Market Data

October 15, 2020

CRU: A Stormy Q4 for the Dollar

Written by Ippolito Tarabini

By CRU Economist Ippolito Tarabini, from CRU’s Steel Sheet Products Monitor

The dollar has been extremely volatile over the past two quarters. Underlying this is macroeconomic uncertainty linked to the coronavirus pandemic. We expect such uncertainty and volatility to continue into Q4, but trade-weighted dollar and dollar-euro to be range bound around a stable trend. This article also addresses clients’ frequently asked questions on the greenback.

What is Our House View on the Dollar?

When we talk about dollar view, it is important to be clear about the currencies against which the dollar is compared. Here we focus on the trade-weighted dollar (TWD) and on the dollar-euro pair. Of course, many of our clients also care about the dollar in relation to the currencies of commodity-producing and commodity-buying countries. We cover this in our quarterly Exchange Rate Outlook.

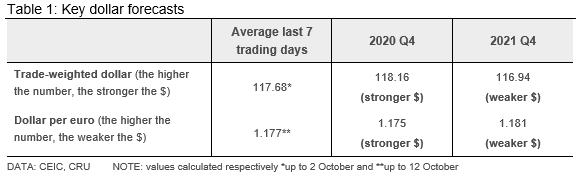

The dollar not unravelling, but not flexing its muscles either. Between now and the end of 2020, we think the TWD will remain broadly stable—that means relatively strong from a historical perspective, but weaker than the highs reached in Q2 2020. However, broad stability in our forecasts does not mean the dollar will not fluctuate heavily. Rather, it means that those fluctuations will happen around its average value over the past seven days. Also, our view is that the USD will remain strong against emerging market currencies, and relatively weak against advanced economy currencies.

Looking one year ahead, our view is that the dollar will continue to decline from the recent highs as global economic activity recovers and risk-on sentiment somewhat returns. However, this is not the beginning of the dollar’s unravelling. Indeed, we expect the TWD to average 116.9 in 2021 Q4, only 0.5% weaker than our 2020 Q4 forecast. Of course, there are risks around this outlook; should the virus trajectory deteriorate, it would create uncertainty in financial markets.

Turning to the dollar-euro pair, in the very short-term we expect event-driven volatility. U.S. elections, Brexit, uncertain virus trajectory on both sides of the pond, and central bank actions provide the perfect cocktail for a volatile Q4. That said, our view is that the dollar-euro pair will average 1.175 over the last three months of 2020.

Outlook 12 Months Ahead

Looking one year ahead, we think the dollar will be stable against the euro. Directionally, our view is that the dollar will lose 0.5% between 2020 Q4 and 2021 Q4. This reflects two things: our view that in the long term the euro will appreciate against the USD and the conviction that improving global trade will lift the euro. In the longer run, we see the euro continuing to appreciate against the dollar, but nonetheless never reach the highs seen in the first half the last decade.

How Will the U.S. Election Result Affect the Dollar?

The U.S. election result will affect the dollar through two main channels: sentiment and fundamentals. Changes in sentiment (in the USA and abroad) can affect the dollar in ways that are almost impossible to predict; a contested U.S. election result would certainly add to market volatility.

In terms of fundamentals, insofar as a Biden victory implies more worker focused stimulus (as opposed to Trump’s comparatively more business friendly policies), we could see a slightly weaker dollar should Obama’s former vice president make it to the White House. Similarly, even though we do not believe a Biden presidency would result in a softer trade stance against China, we are convinced that Biden’s broader trade policies would be more predictable and hence less likely to benefit the dollar’s safe haven status.

How Will Brexit Affect the Dollar/Pound Pair?

Deciding to break ties with the EU hurt UK growth prospects. Not knowing how these ties will be broken continues to generate uncertainty. And uncertainty hurts both consumer and business confidence, which translates into lower domestic spending. Against this backdrop, fluctuations in the dollar-pound pair will also be event-driven—for example, around events like the European Council meeting on Oct. 15-16, where EU-UK relations will be discussed. Generally, more (less) clarity around Brexit is likely to favor (hurt) the pound. To the extent that a no deal Brexit hurts both the UK and the Eurozone economies, the dollar could gain against both currencies.

What About Inflation?

Inflation differentials can drive exchange rate movements. For example, higher inflation in the USA compared to the Eurozone, would lead to a fall in the dollar/euro exchange rate, to compensate investors from the erosion of the value of their dollar investments.

The unprecedented degree of monetary policy accommodation, in response to Covid-19, has caused some to question whether such policies will lead to higher inflation. Our base case view is that higher inflation is unlikely in the medium term in either the USA or the Eurozone. That view rests on our judgement that the negative demand shock following from Covid-19 (and the associated social distancing restrictions) will continue to weigh on inflation out to 2023. Indeed, the Fed is not worried about inflation, either, and has given forward guidance that interest rates would remain at the effective zero lower bound until 2023. Against this backdrop, while we will continue to monitor inflation developments in key economies, we do not believe high inflation will be a threat in the medium term. Our view continues to be that inflation differentials will remain stable in 2021 and not drive movements in the dollar-euro pair.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com