Market Data

July 31, 2020

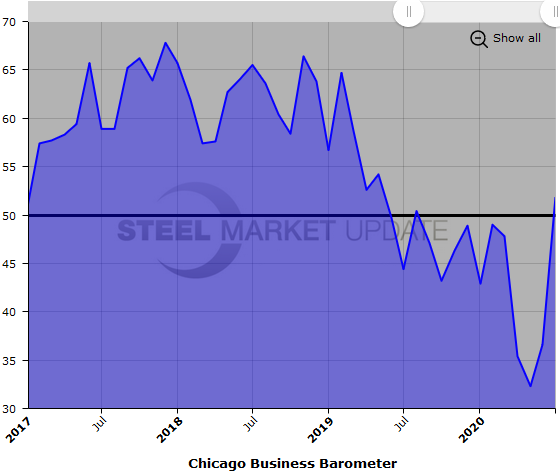

Chicago Business Barometer Rebounds, But Firms Remain Worried

Written by Sandy Williams

A spike in business activity was recorded by the Chicago Business Barometer in July. The index rebounded from 12 months of contraction to a reading of 51.9.

Increasing demand resulted in a vault of 23.8 points for the new orders index to its highest level since August 2019. Production soared 49.5 percent and back into expansion territory. The future outlook remained uncertain for participating firms, however, due to the ongoing pandemic.

Order backlogs remained in contraction with a gain of 15.3 points in July. Inventories gained 6.9 points after a steep decline in June. The supplier deliveries index fell 6.4 points to its lowest reading since January and prices paid reached a seven-month high.

Although employment gained 26 percent, survey participants mentioned continued layoffs due to the coronavirus and difficulties finding new staff.

A potential second wave of COVID-19 has 51.3 percent of companies making contingency plans. The majority of firms, 65 percent, said they expect growth for the balance of the year to be below 5 percent.

Below is a graph showing the history of the Chicago Business Barometer. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.