Prices

November 3, 2020

CRU: Refined Zinc Surplus to Swell to 900,000 Tons in 2020-21

Written by Helen O’Cleary

By CRU Senior Analyst Helen O’Cleary, from CRU’s Steel Sheet Products Monitor

The impact of Covid-19 restrictions on global manufacturing this year has led to the loss of ~ 700,000 t of refined zinc demand compared to our pre-Covid-19 forecasts. Smelter output has been far less impacted, despite mine supply losses, and this has led to a sizeable refined surplus. In our Insight dated Nov. 29, “Zinc mine supply bouncing back in 2021 but market to remain tight,” we looked at how Covid-19 affected mine supply and the concentrate market, which is expected to remain tight next year even as mine output continues to recovery. In this Insight, we will look at how we see the refined market balance this year and next.

Refined Demand May Not Recover Fully Until 2022

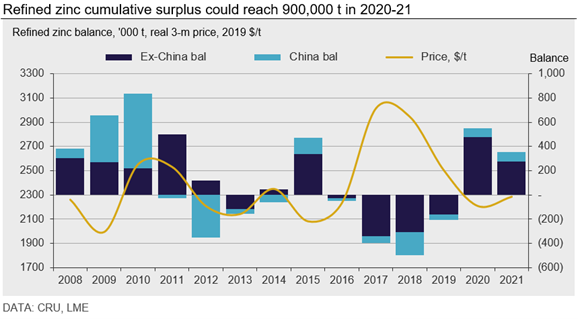

In January 2020, we were expecting refined zinc demand to return to growth this year, following modest contractions in 2018 and 2019. We were also expecting the market to return to surplus, following four years of deficit, during which much of the excess metal stock built up since the global financial crisis had been drawn down.

This year’s Covid-19-related demand slump against relatively normal levels of smelter output has led to a surging refined market surplus. Auto makers were among the first to feel the disruptive impact of the virus as China went into lockdown in 20 Q1 in an attempt to contain the outbreak. This disruption to global supply chains was soon followed by the rapid spread of the virus and extensive lockdowns worldwide, with very few sectors of zinc demand spared the impact.

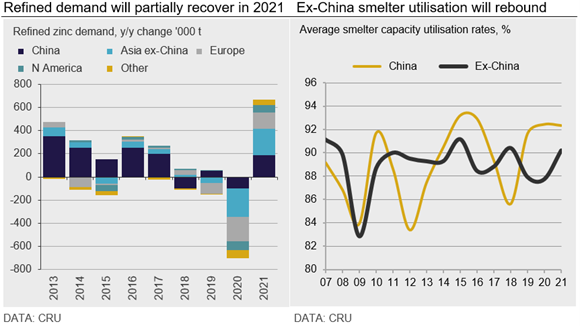

Chinese demand has recovered more strongly than expected and we believe that losses there will be limited to 1.5% y/y. In ex-China, we expect losses to be 8.5% y/y, with Europe and parts of Asia (Japan and India) particularly hard hit. We estimate that virus-related restrictions will lead to refined demand losses of 5.1% y/y, or ~700,000 t, compared to our January forecast. We now expect refined demand to fall to 13.0 Mt this year and for it to rebound by 5.2% y/y in 2021, but to not quite recover this year’s losses.

Refined Output Has Been Less Impacted, Expected to Grow Next Year

Despite this year’s mine supply losses, many smelters have continued to produce normally, helped by being allowed to continue operating through lockdowns in some countries, concentrate stocks compensating for mine supply losses, and zinc prices which have risen by more than enough to offset falling TCs. The main exceptions to this are Vedanta’s Indian smelters, where the expected increase in mine supply did not materialize and smelter output therefore remained flat y/y, Vedanta International’s Skorpion, which ceased production in 20 Q1, and Nexa’s Cajamarquilla, which was impacted by the lockdown in Peru in H1.

At the same time, Chinese refined output has remained robust, and we expect it to grow by 1.4% y/y, or 85,000 t, this year, and we estimate that U.S. smelter output will increase by 48.3% y/y, or 80,000 t, thanks to the ongoing ramp-up at AZR’s Mooresboro. We expect global smelter output to increase by 0.4%, or 52,000 t this year, to 13.55 Mt.

Next year, although we expect prices to be under downward pressure, smelter economics should remain favorable and we expect smelter utilization rates to increase and refined output to grow by 3.5% y/y, to 14.0 Mt. We expect the largest increase to be in ex-China (by 5.1% y/y to 7.78 Mt), with delayed ramp-ups at Hindustan Zinc and Torreon contributing the most, alongside the ongoing ramp-up at Mooresboro. At the same time, China’s refined output is expected to grow by 1.5% y/y, to 6.25 Mt, due to higher global mine supply.

This Year’s Refined Surplus of 550,000 Tons to be Followed by 350,000 Ton Surplus in 2021

We forecast that 2020’s switch to refined surplus could herald the start of a period of significant over supply. Our numbers suggest that this year’s 550,000 t surplus will be followed by a 350,000 t surplus next year. Zinc’s stellar price performance this year has encouraged smelters to continue operating even as demand has slumped and, although we expect prices to fall next year from current high levels ($2,800 /t at the time of writing), we do not currently foresee a collapse to the kind of levels that would remove a large tranche of mine supply. That said, we will remain in uncharted waters in 2021 for as long as Covid-19 is circulating and we cannot rule out isolated mine closures, which would further tighten the concentrates market and impact refined supply. However, the greatest downside risk remains to our demand forecast, and a weaker-than-expected recovery could lead to an even larger surplus next year.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com