Market Segment

October 22, 2020

Nucor Exceeds Expectations for Q3

Written by Sandy Williams

Nucor reported better than expected results for the third quarter of 2020. The company’s bar and structural mills led earnings, benefiting from a good nonresidential construction market. Joist and deck orders, quotes and backlogs are up year-over year with strong demand from nonresidential, including data and distribution center construction, company executives told investors and analysts during the quarterly conference call.

Automotive manufacturing continued its strong rebound in the third quarter, and the fourth quarter is expected to match or exceed demand. OEM inventory days-on-hand is at a 10-year low.

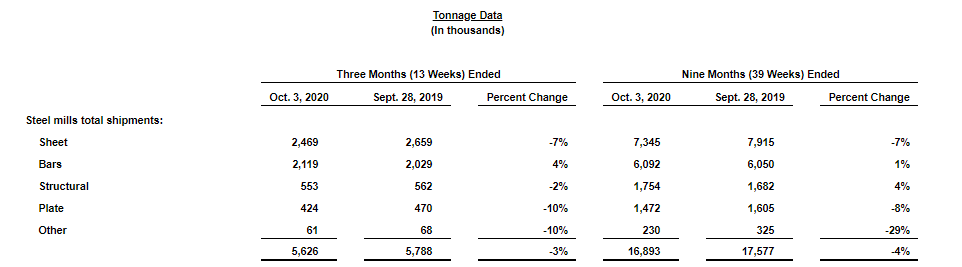

Sheet and plate demand were challenged during the third quarter, but show improvement in the fourth. Total sheet shipments slipped 7 percent from the third quarter and plate shipments fell 10 percent. Recent increases in plate pricing were supported by customers, with Nucor collecting 100 percent of the price increase. Due to a lag in contract pricing, increases in hot rolled pricing will be realized in fourth quarter, the company said.

Repairs have been completed at the Louisiana DRI plant. Price increases should give the Louisiana and Trinidad plants tailwinds as 2020 closes and next year begins.

The scrap market is expected to be stable in the near term, other than some normal seasonality in December and January.

Nucor’s expansion and modernization projects are on schedule. The cold roll mill in Hickman, Ark., continues to ramp up and has conducted trials on AHSS and Nex Gen steels. It is currently running at about 90 percent of capacity. The Gen3 galvanizing line in Arkansas is under installation and Nucor anticipates start-up in the second half of 2021.

Nucor’s rebar micromill in Florida will start later this year and the Gallatin expansion in the second half of 2021. The Brandenburg, Ky., plate mill will follow in late 2022.

“With the election less than two weeks away, we believe that no matter who sits in the White House or holds the majority in Congress next year, our leaders in Washington must understand the need to move forward with a significant infrastructure spending bill that includes strong Buy American provisions,” said Nucor CEO Leon Topalian. Nucor is also encouraging Congress to pass reauthorization of the Water Resource Development Act before it adjourns.

Nucor’s consolidated net sales increased 14 percent to $4.93 billion in the third quarter compared to the second quarter, but decreased 10 percent from a year ago. Net earnings were $223 million, which included a $16.4 million restructuring charge related to the metal buildings business. Total steel shipments increased 16 percent from the second quarter to 5,626,000 tons. Downstream steel product shipments to outside customers increased 14 percent. Average sales price per ton fell 2 percent compared to last year’s third quarter and 7 percent year-over-year. Steel mill capacity utilization improved to 83 percent compared to 68 percent in the second quarter.