Market Segment

October 25, 2020

Cleveland-Cliffs: “A Real Player” in Automotive

Written by Sandy Williams

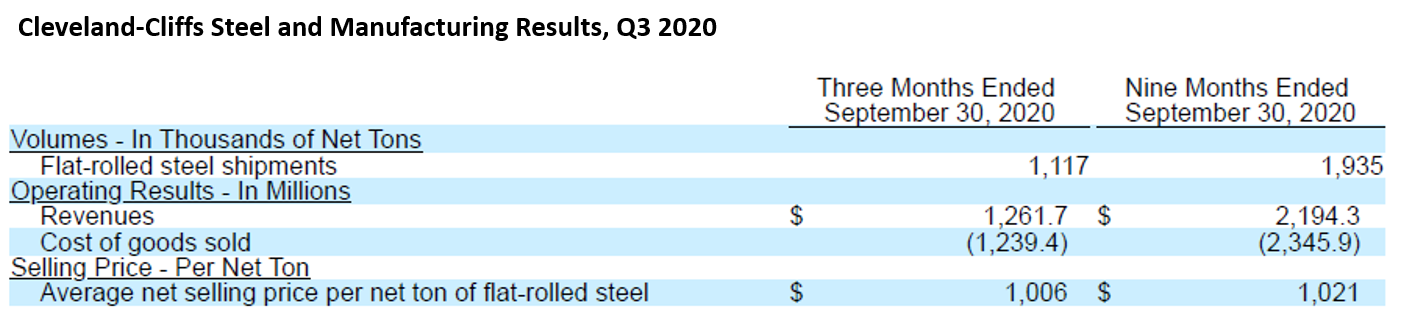

The return of automotive manufacturing after closures due to the pandemic boosted demand for Cleveland-Cliffs’ products and resulted in revenue of $1.6 billion and net income of $2 million for the third quarter of 2020.

“We were significantly affected in Q2 by the unprecedented shutdowns that took place throughout the entire auto sector for an extended period of time of more than 10 weeks,” said Chairman, President and CEO Lourenco Goncalves. “Conversely, the sharp recovery in automotive production starting in the second month of Q3 made abundantly clear who are the real players for automotive and who are the ones that are less relevant as suppliers or not relevant at all.”

Cliffs was particularly pleased with the adjusted EBITDA of $126 million and free cash flow of $246 million during the quarter. Results were negatively affected by slower shipments and idling of the Dearborn, North Shore and Mansfield facilities in the early part of the quarter, but improved significantly by the end.

Flat rolled volumes increased 80 percent to 1.1 million tons, driven by the automotive market which comprises 73 percent of company sales. “It pays off to be able to produce all types of material for automotive clients, particularly exposed parts,” said Goncalves.

Cliffs’ acquisition of ArcelorMittal USA is expected to close by the end of this year. “We fully recognize the responsibility that comes with becoming the largest flat-rolled steelmaker in North America,” said Goncalves. “I have long been a proponent of a value over volume approach. Under my watch, Cliffs has never been, and will never be, tempted by the stupidity of volume for volume’s sake.”

Cliffs’ new HBI plant in Toledo is completed and commissioning is under way with production starting in the next few weeks. Initially the plant will run 1.8 percent carbon HBI that will be consumed in-house. Next year Cliffs will transition to 3 percent carbon HBI that will be offered to the EAF market by the beginning of the second quarter.

Ninety percent of the HBI produced in Toledo will be consumed by Cleveland-Cliffs’ own EAF, BOF and blast furnace mills. An estimated 1.0-1.1 million tons will be available for purchase. In-house consumption will significantly reduce the risk of volatile commodity prices, including substituting some scrap usage with HBI. Goncalves said he will not sell HBI to blast furnace-based mills and does not expect sales to Canada.

The use of HBI, produced with natural gas, will help reduce the company’s environmental footprint and give Cliffs an edge over other less sustainable integrated producers, he said.

When asked if Cliffs will be producing pig iron in the future, Goncalves said there is potential to do so with some of the company’s currently idled mills, but there is no plan to do so at this time.

The ArcelorMittal acquisition is a win-win for both companies, said Goncalves, but there is no win-win without someone losing. Cleveland-Cliffs, with the combined assets of ArcelorMittal USA and AK Steel, will be formidable competition and could have an impact on the domestic steel industry.

“For the [steel producers] that were sort of dying on their own, they will continue to die on their own,” said Goncalves. “And for the ones that are flying with no competition, now they have competition. But the good ones will survive, the bad ones will not. And we will see.”