Market Data

October 16, 2020

SMU Market Trends: Buyers Bullish on Next Year

Written by Tim Triplett

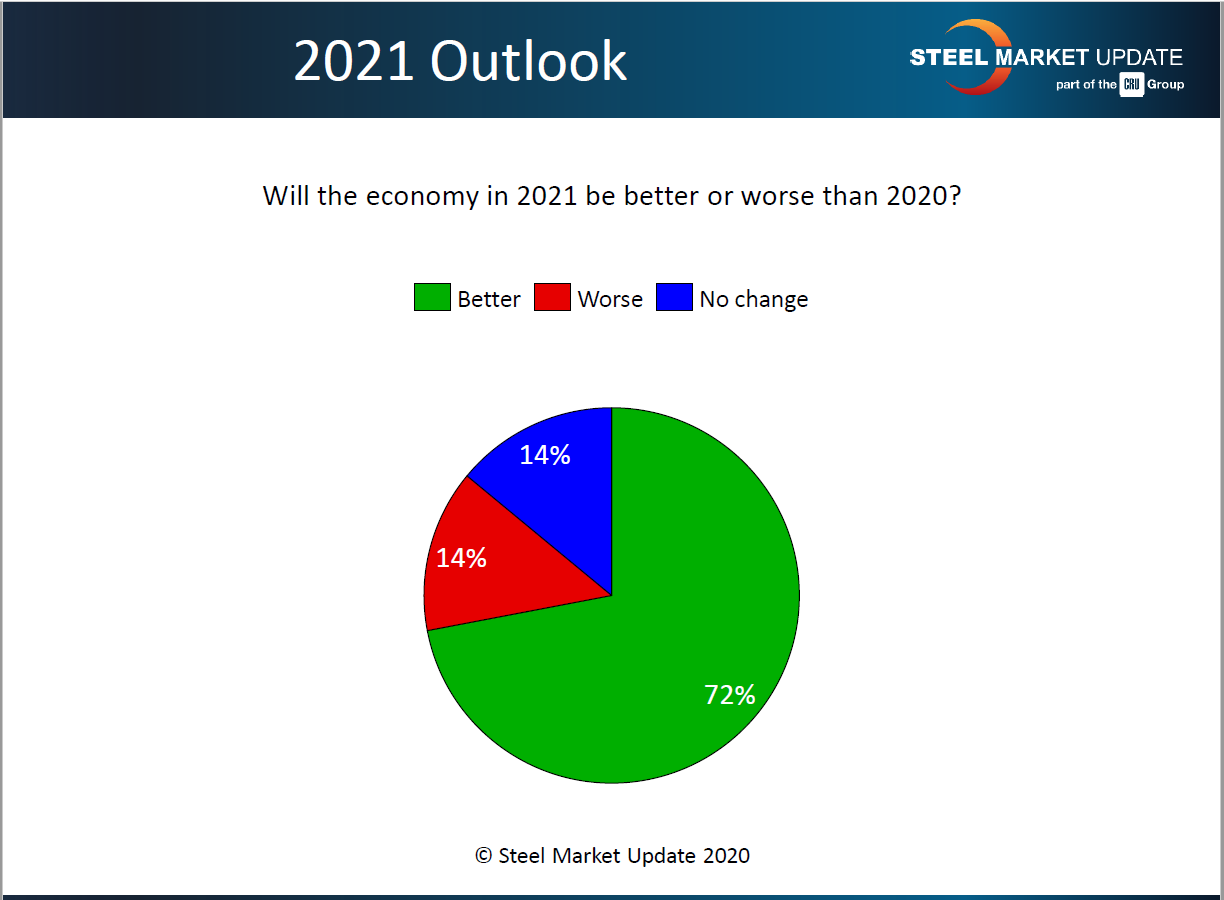

About 72 percent of the service center and OEM executives polled by Steel Market Update this week said they expect the economy in 2021 to be better than 2020. The other 28 percent was evenly split between those who expect more of the same and those who see next year being even worse.

No surprise, their comments focused on two factors: the outcome of the election and the spread of COVID-19. “It all depends on who is elected president,” said several respondents. “It all depends on the virus,” said several others. Expressed one optimist: “The best is yet to come. I’m a glass half full type of person.”

