Market Segment

October 15, 2020

CMC Weathers Storms for Strong Fiscal Year

Written by Sandy Williams

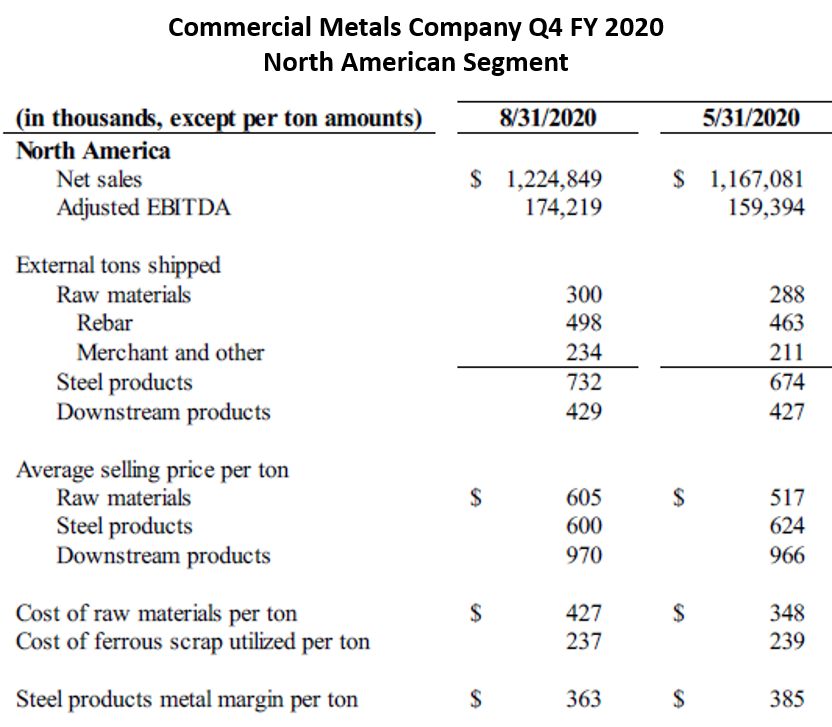

Resilient construction demand enabled Commercial Metals Company to weather the COVID-19 crisis without disruption to productivity. CMC’s fourth-quarter FY 2020 earnings totaled $67.8 million, a 6.5 percent increase from the third quarter. Consolidated net sales totaled $1.4 billion, with sequential increases in both the North America and Europe segments. Net sales for the year reached $5.4 billion and earnings $278 million compared to a profit of $199 million in FY 2019

Inclement weather added to challenges for the quarter. Shutdowns due to hurricanes in Louisiana and Texas resulted in disruptions at CMC and customer operations. “You prepare and shut down the day before the storm comes, you are down and then you have to restart. You lose 3-4 days in a particular region and it is hard in a 90-day time frame to make up those shipments,” said Chairman, President and CEO Barbara Smith.

CMC expects seasonal effects on shipments as the construction season winds down and the market moves into the holiday season. “We historically see our backlogs start to decline a bit in the fall season and pick back up when construction beings to prepare for the coming year,” said Smith. Volumes are expected to decline by mid to high single digits as the construction season ends.

“Clearly this was an unusual year. Every year when facing an election, we see projects that are slower to be committed to because of uncertainty,” said Smith. Owners of projects are willing to sit on the sidelines to see the outcome of the election and the policy changes that may occur. Smith expects an infrastructure bill will be passed after the election, adding to opportunities for growth in the construction market.

The pandemic caused a drop in state revenues that affected public construction starts. Surprisingly, there has been a nice recovery in state revenue receipts, said Smith. States are not quite back to pre-pandemic levels, but are on a V-shaped recovery.

Supply chain reshoring is beginning, following the challenges of sourcing medical supplies during the pandemic. Pharmaceutical companies, in particular, are gearing up to bring capacity back to the U.S. There is some optimism about industrial activity returning, but how quickly is still an unknown. The migration of households from cities to the suburbs will create some interesting construction trends going forward, said Smith.

CMC recently announced it will construct a third micromill in Mesa, Ariz., with an annual capacity of 500,000 tons. The mill will replace older capacity and have the flexibility to produce rebar or merchant bar depending on demand. Groundbreaking is anticipated in early FY 2021 and start-up in FY 2023. CMC said it is in the process of decommissioning Steel California, while ensuring a seamless transition of rebar supply to the Southwest.

Last July, CMS acquired Galvabar, the only galvanized rebar product that can be fabricated after coating, the company said. A third rolling mill in Poland, to be operational in late 2021, will use 200,000 tons of current excess melt capacity to produce higher-value-added finished products.

As part of its strategic transformation this year, CMC consolidated a number of rebar operations acquired from Gerdau and closed its Rancho Cucamonga facility in California.

Smith said CMC plans to maintain a robust balance sheet to give it the flexibility to respond to disruptions in the economy, changes in demand, internal organic needs and M&A opportunities.

“We expect finished steel volumes for our North America and Europe operations to follow typical seasonal trends in the first fiscal quarter, with some negative impact in North America due to storms in the Texas and Gulf Coast markets. Shipments of steel and downstream products in the near-term should be supported by our solid construction backlog. We anticipate margin headwinds in the first quarter within North America due to the recent rise in scrap costs, mitigated in part by steel price increases that became effective during the quarter.

“The market for long products in Europe is expected to remain challenged due to elevated import levels. However, demand appears solid, driven by construction sector resilience, and rebounding Central European industrial production,” she added.