Market Data

November 1, 2020

SMU Steel Buyers Sentiment: Better Than Before the Pandemic

Written by Tim Triplett

Industry sentiment has rebounded to levels exceeding those seen prior to the pandemic, and steel executives polled by Steel Market Update this week have a fairly optimistic outlook on their future as well despite concerns about a second wave of COVID-19.

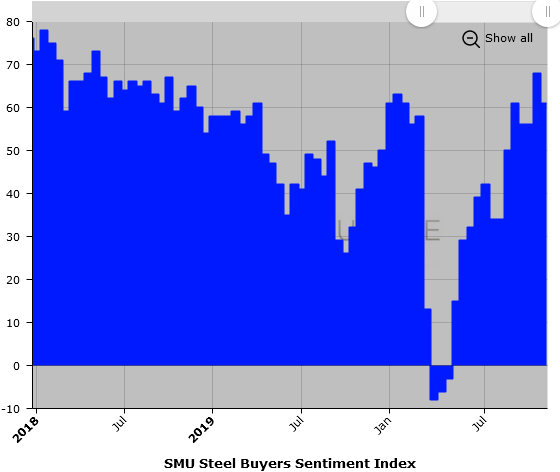

Every two weeks, SMU asks steel buyers how they view their company’s chances for success in the current environment. The Current Sentiment reading has dipped by seven points since mid-October, but remains at an optimistic +61. For comparison, the average sentiment reading in the 12 months prior to the pandemic was +48. At this time last year, SMU’s Sentiment Index reading was +41. Current Sentiment has rebounded by 69 points since hitting a low of -8 in the first week of April as the virus shut down much of the economy.

Future Sentiment

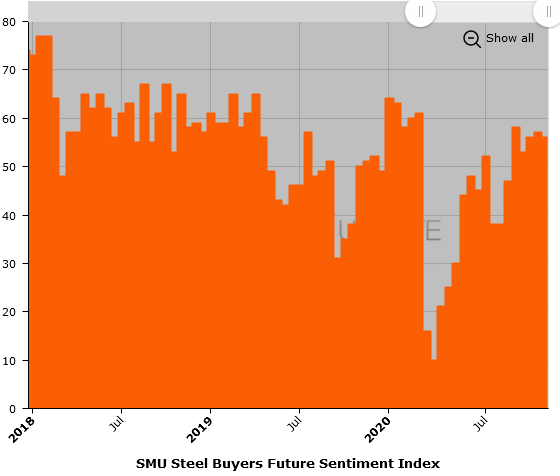

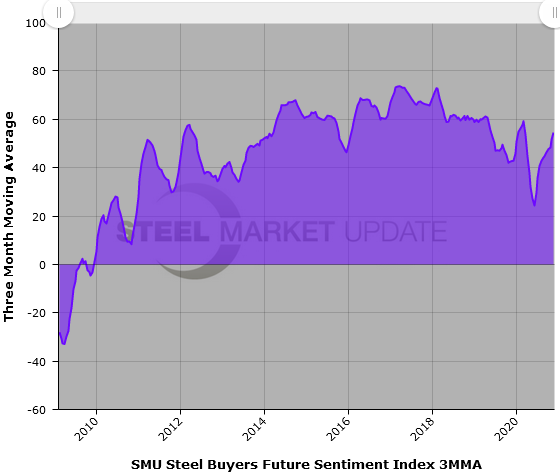

SMU also asks buyers how they view their company’s chances for success three to six months in the future. SMU’s Future Sentiment Index registered a healthy +56 this week, up 46 points from a low of +10 back in April. Future Sentiment has been stable in the mid-50s since early September—higher than the index average of +51 last year.

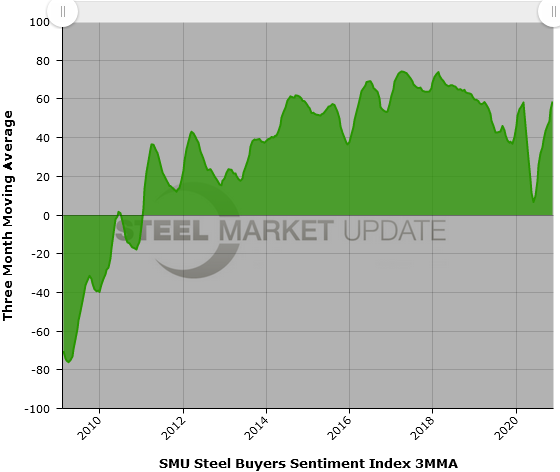

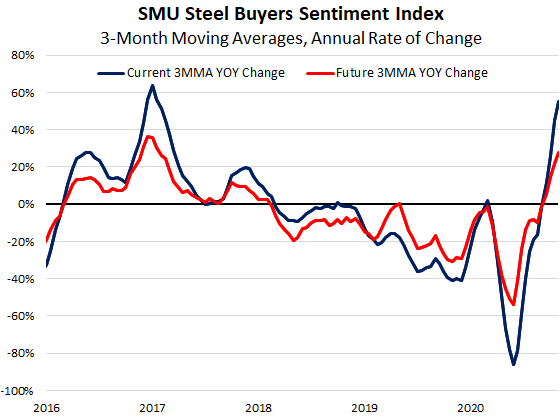

Three-Month Moving Averages

Calculated as a three-month moving average to smooth out the monthly variability, Current Sentiment now measures +58.67, slightly higher than the 3MMA just prior to the pandemic.

With the global economy in the throes of a deadly pandemic, and the U.S. in the midst of one of the most contentious presidential elections in history, it’s difficult to fathom why so many in the industry are feeling so optimistic. No doubt it reflects positive feelings about rising steel demand and steel prices. And perhaps also that the end is in sight for the virus and the vote, and there’s a collective sense of relief that the steel industry will survive both.

What Respondents Had to Say

“We are extremely busy. Our business is off only 2 percent from last year. We continue to have a large backlog going into November.”

“All of our capacity is sold out through the end of Q1. Customers are still wanting more and paying higher prices for us to work overtime.”

“If the supply chain was better, I would say [our prospects are] excellent.”

“Pricing is good and demand is average.”

“The fundamentals are getting better, but lots of uncertainty remains, especially on COVID-19 and future slowdowns.”

“I think the pricing and tightness of metal will slow down the construction sector.”

“Prospects are good unless the second wave of the virus gets out of control and there are economic shutdowns.”

“Silly mill-related games are crimping the supply dynamics and limiting economic growth.”

“The future is not clear. There’s too many moving parts.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies; approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.