Market Data

September 17, 2020

Steel Mill Negotiations: More Mills Holding the Line

Written by Tim Triplett

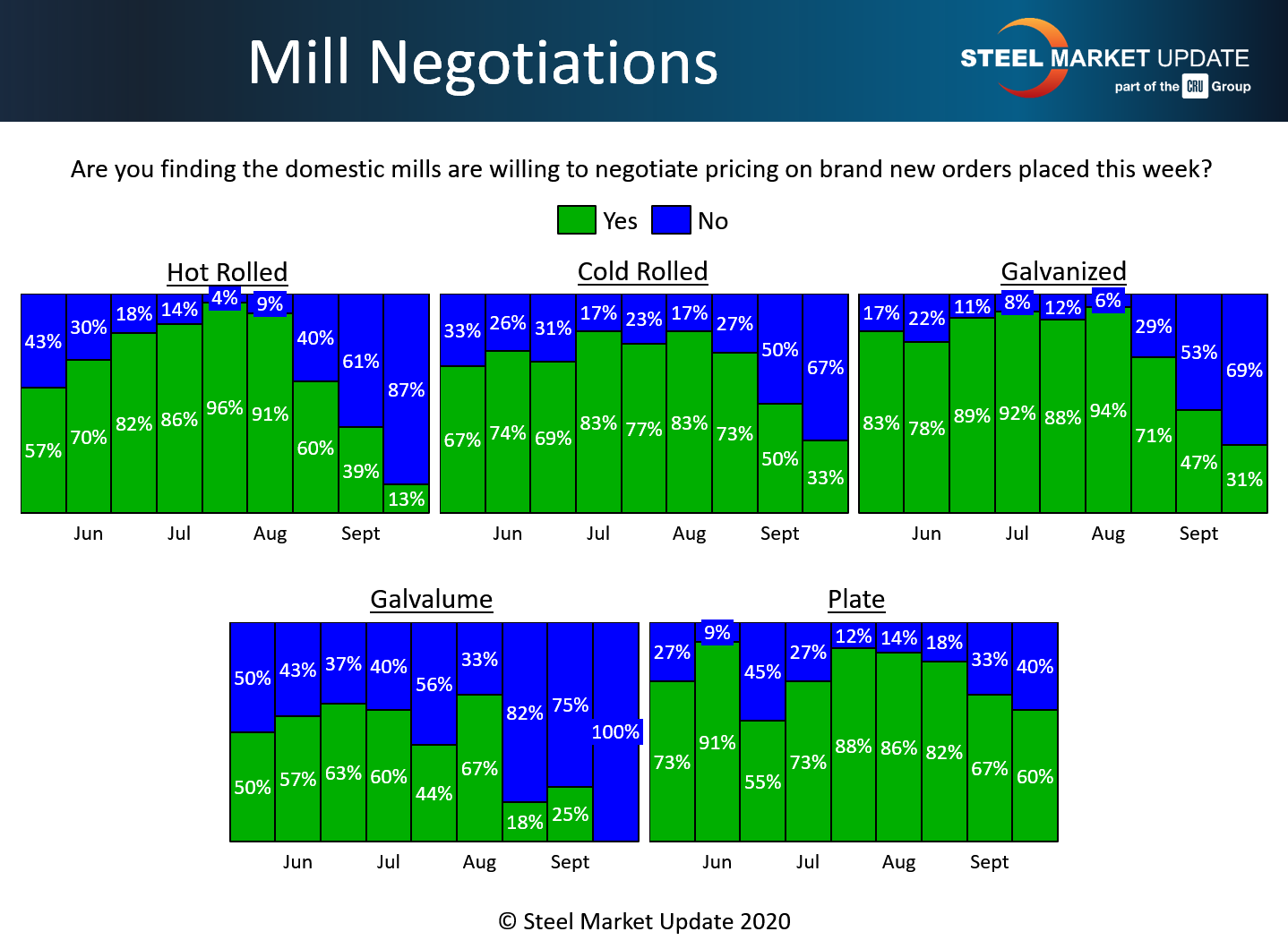

With steel prices on the rise and another round of increases in play, the mills appear to have the upper hand in negotiations. The mills are holding the line in price talks on hot rolled, cold rolled and coated steel orders, as well as plate, according to respondents to Steel Market Update’s market trends questionnaire this week.

About 87 percent of the hot rolled steel buyers responding to SMU’s poll this week said the mills are no longer willing to deal on HR. That’s up from 61 percent two weeks ago. Only 13 percent said the mills are still willing to bargain to secure an HR order.

In the cold rolled segment, 67 percent said the mills are not willing to talk price. That’s up from 50 percent two weeks ago. The other 33 percent reported some room for price negotiation.

The percentages are about the same in galvanized, where 31 percent reported the mills still open to discounts, but the majority, 69 percent, said the mills are saying no. All those responding to the question on Galvalume reported zero room for negotiation as supplies remain tight.

Negotiations are more common in the plate market, where 60 percent said the mills are still willing to bargain to capture the sale, while 40 percent reported the mills standing pat—a slight tightening in talks compared with two weeks ago.

Benchmark hot rolled steel prices now average $580 per ton, based on SMU’s latest check of the market. That’s up sharply from $440 a ton a month ago. Steel prices have strong upward momentum, as supplies are tightening in an improving market.

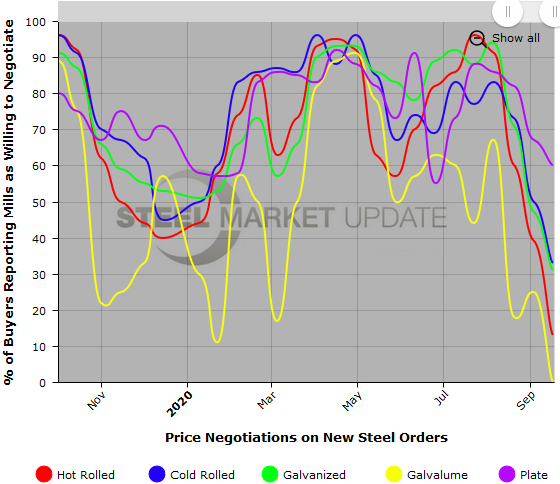

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data (example below), visit our website here.