Market Data

November 3, 2020

CRU: China’s High-Scoring 13th Five-Year Plan a Sign of Things to Come

Written by John Johnson

By CRU China CEO John Johnson and Economist Yingrui Wang

Steel Market Update is pleased to share this Premium content with Executive members. For information on upgrading to a Premium level subscription, email Info@SteelMarketUpdate.com.

China’s Five-Year Plan (FYP) is a key guide to the strategic direction of China. In this Insight we explain the significance of China’s Five-Year Plan, including an examination of the performance during the current 13th Five-Year Plan (2016-2020). We also offer some early thoughts on the likely emphasis of the 14th Five-Year Plan (2021-2025). As more details of the next plan become available, CRU will provide updates on how it is likely to impact the mining, metals, and fertilizer industries.

Planning a Major Strength of China’s System

The Chinese government regards medium and long-term planning as a major strength of its system because the state can direct and coordinate activity across many policy areas. The most prominent feature of this is national five-year planning, in which the Chinese Communist Party and government establish their priorities.

The Five-Year Plan sets forth China’s strategic intentions and defines its major objectives, tasks and measures for economic and social development. It serves as guide to action for market entities, an important basis for government performing its duties, and a common vision to be shared among the people of China. (Translation by Central Committee of the Communist Party of China taken from 13th Five-Year Plan.)

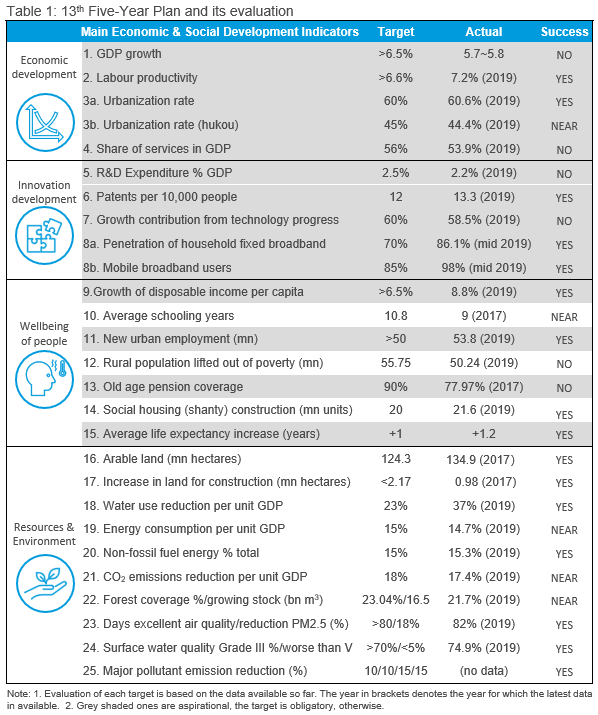

The Five-Year Plan can be divided into many subcomponents for all major sectors of the economy, industries and society. However, for convenience and simplification, the 13th Five-Year Plan can be summarized by 25 main economic and social development indicators covering four broad categories: economic development, innovation, wellbeing of people, and resources and environment. These indicators are shown in the accompanying table together with CRU’s assessment of their success or otherwise (see Table 1).

SOURCE: China’s 13th and 14th Five-Year Plans: Review and Advice; News (CN); SCIO (CN); Xinhua1 (CN); Xinhua2 (CN); China’s government website (CN); BP Statistical Review of World Energy 2020; CRU

It is important to note that the time span for the 13th Five-year Plan is the end of 2020. In that respect, we have not yet reached the end of the plan yet. The assessment provided in Table 1 is based on published data that captures performance to date. Some of these data are available with a lag, so progress by the end of the year is expected to improve.

The Proof is in the Pudding

To score the performance of the 13th Five-Year Plan, CRU has created a subjective scoring system for each indicator based on whether targets have already been met (1 point), are “near” to being met (0.75 point), or are expected to be missed or not so “near” (0 point). The overall score is based on internal research and is not official, but we attempt to be as fact-based as possible.

This methodology suggests that at least 72% of these high-level indictors have already been achieved. Previous Five-Year Plans in recent history, including the 12th Five-Year Plan (2010-2015) met most of their key social and economic indicators and are likely to have achieved a slightly higher success rate based on this simple yardstick. However, the score during the 13th Five-Year Plan would certainly be much closer to 80% had Covid-19 not derailed economic targets in 2020. It may still surprise on the upside since we have not yet reached the end of 2020 and data has not been fully published. It is also worth pointing out that this excludes the performance at the industry-sector level.

