Market Data

October 4, 2020

SMU Steel Buyers Sentiment: Stable at Healthy Levels

Written by Tim Triplett

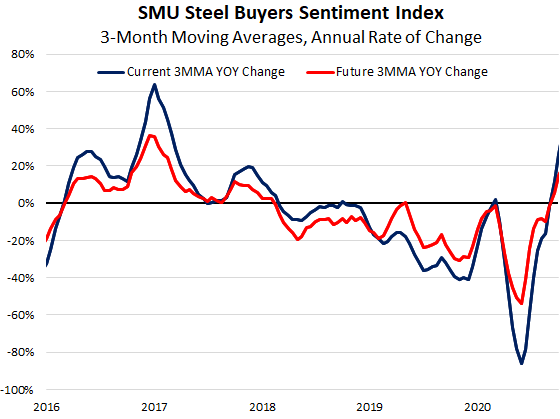

Industry sentiment, as measured by Steel Market Update, has seen little change in the past month, but has stabilized at relatively healthy levels.

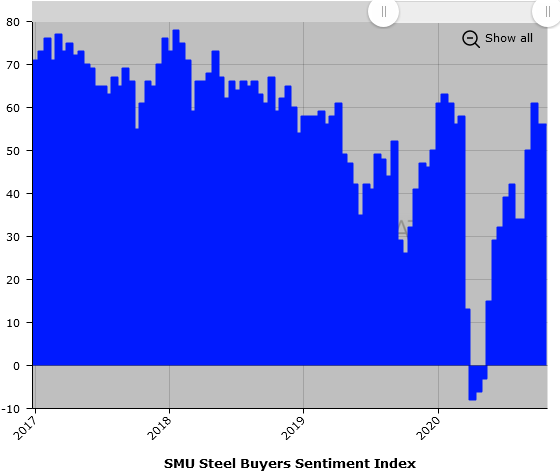

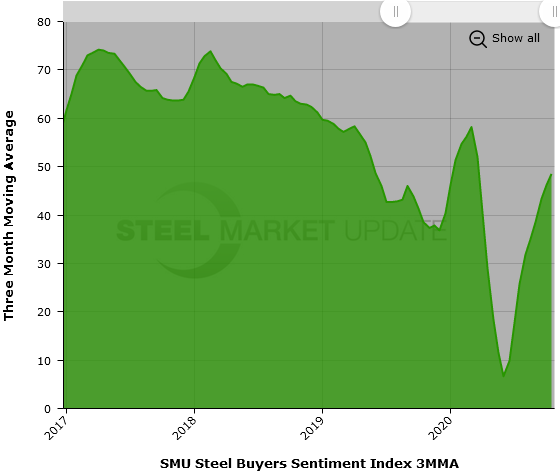

Every two weeks, SMU asks steel buyers how they view their company’s chances for success in the current environment. The Current Sentiment reading was unchanged at +56 this week. Compared with the first week of August, that’s up 22 points. Compared with the first week of April, when the coronavirus effect was at its worst at a reading of -8, that’s a 64-point improvement. Current sentiment today is much healthier than at this time last year when it registered a weak +26. Last October, market conditions had forced the hot rolled steel price below $500 per ton.

Future Sentiment

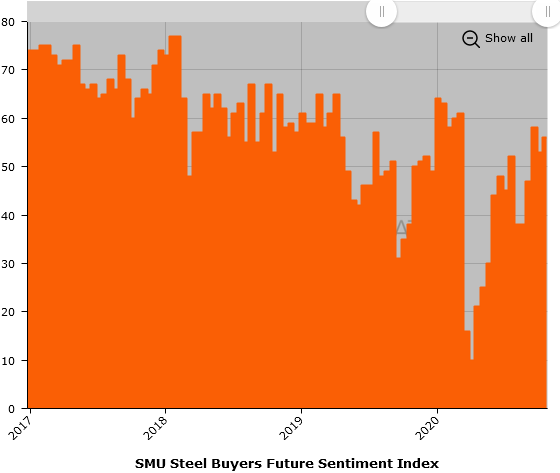

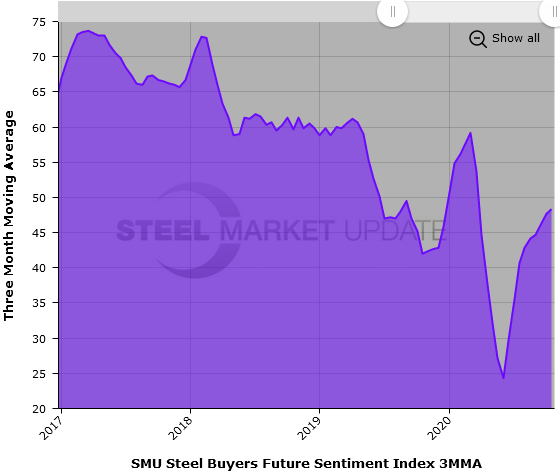

SMU also asks buyers how they view their company’s chances for success three to six months in the future. SMU’s Future Sentiment Index also registered +56, up just slightly from mid-September, but an 18-point improvement from early August and a 46-point rebound from the low of +10 shortly after the pandemic hit. At this time last year, Future Sentiment registered a pessimistic +35.

What Respondents Had to Say

“Business is good right now.”

“We need more labor to be able to produce more product.”

“Rising inventory cost and possible slow demand in the first half could cause a squeeze.”

“COVID cases are on the rise.”

“Uncertainty of COVID-19 and its effects remains large.”

“Unsure where the construction market will be as a result of COVID.”

“Trade restrictions and uncertainty have not changed. It will be clearer after the presidential election.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies; approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.