Market Data

August 6, 2020

Steel Mill Negotiations: Price Talks Tighten

Written by Tim Triplett

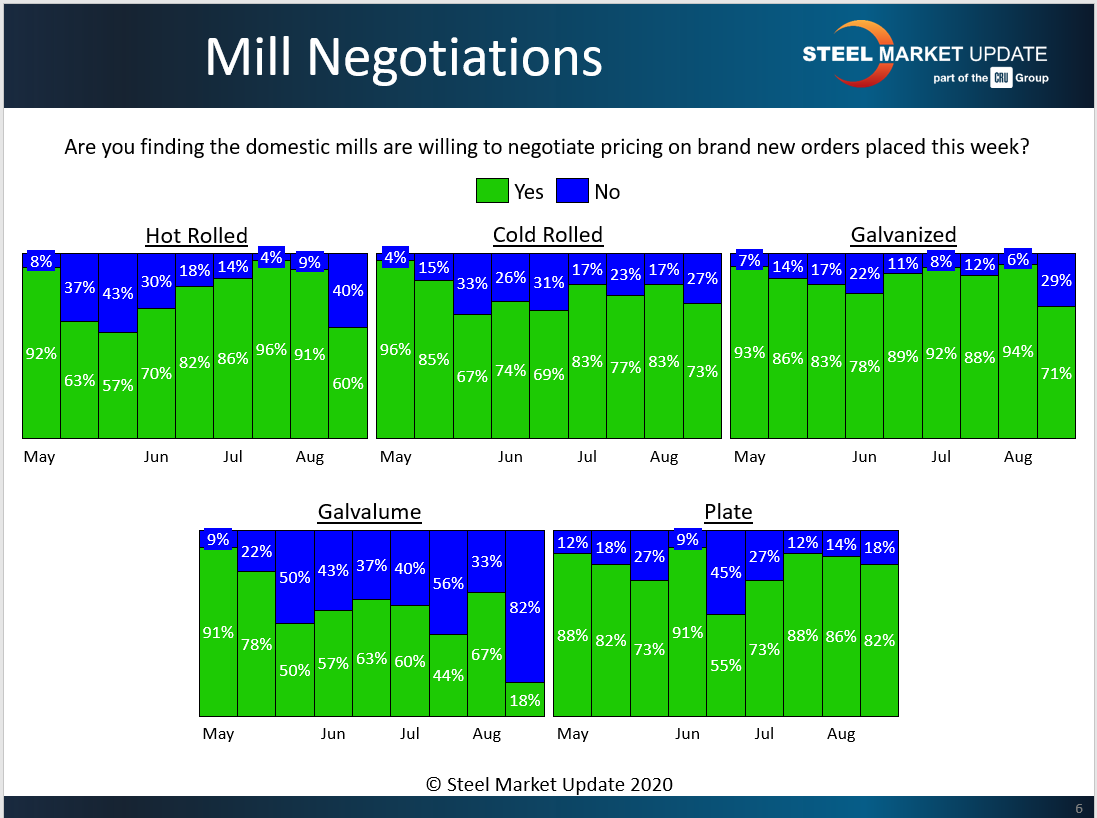

Negotiations between buyers and the mills appear to be tightening as steelmakers attempt to firm up prices in response to improving demand. Steel Market Update’s market trends questionnaire this week shows significantly more mills holding the line in price talks on hot rolled, cold rolled and galvanized steel orders compared to earlier in August.

About 40 percent of the hot rolled steel buyers responding to SMU’s poll said the mills are no longer willing to deal on HR. That’s up sharply from just 9 percent two weeks ago. About 60 percent still say the mills are willing to bargain in order to secure an order, however.

In the cold rolled segment, 73 percent reported the mills still willing to talk price, down from 83 percent two weeks ago. About 27 percent said the mills are now saying “no” to discounts.

In galvanized, 71 percent reported the mills open to discounting prices this week, down from 94 percent in SMU’s last canvass of the market. About 82 percent said the mills are holding firm on Galvalume prices.

Negotiations are more common in the plate market, where 82 percent said the mills are still willing to bargain to capture the sale, while just 18 percent reported the mills standing pat. That compares to 86 percent vs. 14 percent two weeks ago.

Benchmark hot rolled steel prices now average $465 per ton, based on SMU’s latest check of the market. That’s down from about $560 per ton prior to the pandemic, but up from $440 a ton last week. Steel prices may have turned the corner after bouncing along the bottom in recent weeks.

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.