Let us highlight the performance for several of the key indicators, notably those that impact on commodities. These may also help to tee-up expectations for the 14th Five-year Plan.

First, the 6.5% average GDP target rate between 2015 and 2020 was set at a slower growth rate than the previous plan (7%). In fact, this was well on course to be achieved, but the impact of Covid-19 on 2020 growth (at circa 2% GDP) has meant we expect growth to average 5.7-5.8%. It is being speculated whether the 14th Five-Year Plan will have any explicit GDP target. However, whatever happens China is expected to continue to address economic rebalancing during the next plan. CRU is currently forecasting an average GDP growth rate of around 5% between 2021-2025.

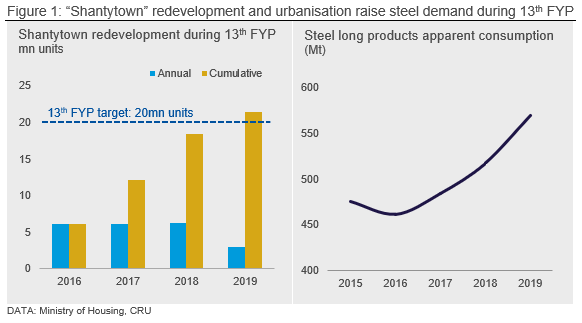

Second, the target for urbanization rate rose from 56% to 60%. Related to this the target for social housing or “shanty housing” reconstruction was set at 20 million units. Both appear to have been more than successfully accomplished by the end of 2019 (Figure 1). As a result, this success has generated significant growth in China’s metals demand in recent years. “Shantytown” redevelopment involves compensation, demolition and rehousing in newly built housing. We estimate that the replacement of 20 million units created direct demand for the equivalent of ~75 million tonnes of steel. Together with other drivers, this has helped Chinese finished steel demand to grow by almost 20% from 2015 to 2019. Much of this growth emanates from steel long products, which are used in construction. This shows just how important it is to follow new targets for urbanization and social housing in the next Five-Year Plan.

The Environment is a Key Focus

It is also worth drawing special attention to the environmental targets which were all regarded as “obligatory”, as opposed to “aspirational.” These targets were drawn up in the aftermath of the 2013 “smog crisis” that swept over northern China. In fact, these targets are expected to be met or very close to being met by the end of 2020.

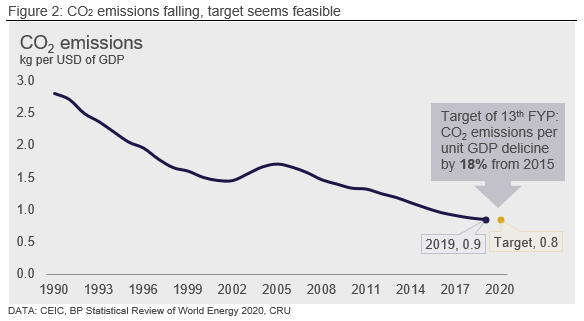

Looking forward, we expect environmental targets to continue to form a significant part of the 14th Five-Year Plan, but they are likely to take on a different focus, such as CO2. This was confirmed by President Xi’s announcement to the UN that China “aims to have CO2 emissions peak before 2030 and achieve carbon neutrality before 2060.” Policies in this area are likely to be escalated over the next Five-Year Plan and are bound to have a profound impact on metals industries.

Figure 2 illustrates the fall in emissions per unit of GDP, but the next Five-Year Plans will need to be more focused on absolute reductions in CO2, rather than per unit of GDP. This will be more difficult to achieve in a growing economy at China’s stage of development.

Finally, some high-level target “misses” or “near-misses” are likely in R&D expenditure, growth from technological progress, the number of rural populous lifted out of poverty and pension coverage. These innovation and poverty reduction targets are likely to be a key focus for the next plan, with the former having significant implications for metals demand through new infrastructure investments in 5G, electric vehicles, renewables, UHV lines, and the latter supporting the focus on domestic consumption.

The evidence to date suggests that China has thus far achieved 72% of the targets of the 13th Five-Year Plan. That should be considered a respectable result on two counts. First Covid-19 has derailed some of the expected progress. Second, the timeframe for the Five-Year Plan is end 2020, and we expect a larger share of the targets to be met by then.

The targets set in the Five-Year Plan are important drivers for metals markets and should be watched carefully. As more details of the 14th Five-Year Plan become available over the coming weeks and months, CRU will be monitoring the likely impact of these on the mining, metals and fertilizer industries. At this stage we expect targets to enable the economy to further pivot towards self-sufficiency, technological advancement, and the environment.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com