Long Products

October 6, 2020

CRU: Costs Push U.S., EU Longs Prices Up, But Asia Waits for China

Written by James Campbell

By CRU Principal Analyst James Campbell from CRU’s Long Products Monitor

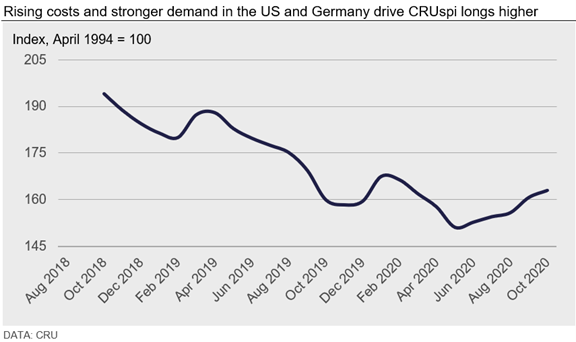

Global long product prices increased in many markets this month as strengthening demand combined with higher costs and for some products in particular. Strength was not uniform however; prices were weaker in Southeast Asia and China, the latter due to weaker sentiment following lower than expected demand in September. Across Asia, the market is concerned on the direction demand in China will take after the national holidays.

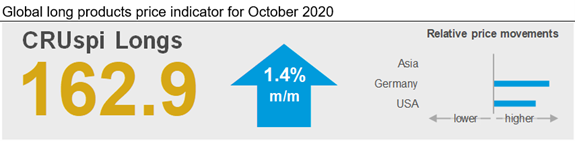

Overall, the Global Long Products Price Indicator (CRUspi Longs) increased by +1.4 percent m/m to 162.9 in October 2020. After the strong rises in Asia in recent months, it is higher prices in Germany and the U.S. that drove the index up this month.

Prices are Rising Outside Asia…

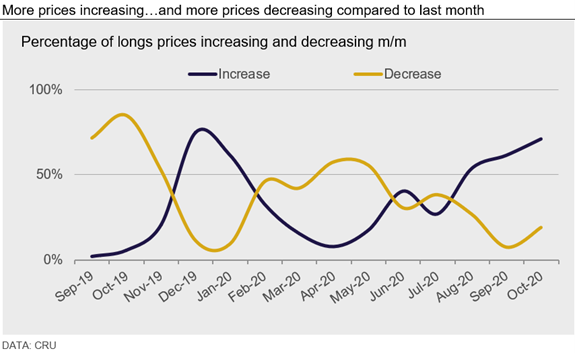

The theme so far for prices in 2020 has been the strength of prices in Asia while the U.S. and European markets have struggled by comparison. This month, we have a reversal of fortune. Prices in Germany and in particular the U.S. have surged higher, but prices in Asia have started to weaken. This month, 71 percent of longs prices increased, compared to 62 percent in September, while 19 percent of prices fell (last month: 8 percent).

…as Costs Increase and Demand Improves…

Rebar prices in Southeast Asia are now $65 /t higher than the 2020 low. The U.S. and European markets have been slow to match this increase but are now catching up; prices in those regions are now $33 /t and $65 /t off the low, respectively. Scrap prices have seen significant rises—U.S. producers saw scrap increase by $30-50 /l.ton last month. U.S. demand is described as solid right now due to strength in the construction sector. This is also a theme in the Middle East and India. Although the seasonal demand improvement in China has disappointed, we need to put this in perspective. The level of demand is at a level many other countries can only dream about in the middle of a pandemic-driven global recession; although Chinese infrastructure sector growth halved in August, it still remains +4 percent y/y.

…Particularly for Markets Hit Most During the Lockdown

Wire rod is the strongest product right now. Prices have increased more than rebar in most markets in recent months and are now around $70–80 /t higher than the 2020 low. A common factor in the strength in wire rod prices is improving demand in the automotive sector. Production has recovered fast from the near total shutdown during the peak Covid-lockdown period earlier this year. Supply tightness has been felt more in India due to wire rod production problems and in the U.S. due to the heavy reliance on domestic production.

Outlook: Post Holiday Demand in China Will Set the Direction

There is no doubt demand has improved from the Q2 low, but there are some concerns for prices. In Europe, we are now seeing evidence of improving demand—part automotive, part seasonal. However, many buyers bought heavily at the bottom of the market so are refraining from large purchases on the expectation of lower costs and lower prices in the autumn.

In the U.S., construction activity is strong now but the architecture billings index has been contracting for six months. This is a lead indicator for demand 9-12 months in the future. An improvement is unlikely until after the U.S. presidential election, meaning demand may weaken in the new year.

In Asia, prices appear to have peaked for now. Whether they can maintain current price levels depends on the trajectory of Chinese demand after the national holidays. This is likely to set the tone for global markets in the autumn.

Outside steel market factors, there is growing concern on the impact a second Covid-19 wave could have on demand. This is a risk that will be ongoing through the winter at the very least.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com