Analysis

October 8, 2020

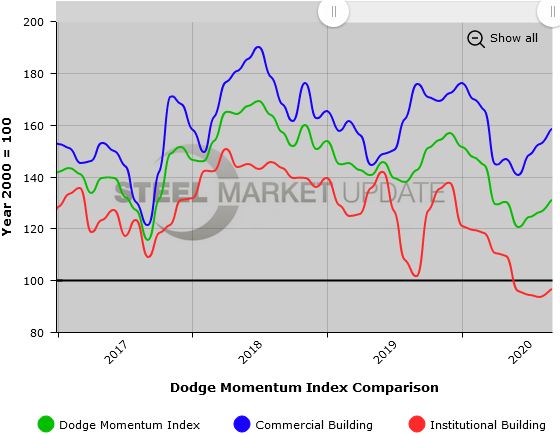

Dodge Momentum Index Shows Steady Improvement

Written by Sandy Williams

Nonresidential construction projects in planning rose in September. The Dodge Momentum Index gained 3.7 percent, climbing to 130.8 last month. Planning for commercial projects jumped 3.9 percent, while institutional projects moved 3.2 percent higher.

The index has increased at a slow and steady pace since its low point in June, gaining 2.2 percent in the third quarter versus the second quarter. Commercial planning, led by warehouse projects, gained 7.4 percent in Q3.

“Somewhat surprising is that office projects entering planning also posted a tepid gain despite concerns that office work is shifting to remote settings,” said Dodge Data & Analytics.

Planning for institutional projects fell 6.8 percent during the third quarter due to the scrapping of educational projects as state and local revenues declined.

Seven projects with a value of $100 million or more entered the planning phase in September.

Below is a graph showing the history of the Dodge Momentum Index. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.