Market Data

October 29, 2020

Steel Mill Negotiations: Mills Hold the Upper Hand

Written by Tim Triplett

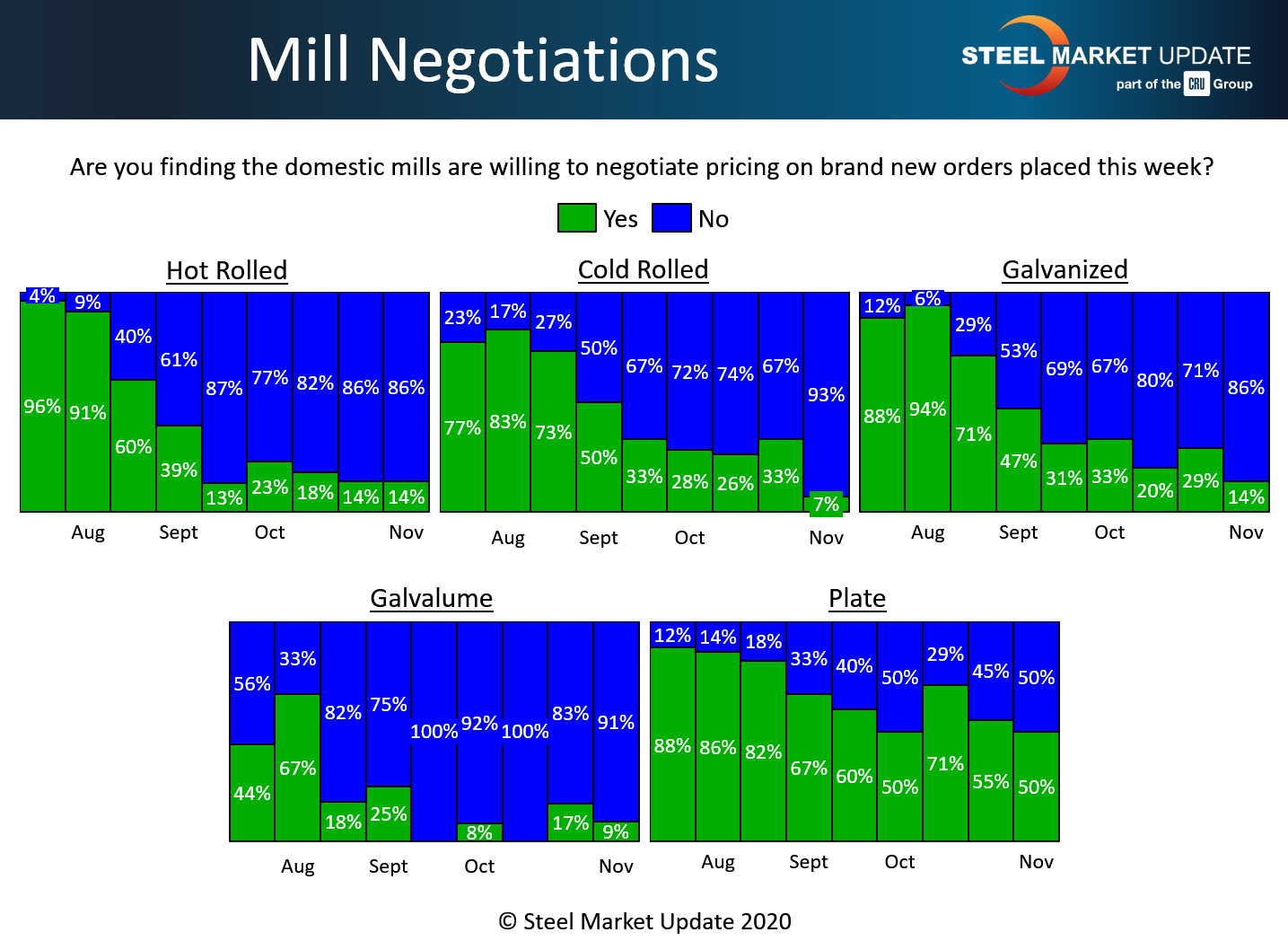

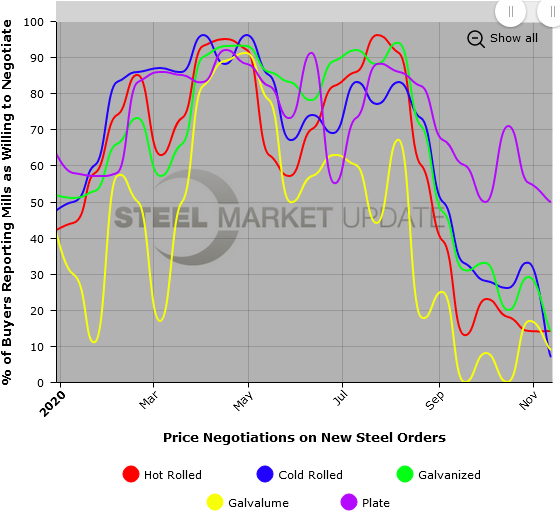

Mills continue to hold the upper hand in negotiations over hot rolled, cold rolled and coated steel orders as they work to collect higher prices in a tight market with extended lead times. Buyers report the mills will only negotiate on big tonnages to be delivered in 2021.

About 86 percent of the steel buyers responding to Steel Market Update’s market trends questionnaire this week said the mills are unwilling to deal on hot rolled. Only 14 percent said the mills are now willing to bargain to secure an HR order. Those percentage are unchanged over the past two weeks.

In the cold rolled segment, 93 percent said the mills are not willing to talk price, up from 67 percent two weeks ago. Only 7 percent reported some room for price negotiation on cold rolled.

Negotiations for coated steel orders are just as tight. About 86 percent said the mills are saying no to discounts on galvanized, up from 71 percent two weeks ago. About 91 percent of those responding to the question on Galvalume reported little room for negotiation.

In the plate market, buyers report, it is a 50-50 proposition whether a mill will show some flexibility on price.

Plate prices have remained relatively flat compared with flat rolled prices that continue to rise, which explains the low percentages of sheet mills open to negotiation.

Based on SMU’s latest check of the market, the benchmark price for hot rolled steel continues to rise and now averages around $710 per ton.