Analysis

October 22, 2020

Sales of Existing Homes Soar in September

Written by Sandy Williams

Existing home sales soared in September, up 9.4 percent to a seasonally adjusted annual rate of 6.5 million. Compared to September 2019, sales were up nearly 21 percent, reported the National Association of Realtors.

“Home sales traditionally taper off toward the end of the year, but in September they surged beyond what we normally see during this season,” said Lawrence Yun, NAR’s chief economist. “I would attribute this jump to record-low interest rates and an abundance of buyers in the marketplace, including buyers of vacation homes given the greater flexibility to work from home.”

The demand for housing has left inventory historically low, said Yun. “To their credit, we have seen some homebuilders move to ramp up supply, but a need for even more production still exists.”

Total housing inventory was 1.47 million units at the end of September, down 1.3 percent from August and 19.2 percent from a year ago. Inventory is at a 2.7-month supply at the current sales pace and at a record low.

The median existing home price leapt 14.8 percent year-over-year to $311,800 for the 103rd straight month of annual gains.

Single-family home sales jumped 9.7 percent from August and 21.8 percent from a year ago to a seasonally adjusted annual rate of 570,000. The median price rose 15.2 percent to $272,700.

Condominiums and co-op sales jumped 6.3 percent from August and 13.6 percent from September 2019 to a SAAR of 670,000 units. The median sales price of $272,700 increased 9.9 percent year-over-year.

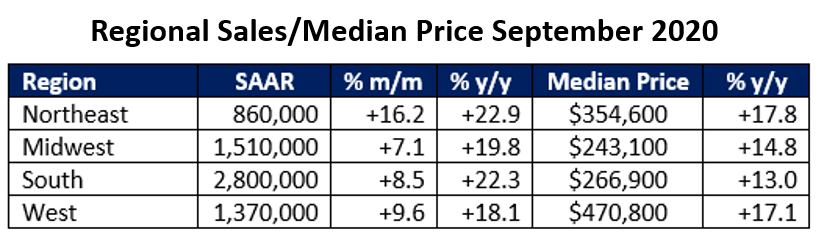

Sales grew in every region from August to September and prices increased from a year ago by double digits.