Overseas

August 14, 2020

CRU: U.S. Sheet Price Rebound Looks Imminent

Written by Tim Triplett

By CRU Prices Analyst George Pearson, from CRU’s Steel Monitor

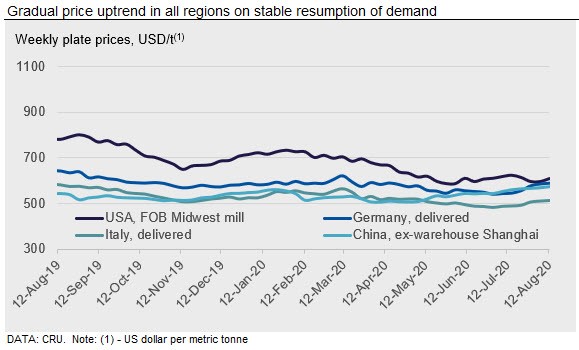

Sheet prices in the U.S. Midwest market were led lower by declines in HR and CR coil. The price of HR coil is now back down to the low reached in early May, though market participants have noted that low priced offers have become scarce. We expect that prices will rebound rapidly as lead times appear to have extended. Furthermore, lower contract prices will lend additional support to mill order books and lead times through September.

In Europe, German HR coil increased again this week, rising by €6 /t to €424 /t. Certain mills have sold their September volumes, which is creating gaps in supply for any spot material needed outside contracted volumes from buyers. Some German buyers have had to look to alternative suppliers, including in Italy, to fill these volumes in the last week. We have also heard of material booked from Russia only slightly below our German index price including duty, again suggesting that buyers expect domestic prices to be higher in the coming months. We have heard that a large German automaker has ordered similar Q4 sheet quantities as it did in Q4 2019. More broadly, near term production expectations in Europe’s automotive sector are running at almost their highest-ever level, albeit that part of this expectation is probably in contrast to the carnage of Q2. Robust auto sector demand is one factor supporting HDG coil prices. CR coil rose the most out of sheet prices in Italy, up by €3 /t, but others changed little because of the quiet market conditions during August.

Chinese steel prices softened this week with HR coil down by RMB 30 /t to RMB 4,070 /t and rebar stayed flat w/w at RMB 3640 /t. The market weakened mainly because of lower buying activity. However, although generally slower in Q3 than Q2, steel consumption has still been stronger y/y. Total steel inventory decreased this week for the first time in the last two months. Weekly output remained at an historically high level given high steelmaking margins, at 5 percent and 15 percent (EBITDA) for rebar and HR coil, respectively, according to CRU’s Steel Cost Model. We expect prices will rise again after a short period of setback because of higher steel demand in September.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com