Prices

September 17, 2020

Hot Rolled Futures: High Velocity Price Surge Lags BUS Prices

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

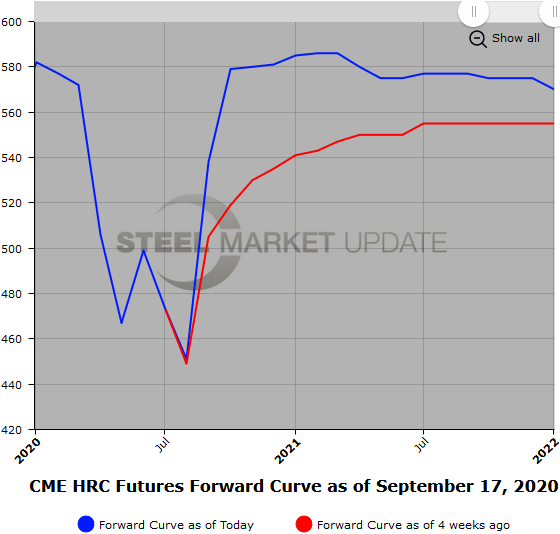

Hot Rolled

Since I last reported on the last Thursday in August, we have seen a strong move higher in both spot HR and HR futures. Since Aug. 26, values for HR futures prices per ST have risen on average for the futures curve out 12 months by $39/ST. In that same timeframe spot has risen roughly $100/ST or more from $477/ST to the current daily indexes, which have been reported around $580/ST, driven higher by a number of mill price increase announcements. Lead times continue to move out. Some mills are reportedly sold out through November and a number of mills are disallowing any overages through year end. This combined with quite a few planned year-end maintenance outages and political uncertainty will keep price volatility high even as manufacturing activity steadily improves.

The recent price surge has led to a shift in the forward curve from a slight contango to a slight backwardation as you look beyond the settling month. You can see the shape shift by comparing the quarters from the end of August to the current values. End August HR futures Q4’20 $532/ST, Q1’21 $547/ST, Q2’21 $550/ST and Q3’21 $552/ST reflect a nice gradual upward sloping curve versus this week’s Q4’20 $587, Q1’21 $587, Q2’21 $580 and Q3’21 $578, which is flat in the near end and downward sloping in the latter half. The prices reflect participants’ expectation that with this strong move higher, prices will peak sometime in early 2021. The nearby HR price rise is double that of the latter half of the forward curve. The quick rise in prices generated pretty strong volume as participants covered short positions and others took profits or unwound hedges as they were able to move physical inventory. September HR volumes are close to 325,000/ST. The rise in prices for HR has cooled in the last few days due to a pause in the BUS futures.

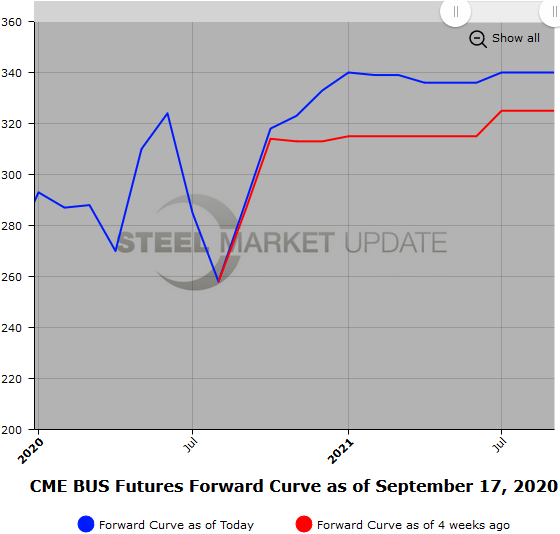

Scrap

CME BUS futures September settlement of 288.78 perhaps was a bit lower than some folks were expecting. More interestingly, BUS prices along the forward curve have only risen $12-13/GT from late August to this week. Most of last week and early this week, Oct’20 BUS futures have traded around $318/GT about $30/GT above the September settle. Cal’21 BUS futures prices have hovered in the mid-$330/GT range the last week or so, leaving BUS futures with an upward sloping forward curve. Supplies of prime and obsolete still remain tight, below pre-pandemic levels, but with planned outages going into the end of the year and Illinois River transport disruptions, forecasting demand will prove difficult. The weaker U.S. dollar and export demand could continue to pull shred prices higher. The latest settlements saw the BUS-Shred spread narrow to within $10/ton.