Market Data

October 1, 2020

Steel Mill Negotiations: Mills Still Holding the Line

Written by Tim Triplett

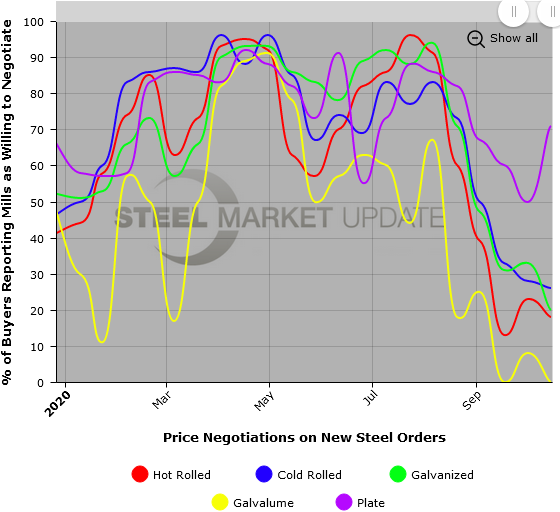

Mills continue to stand firm in price talks on hot rolled, cold rolled and coated steel orders as they seek to collect the $40-50 price increases they announced two weeks ago, report respondents to Steel Market Update’s market trends questionnaire. Based on SMU’s latest check of the market, the benchmark price for hot rolled steel now averages around $650 per ton. That’s up sharply from $440 a ton two months ago, but little changed over the past two weeks, suggesting that the uptrend in steel prices may be nearing a peak.

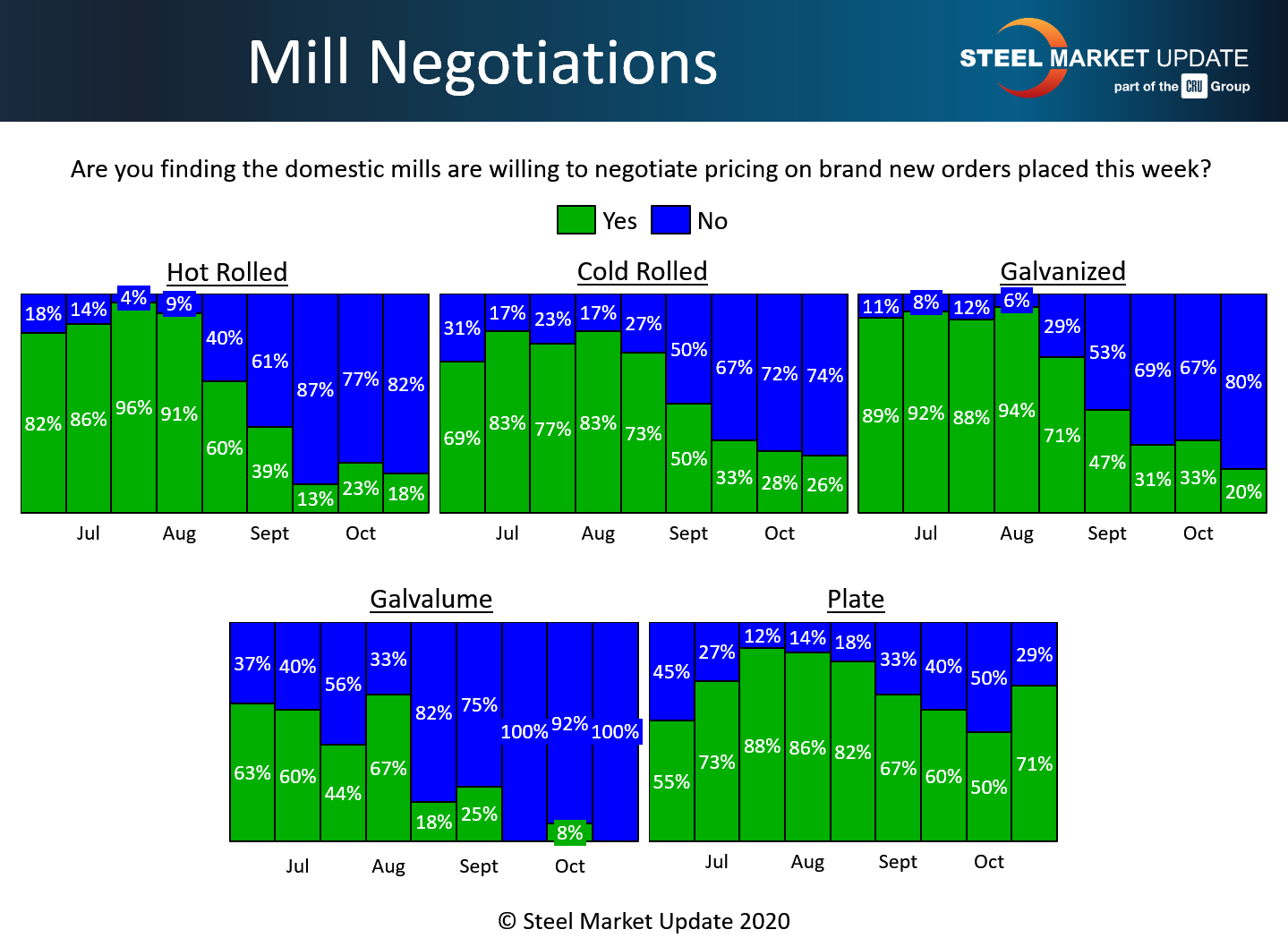

About 82 percent of the hot rolled steel buyers responding to SMU’s poll this week said the mills are not willing to deal on HR. That’s up five points from 77 percent two weeks ago, but down slightly from 87 percent at this time last month. Only 18 percent said the mills are now willing to bargain to secure an HR order.

In the cold rolled segment, 74 percent said the mills are not willing to talk price. That’s up a slight two points in the past two weeks. The other 26 percent reported some room for price negotiation on cold rolled.

The percentages are similar in galvanized, where 80 percent said the mills are just saying no, while the other 20 percent reported mills open to discounts. Virtually all those responding to the question on Galvalume reported little room for negotiation as supplies remain tight.

Talks have loosened a bit in the plate market, where 71 percent said the mills are now open to negotiation, while just 29 percent said the mills are currently holding the line on plate. Plate has stalled at around $635 per ton, based on SMU’s market checks, despite the mills’ efforts to move prices higher.

At this time last year, with sub-$500 hot rolled, the dynamic was the exact opposite, with buyers in the strong negotiating position.