Prices

August 27, 2020

Hot Rolled Futures: Prices Begin to Push Higher

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

In the last month, HR spot prices have had a fairly wide range, trading at least a $40/ST range based on reported indexes. August HR spot settled at $451/ST. August, which can be a rather quiet month for futures hedging transactions, was very active due to the following factors—lead times lengthening, strengthening scrap prices and forecasts for improving prices and demand. This month, lead times pushed out over six weeks at a number of mills, improved demand for scrap pushed prices higher and offer inquiries for HR futures ticked up.

The HR futures market has been very active in both the nearby months and Q4’20 and Q1’21 periods. The volume of futures nearly tripled from July as almost 500,000 ST of steel futures traded, in part due to quite a few calendar spreads being transacted.

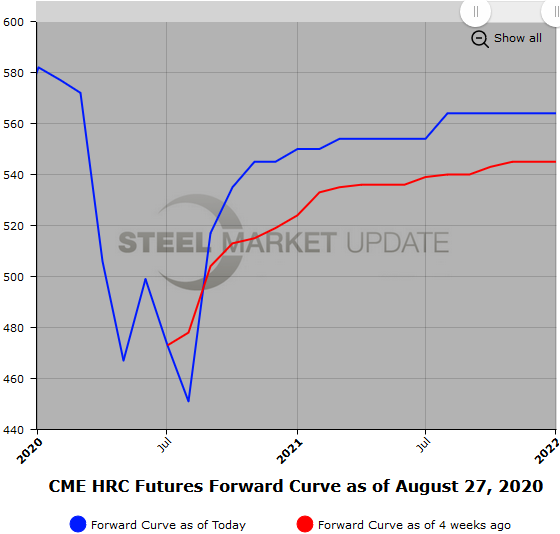

The futures curve reflected stronger demand for both Q4’20 and Q1’21, which steepened the contango. During this period, the HR futures curve prices have shifted higher. It is up about $15/ST for the two periods. From one month to 12 months out, the curve prices rise about $45/ST.

Scrap

Expectations for higher HR prices have been reflected in higher prices for BUS as reflected in BUS futures. The futures curve has risen almost $14/GT on average over the last month with Q4’20 BUS futures trading in the $310/GT range. There still exists a wide margin between the latest BUS settle at $258 and spot month futures. Early chatter has BUS futures prices climbing $10-30/GT. Export scrap demand does not show signs of weakening anytime soon, which will support higher BUS prices.