Market Segment

October 24, 2020

SSAB Americas Posts Loss in Q3

Written by Sandy Williams

Lower prices and planned maintenance contributed to reduced earnings for SSAB Americas in the third quarter of 2020. Revenue fell 16 percent from the prior quarter and 39 percent year-over-year to SEK 2,715 million ($309.5 million U.S.). The segment posted an operating loss of SEK 436 million ($49.7 million), down SEK 425 million from Q2 and a plummet of SEK 957 million from Q3 2019. Demand during the quarter was impacted by Covid-19 and lower economic activity.

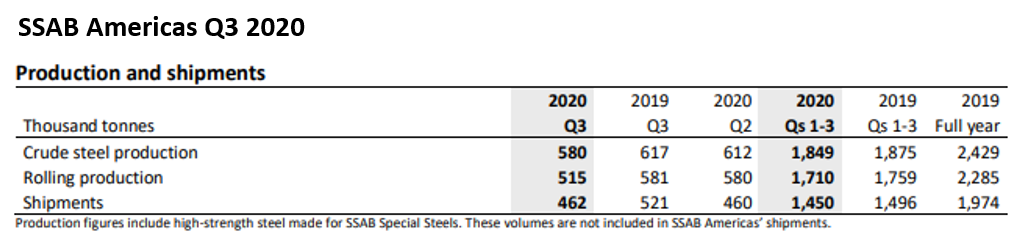

Crude steel production fell 5 percent from the second quarter. Rolling production was down 11 percent from both the second quarter and Q3 2019 primarily due to planned maintenance.

External shipments were mostly flat with the prior quarter while slipping 11 percent year-over-year.

SSAB Group results also suffered from weak demand due to lower economic activity resulting from the pandemic as well as maintenance costs of SEK 570 million ($65 million) during the quarter. Revenue of SEK 14,481 million ($1.65 billion) fell 26 percent from a year ago and 4.5 percent from the second quarter. Operating loss for the third quarter of 2020 was SEK -973 million (-$111 million), a plunge of SEK 1,273 million from Q3 2019 and SEK 722 million from Q2 2020.

“Fourth-quarter demand for steel is expected to recover somewhat, following two weak quarters,” said President and CEO Martin Lindqvist. “However, there are major uncertainties, mainly related to the spread of Covid-19. Normal seasonal slowdown is expected towards the end of the fourth quarter. Global demand for high-strength steel is expected to improve somewhat compared to the third quarter.”

Shipments from SSAB’s Americas, Europe and Special Steels segments are expected to increase somewhat during the fourth quarter. Prices realized by SSAB Americas are expected to be flat while SSAB Europe prices are expected to be lower due to a weaker product mix in the quarter. Stable prices are anticipated for SSAB Specialty Steel.