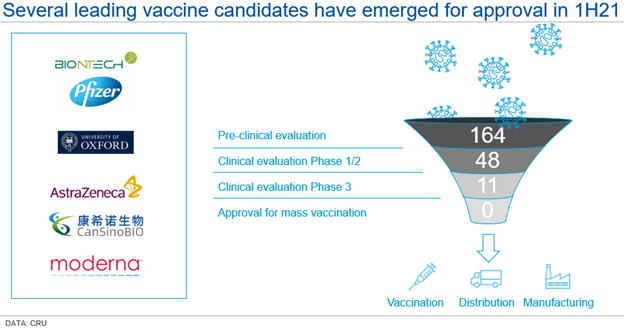

Recent weeks have brought good news on vaccine development. The Pfizer-BioNTech, Moderna and Oxford/AstraZeneca vaccines are showing 70-95% efficacy rates in Phase III clinical trials. Although none have received regulatory approval yet, this could come quickly, and we expect all three vaccines to start being administered in the U.S., Europe, and Japan during 2021 Q1. We expect most of the population in advanced economies to be vaccinated through 2021; it will take longer in emerging economies.

A Slightly Rosier Macro Outlook

Our November Global Economic Outlook is consistent with the vaccine being widely available to the public from 2021 Q2. That is up to two quarters earlier than what we had expected in our previous economic forecast. The substantial downside risk to our forecasts of a vaccine failing to materialize has now virtually disappeared.

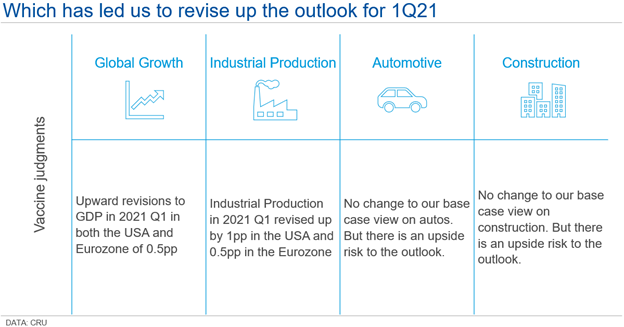

Positive news on the earlier-than-expected vaccine has led us to bring forward the economic recovery to within 2021. Our view is that business and consumers can now see an end to the pandemic, and a likely return to normality. Although vaccines will not resolve the pandemic in Q1, the certainty that vaccines are a matter of when, not if, should provide a boost to confidence and spending in the Eurozone and the USA starting in Q1. In turn this should boost corporate earnings and household incomes.

Our judgement is that the vaccine will provide a boost to GDP growth in the USA and Eurozone of around 0.5pp in the first quarter of 2021. Industrial production will be correspondingly higher. The boost to IP in the USA is larger than it is in the Eurozone, reflecting the fact that IP in the U.S. has been more sensitive to both the fall and the recovery.

The upward revision to the macro forecast in 2021 Q1 is one of timing—the earlier-than-expected distribution of a vaccine allows for an earlier economic recovery and return to normality.

Upside Risks to Auto and Construction Sector Outlooks

In five features of the pandemic recovery we explain why the outlook for construction has been more bullish than that of autos sales during the pandemic. Ultimately it has been because lockdowns have been less disruptive for construction sector activities. Moreover, Covid-19 has had a disproportionately smaller impact on the income of potential home buyers, who have kept their jobs and benefitted from government stimulus. Covid-19 has hurt commercial real estate, particularly office and retail space, where pre-Covid-19 trends towards working from home and online shopping have accelerated. An earlier-than-expected vaccine provides some relief to this sector, offering upside risks to our forecast for non-residential construction in 2021. With residential construction already buoyant, we do not see much more upside there.

Automotive production was one of the hardest hit manufacturing sectors during the pandemic. Complex supply chains suffered severe disruptions, social distancing closed showrooms in many countries and uncertainty about the future reduced demand. The second half of 2020 has seen a sharp recovery, which we expect will continue into 2021. The earlier-than-expected vaccine provides upside risks to our auto forecasts for 2021. This arises because as consumers and firms have more certainty about their future income, they will be more willing to part with the substantial sum of money required to purchase a vehicle.

How Will Metals Demand Be Affected?

We expect an early rollout of the vaccine to bring forward the recovery in metals demand during 2021 too. The earlier boost is likely to be most pronounced for products exposed to consumer products such as automotive. A good example here is the steel flat products market outside China. Demand was hit harder than expected in our base case in 2020 Q2—in fact, it was closer to our downside case following a near total shutdown of auto production outside of China during April.

Since then, demand has recovered fast, supported by restocking and a consumer-led pull for manufactured products such as cars and domestic appliances. Producers and consumers throughout the manufacturing supply chain are still highly uncertain as to where underlying demand will outturn and when the widescale supply chain restocking ends.

Does This Mean Higher Metals Prices?

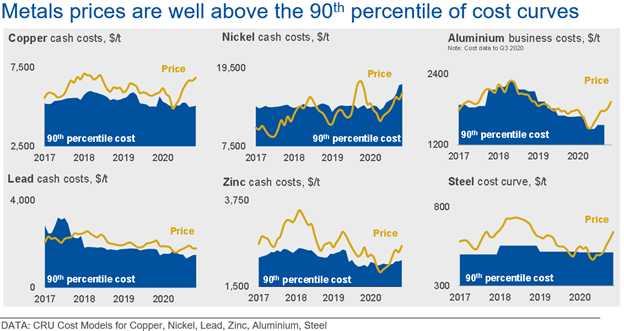

Although the outlook for demand looks stronger, this may not translate into higher metals prices; prices for many metals have in many cases detached from cost during 2020. Prices for many commodities are now well above the 90th percentile of the cost curve, as determined by CRU’s cost models. Financially traded commodities are vulnerable to profit taking, as traders sell the commodities at a high price and focus the money elsewhere, such as cyclical stocks. The prices of commodities that are reliant on physical trading such as steel may also come under pressure as supply constraints ease. For example, restarts in steel supply and restocking through the chain are likely to reverse the bottlenecks that had supported prices through 2020.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com