Market Data

October 20, 2020

CRU: With Congress Divided, Biden's Ambitions Will Be Limited

Written by Anissa Chabib

By CRU Principal Economist Alex Tuckett and Economist Anissa Chabib, from CRU’s Steel Monitor

It now seems clear that Joe Biden will become U.S. president in January. However, it is likely that the Republicans will maintain their Senate majority. This will significantly limit Biden’s ability to implement his economic policy agenda. In this insight, we revisit our previous analysis of his plans and look at what could still be possible. Trade is the area where the lack of a Senate majority will be least constraining. For fiscal and green policies, he will need to limit his ambition and compromise.

A Divided Congress, a Divided Country

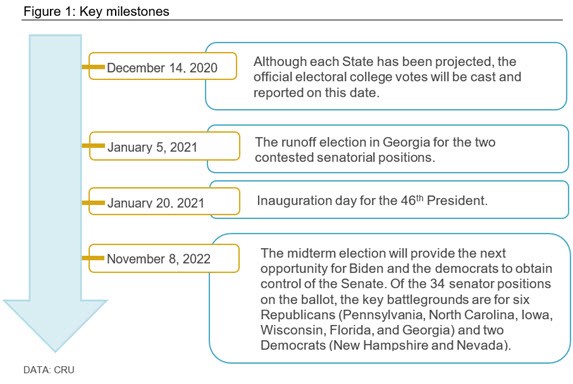

It now seems clear that Joe Biden will become U.S. president in January, although Trump has launched a range of lawsuits challenging the process. Figure 1 shows the remaining milestones in this electoral cycle.

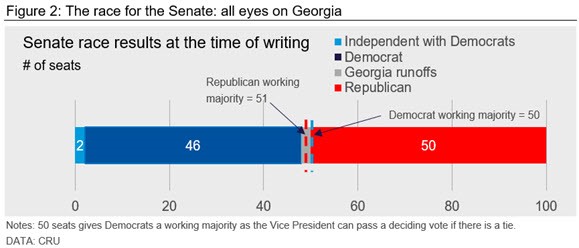

The Democrats did not make the gains in the Senate they were hoping for. The Republicans have 50 seats. Including two independents who vote with them, the Democrats so far have 48 seats in the Senate. To gain a majority in the Senate, Democrats must win both the run-off races in Georgia taking place on Jan. 5. As Vice-President Kamala Harris will be able to pass the deciding vote in the event of a tie, 50 seats would give the Democrats a working majority. Figure 2 illustrates this.

If the Democrats manage to win both Senate races, Biden should be able to push ahead with his ambitious policy program. However, winning both races will be difficult in a historically Republican state—although continued refusal to concede by Trump could damage the Republican Party’s standing in these races.

If the Republicans retain their Senate majority, they are likely to obstruct many of the legislative priorities of the future Biden administration. This would leave Biden with three options to try and achieve his goals:

Executive orders: The president has the ability to sign federal directives called Executive Orders (EO) without congressional approval. An EO can overturn a previous EO, but it cannot reverse legislation passed by Congress and cannot allocate new spending.

Negotiate with Republicans: Biden may seek to find common ground on aspects of his package. For example, he may try to persuade Republicans that spending on infrastructure and R&D are essential to compete technologically and commercially with China. However, if congressional Republicans fear a backlash from Trump supporters, they will be less willing to compromise.

Persuade moderates to defect: Biden could try and persuade more moderate Senate Republicans—such as Lisa Murkowski (Alaska) or Susan Collins (Maine)—to side with him to pass legislation. This is more likely to be successful on infrastructure and stimulus, less so for green policies and changes to the tax code.

Domestic Policies More Constrained Under a Red Senate

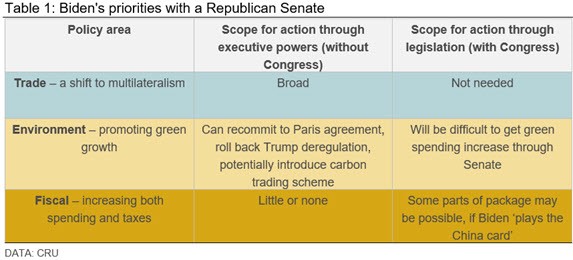

In our pre-election slide deck, we set out the three key areas where a Biden administration would pursue a different policy agenda to Trump: trade, environmental and fiscal policy. What is Biden likely to be able to achieve in each of these areas without a Senate majority? Table 1 summarizes how a Republican Senate interacts with each of Biden’s three policy priorities.

Trade policy is the area where he least needs Senate approval. He will also be able to make progress in some areas of his environmental agenda using EOs. However, spending on green priorities, health and education, and his planned tax increases, will all require legislation. A Republican majority Senate will probably block many of his plans.

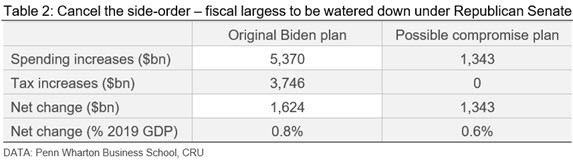

However, the net effect could still provide a modest boost to the economy. Table 2 shows an example. Supposing that Biden can pass only one quarter of his spending plans, and none of his tax plans (given Republican preferences against tax rises), the net fiscal stimulus drops from around 0.8% of GDP per year to 0.6%. Although more modest, that will still offer some tailwind for the economy.

Further Covid-19 Stimulus is Likely to be Smaller

With the money agreed under the CARES Act running out, an immediate fiscal stimulus to boost the recovery will be a priority for an incoming Biden administration.

With two further Senate races in January, it is in the interest of both sides to agree to a second package, though it may need to wait for Biden to be inaugurated and to sign it.

The most likely outcome is a package significantly smaller than the $2.2 trillion proposed by Democrats in the HEROES Act, leaning more towards tax rebates and less to financial support for state and local governments.

Compromise is the Order of the Day

If the Democrats fail to win a majority in the Senate, this will limit their economic ambitions under a Biden administration. Trade is the area where Biden will retain most room to maneuver. He should be able to make some progress on his environmental agenda, although with limited new spending. On fiscal policy more broadly, a Republican Senate would limit his spending plans to areas where there are overlapping priorities. In the near term, a further stimulus package is likely to pass shortly after Biden is inaugurated.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com