Market Data

September 20, 2020

SMU Steel Buyers Sentiment: Small Step Back, But Still Positive

Written by Tim Triplett

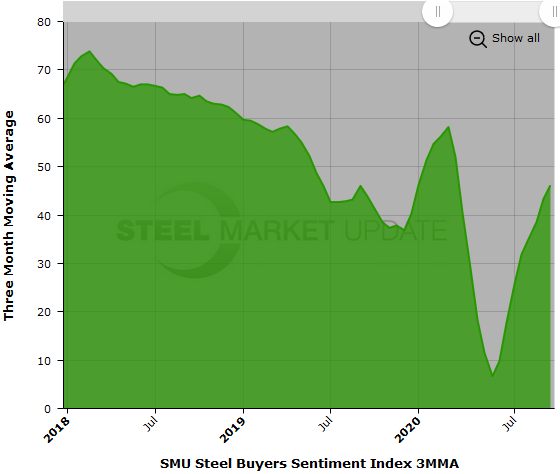

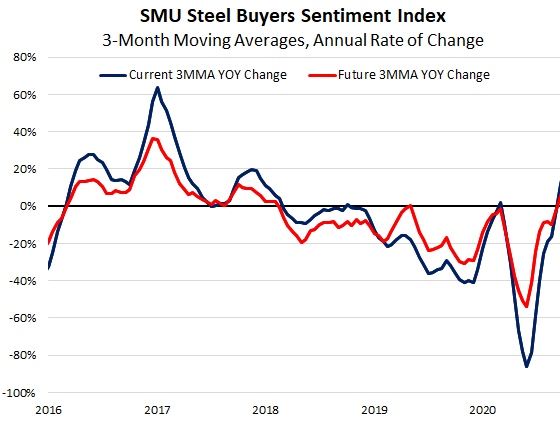

Industry sentiment, as measured by Steel Market Update, took a small step back in the past two weeks, but remains at healthy readings well above recent lows as well as this time last year. With demand and steel prices on the upturn, buyers are still feeling relatively positive about the slowly improving market conditions.

SMU asks steel buyers how they view their company’s chances for success in the current environment. The Current Sentiment reading dipped by 5 points over the past two weeks to a reading of +56. That’s still up 22 points compared to the first week in August when the index had dipped to +34. Current Sentiment has recovered dramatically from a low of -8 in the first week of April when the coronavirus disruption was at its worst. Current sentiment is much healthier than this time last year when it registered a weak +29.

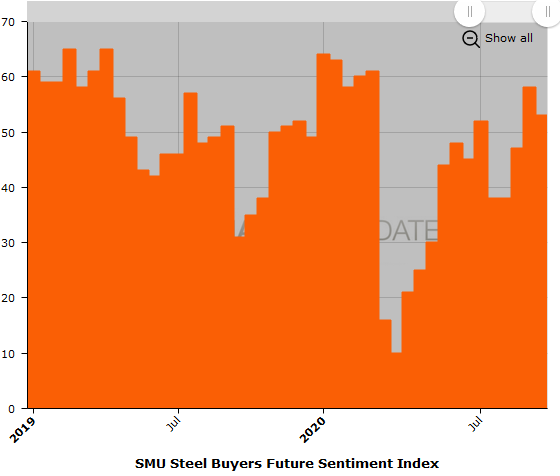

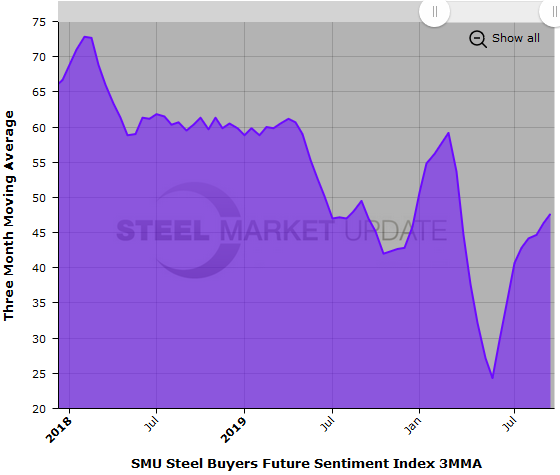

Future Sentiment

SMU also asks buyers how they view their company’s chances for success three to six months in the future. SMU’s Future Sentiment Index also dipped by 5 points over the past two weeks to a reading of +53. That’s still up 15 points from early August. Future Sentiment hit a recent low of +10 in early April shortly after the pandemic took hold. At this time last year, Future Sentiment registered +31.

What Respondents Had to Say

“This is the first time all year I rated our chances fair instead of poor. It’s short-term success, but better than before.”

“I’m optimistic because we have inventory to sell.”

“It would be better if we could hire more workforce.”

“The election will set the tone for post-election Q4.”

“The election is a concern.”

“There are too many question marks surrounding the pandemic. Not sure the demand can be sustained.”

“Six months is a long time. By then the supply-driven shortage will be resolved and it’s unknown how demand will be.”

“We’re concerned the economy is slowing and there will be a delayed impact on the construction sector from the financial impact of COVID on consumers and institutional spending in 2021.”

“There are still some uncertainties out there on the construction side, especially with the election upon us.”

“It’s all dependent on how our raw materials inventory plots out against future demand. A soft landing on the back end of this would be great, but it never happens.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies; approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.