Market Data

September 3, 2020

SMU Steel Buyers Sentiment: Back to Healthy Levels

Written by Tim Triplett

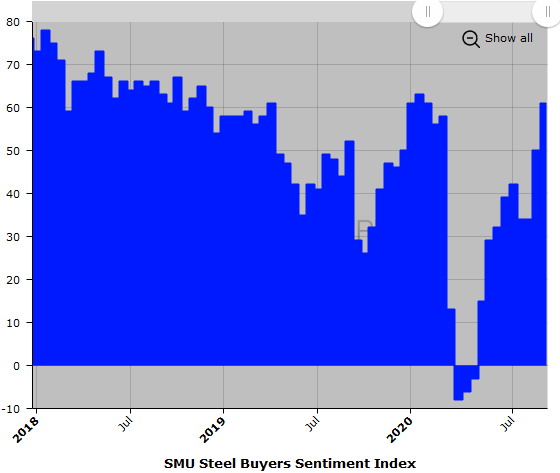

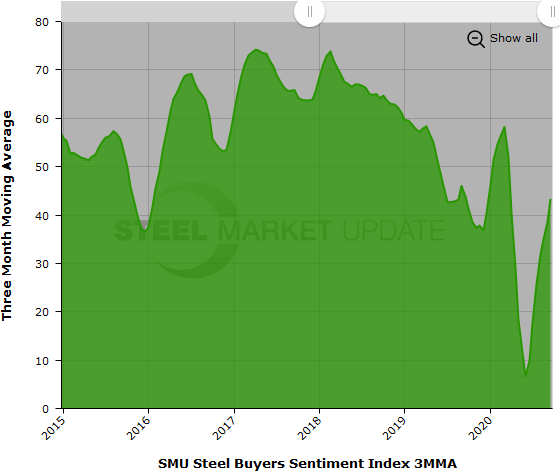

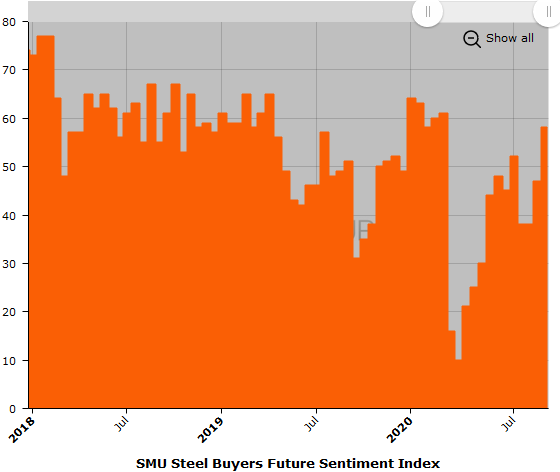

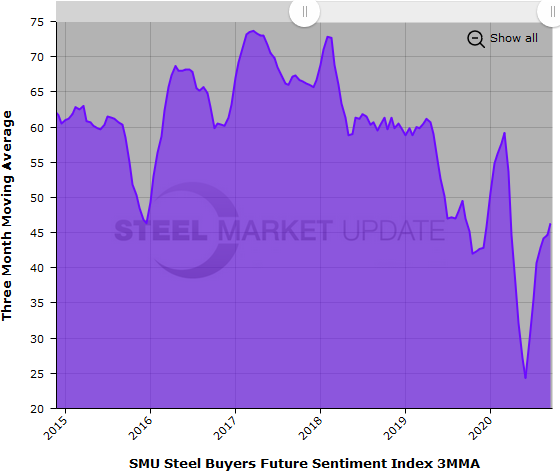

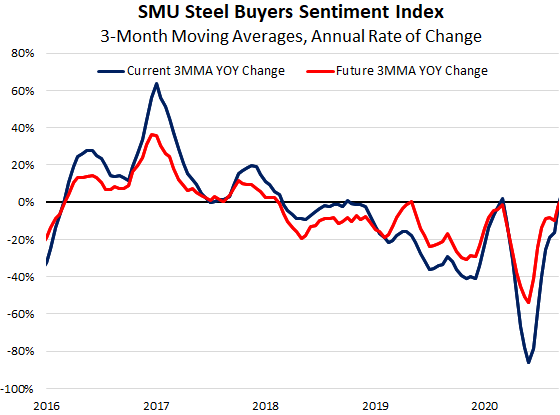

Industry sentiment, as measured by Steel Market Update, has improved to relatively healthy levels even higher than this time last year prior to the pandemic. Both the Current and Future Steel Buyers Sentiment Indexes have jumped by 20 points or more in the past month, suggesting buyers are feeling better about the market’s recovery.

SMU asks steel buyers how they view their company’s chances for success in the current environment. The Current Sentiment reading jumped 11 points over the past two weeks to a reading of +61. That’s up 27 points compared to a month ago when the index had dipped to +34. Current Sentiment has recovered dramatically from a low of -8 in the first week of April when the coronavirus disruption was at its worst.

Future Sentiment

SMU also asks buyers how they view their company’s chances for success three to six months in the future. SMU’s Future Sentiment Index also bumped up 11 points over the past two weeks to a reading of +58. That’s a 20-point improvement in the last month. Future Sentiment hit a recent low of +10 in early April shortly after the pandemic took hold. At this time last year, Future Sentiment registered +51.

What Respondents Had to Say

“We’re still quoting strong.”

“I believe we will survive, but at a lower rate.”

“We have inventory, our competitors do not.”

“Barring any black swans, i.e., election, another round of COVID spikes, business should be very strong through 2Q 2021.”

“Nothing fundamental has changed. Trade restrictions will make prices artificially higher, but how long can that last? Future uncertainty is not going away.”

“It’s very hard to get new workers due to the government handout of extra money.”

“Still too many unknowns to predict accurately.”

“In six months, commercial construction spending might really tank and then where does all the steel go? Automotive seems to be a growth industry and so is distribution, warehousing and residential construction, but not the commercial side, which is my main business.”

“I’m not certain what longer-term damage has been done to the construction sector due to COVID going into 2021.”

“I believe the pandemic has created some serious difficulties that will affect the economy once the stimulus is behind us.”

“All depends if the next wave of COVID actually happens.”

“All depends on the election results.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies; approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.