Market Data

October 1, 2020

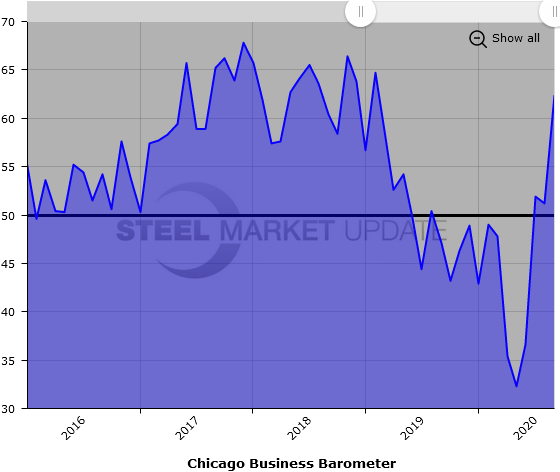

Chicago Business Activity Expands in September

Written by Sandy Williams

Business activity in the Chicago area surged in September, expanding for the third month in a row. The MNI Chicago Business Barometer soared 11.2 points to 62.4, its highest level since December 2018. Business sentiment jumped sharply to 55.2, its best performance since Q1 2019.

Production jumped 16 points, nearing a two-year high, while demand picked up 22 points for the highest new orders reading since November 2018. Order backlogs rose 14.4 percent and supplier deliveries gained 2.8 points. Inventories were at a four-month high, but still mired below the 50-mark.

Employment rose in September, but firms continued to report additional layoffs.

Prices during the month increased at the factory gate, jumping 9.7 percent. Costs rose for raw materials, cleaning supplies and PPE.

A majority of respondents, 52.2 percent, reported an increase in business costs during the pandemic, 13 percent saw costs go down, and over one-third said there were no changes to expenses during the crisis.

Below is a graph showing the history of the Chicago Business Barometer. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.