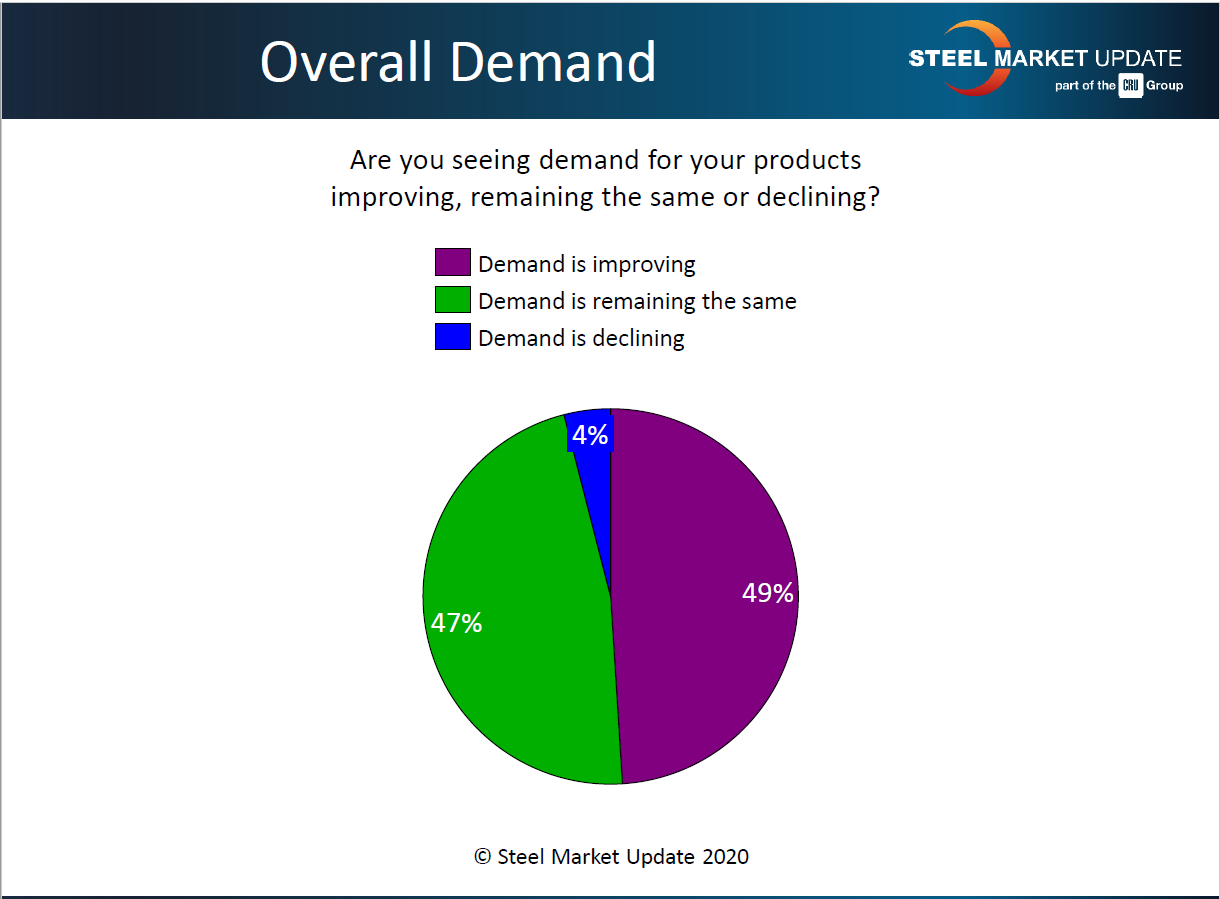

Steel buyers offered mixed views of demand, almost evenly split between those who said demand is the same or declining, and those who see demand improving.

“Demand has been very consistent,” said one buyer. “Construction, both residential and non-res, and agriculture are strong, so our business is excellent,” said another. “Things have slowed some in part because we are running out of inventory that people want or are willing to pay the high prices for,” added a third exec.