Market Data

October 3, 2020

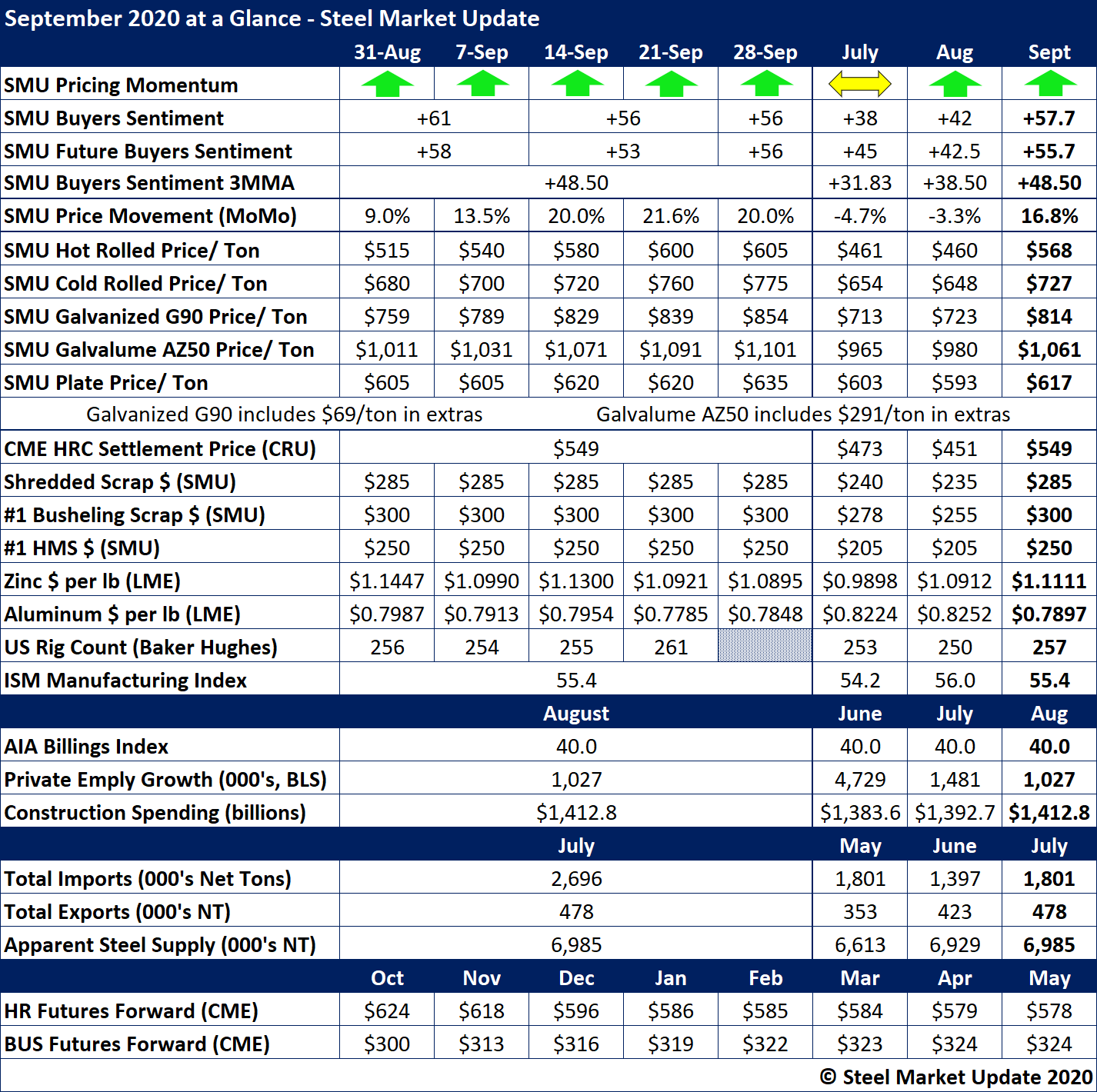

SMU's September At-a-Glance

Written by David Schollaert

Steel prices continued their upward trajectory in September as demand rose further and mills announced more increases on hot rolled, cold rolled and galvanized products. Steel Market Update’s hot rolled price averaged $568 per ton in September, an increase of more than $100 month/month, and has since topped the $600 mark. Average prices for prime and obsolete scrap also rose in September, lending support to those higher finished steel prices.

SMU Buyers Sentiment Index readings rose further, keeping the upward momentum seen in August. Current and Future Sentiment were in the +56-58 range in September, an optimistic level considering the ongoing pandemic The three-month moving average reached +48.50 as of Sept. 30, an increase of 10.0 from August levels. Note that monthly sentiment readings in the chart below are averages for each month.

Key indicators of steel demand were once again mixed. The ISM Manufacturing Index indicated expansion with a reading well above 50. Construction spending increased for the third month in a row in August, though the AIA Billings Index, a predictor of future construction activity, remained flat at 40.0 month/month.

See the chart below for other key metrics in the month of September: